2023 Canada-Alberta Drought Livestock Assistance Q&As

The 2023 Canada-Alberta Drought Livestock Assistance initiative compensated Alberta's livestock producers for the extraordinary costs incurred due to changing management practices from drought and extreme high temperatures in 2023. It supports the management and maintenance of Alberta’s breeding animals.

Program Basics

Q: What does this initiative cover?

This initiative provides compensation for the extraordinary costs incurred by Alberta’s livestock producers due to dry conditions and extreme high temperatures in 2023. Eligible producers can apply for a feed assistance payment based on a feed need calculation with proof of extraordinary expenses incurred due to drought conditions between June 1 and March 31, 2024.

Q: When do applications open?

Applications originally opened on October 30, 2023 and closed January 15, 2024. An expansion of the initiative is opening on January 29, 2024. Applications will be available online through AFSC Connect, which allows for faster processing.

Q: What is the application deadline?

The original deadline was January 15, 2024, which has now been extended until February 22, 2024. The complete application form must be submitted by midnight the day of the deadline.

Q: I applied for the Canada-Alberta Drought Livestock Assistance initiative within the October 30 to January 15, 2024 timeframe. AFSC has since reached out to me for additional information. When is the deadline for me to submit that information?

If you have been contacted by AFSC for additional information and you have not yet received a payment, the deadline for you to provide the information is April 5. If you do not provide information by that date, your application may be denied in whole or part.

Q: I applied for the Canada-Alberta Drought Livestock Assistance initiative within the January 29 to February 22 timeframe. Can I make any changes to my application?

Applications received during this period may be subject to prorating and revisions to applications is limited to those producers AFSC has contacted for additional information.

Q: Why are the application deadlines earlier than the date (March 31, 2024) to which I can incur expenses?

In an effort to get dollars in the hands of producers, the feed need model aims to enable an inclusive program that does not favor one management practice over another. The model indicates a need that may be filled by an expense that has not yet been incurred at the time of application. It acknowledges the already burdensome workload that livestock producers are facing to maintain their breeding herds. Proof of expenses can then be provided after application if requested by AFSC.

Eligibility

Q: What are the eligibility requirements for the initiative?

To be eligible to participate in the initiative:

Participants must:

- Be an individual who is at least 18 years of age; either a Canadian citizen or a permanent resident of Canada; and resident in Alberta; or be a corporation whose majority of voting shareholders are resident in Alberta.

- Report farm income and expenses in Alberta for income tax purposes. Applicants who are not required to file farm income tax must provide documentation that demonstrates the production and sale of agricultural commodities.

- Be responsible for feeding and primary care of eligible animals located in Alberta. Landlords in a cow/calf share arrangement are not considered eligible applicants in respect to those animals.

- Reside or have pasture (rented, leased or owned) located within specific drought impacted areas, depicted in the 2023 CADLA Eligible Geographic Municipalities.pdf map. (Map opens in a new page.)

- Apply to the program as specified in the Terms and Conditions in effect on the date of application.

Animals must be:

- Females that have been bred between January 1 and December 31, 2023

- Grazing animals, limited to:

- Beef/bison

- Horses

- Water buffalo

- Elk/yak/musk ox

- Deer/llamas

- Sheep/goats/alpacas

- Homestead grazing pigs (limited to Kunekune)

Q: Why are there geographical requirements for this initiative? There weren’t any in 2021.

Extreme dry conditions were more widespread in 2021. In 2023, Alberta’s producers are dealing with varying conditions including dry conditions, flooding, and wildfires. This initiative only addresses extreme dry conditions.

By targeting municipalities identified as D2 (reflective of a 1 in 10-year drought) or worse on the Canadian Drought Monitor map, targeted support can be provided to producers in severely affected areas as per this methodology.

Q: Do I need to have a particular number of animals?

To be eligible for compensation, you must have a minimum of 15 animals in a given category. For example, if you had 20 head of cattle and nine bison, only expenses for the cattle would be eligible.

Q: Are hogs, poultry and dairy cows eligible?

No. Hogs in confined feeding operations, poultry and dairy cows for commercial milk production are not eligible for this initiative.

Q: Why are dairy cattle excluded from this AgriRecovery initiative?

Dairy cattle are not presently considered grazing animals. As the dairy industry does not typically use grazing in their practices for breeding/milking animals, they have been excluded from this AgriRecovery initiative.

The dairy industry is governed by supply management, which allows this sector other avenues to compensate for items such as increased feed costs.

Q: I have horses. Are they eligible for this initiative?

Horses that are used for the purposes of producing offspring as part of your farming operation would be considered eligible. Horses used for pleasure – rodeo stock, racehorses – and working ranch horses are not considered eligible.

Q: What other animals are excluded from this initiative?

Market animals and animals that are, or were, fed for weight gain on pasture or in a confined feed operation are excluded from the initiative. Additionally, culled breeding animals, including those selected to be culled during the application period, are excluded. Animals which have yet to be weaned or which are weaned during the initiative’s program dates are excluded even if they are replacement breeding animals.

Finally, animals which are owned in whole or in part by a federally or provincially licensed slaughter facility are excluded from the initiative.

Q: I own/care for animals jointly with another person or entity. How do I apply for the drought livestock assistance initiative?

If you own/care for animals jointly, there are two ways you can apply for assistance through this initiative:

- One person or corporation would apply for 100 per cent of the breeding livestock being cared for by the group.

- Each person or corporation would apply independently for their share of the breeding livestock being cared for by the group. Your application must only include your ownership share stated in the number of animals (Example: If two individuals own 30 eligible animals jointly, one individual would apply for 15 animals, and the other for 15 animals.) Fractional ownership applications will not be accepted).

Q: Are there any other eligibility requirements that I need to know about?

Yes. To be eligible for compensation under the 2023 Canada-Alberta Drought Livestock Assistance initiative, you need to have more than 21 days between June 1, 2023 and October 31, 2023 where you altered your usual grazing practices due to drought conditions.

Q: If I pasture livestock outside of the geographical program boundaries/identified drought areas, am I still able to apply for those animals?

If your residence or any locations of your typical pasture locations are in an impacted identified drought area, they can be included in the application for this initiative. Please isolate each pasture location individually within the application and report changed grazing management practices accurately to reflect each pasture.

Q: I already applied to the initiative but wasn’t within the initial eligible areas. With this expansion I am now within the updated geographic boundaries, do I need to submit a new application?

No, all applications that were submitted are being processed by AFSC. AFSC team members will reach out if more information is required.

Q: What if I had eligible animals under the first application process, and now with the expansion of boundaries, I have additional animals that are eligible?

In specific circumstances such as these, a second application is not required, however please contact AFSC to provide additional information.

Application Process

Q: How do I apply?

Participants are strongly encouraged to apply online using AFSC Connect for faster service. The AFSC Connect online application is an easy, system guided process. Applying online helps immediately identify errors or missing information. It also helps process your application faster.

Individuals who need assistance with applying should contact the AFSC Client Care Centre at 1.877.899.2372 or call an AFSC branch office to discuss their options.

Q: I already applied between October 30 and January 15; can I reapply to get more funding?

No, applicants can apply only once.

Q: I am not a current AFSC client, and I do not have an AFSC Connect account. What do I need to do to participate?

Prior to applying, interested producers are advised to ensure they have an AFSC ID number and an AFSC Connect account. If you are not currently an AFSC client, you will need to be set up as a AFSC client to receive an AFSC ID number. Please contact an AFSC branch office or call the Client Care Centre at 1.877.899.2372 for assistance.

Q: I am a current AFSC client, but I do not have an AFSC Connect account. What do I need to do before I apply?

Producers who are current AFSC clients should ensure they have an AFSC Connect account and are signed up for direct deposit to receive program payments as quickly as possible.

- Instructions for creating an AFSC Connect account are available on the AFSC website How to Create, Login, and Update Your AFSC Connect Account.

- Instructions for setting up direct deposit for payments are also available on the AFSC website Receiving a Payment from AFSC by Direct Deposit

Q: What information will I need to provide on application?

You will need to provide your Premises ID and the number of eligible animals both on June 1 and December 31. Payments will be calculated on the head reported on hand as of December 31, and June 1 inventory record may be used for verification purposes.

You will also need to provide:

- the date the eligible animals were initially placed on pasture

- the usual date eligible animals would have been removed from pasture

- the date you made alterations to your usual grazing practices. This includes various drought management strategies such as early weaning, creep feeding calves, feeding stockpiled feed, using additional pasture/grazing lands such as row crops or hay fields, removing the entire herd from pasture and locating to new grazing source.

- the municipal location of the pasture

Please note that your application must be completed and submitted in one session.

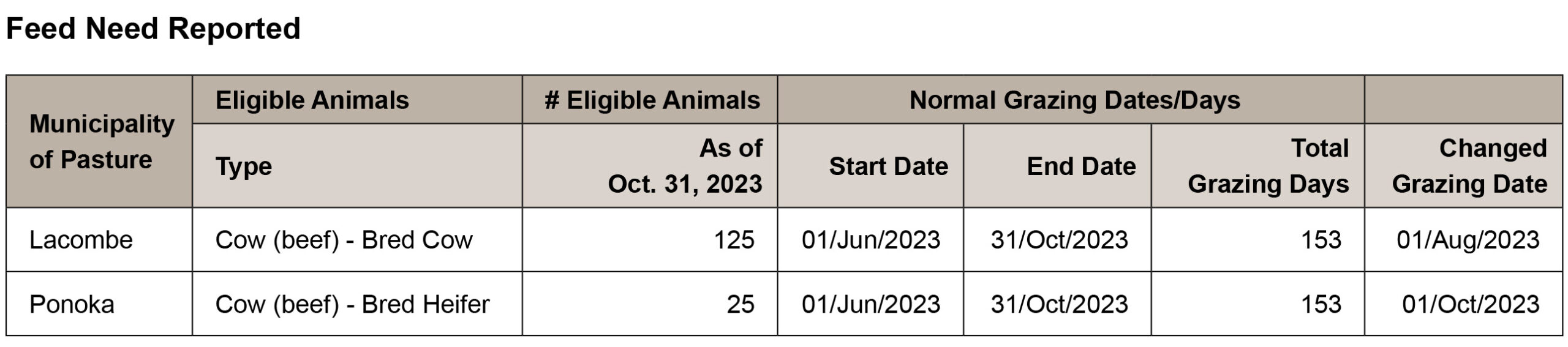

Q: Why do I have to identify each pasture location separately on the application?

Identifying each pasture location is required as change management dates may be different for each pasture during the summer months when drought impacted your grazing availability. Inventory for each pasture location should be identified as it was on June 1, 2023 and December 31, 2023. The December 31, 2023 date is a final inventory count and if cattle on certain pastures were sold between June 1, 2023 and December 31, 2023, please accurately represent that number for the December 31st count in the appropriate line item. A Premises ID to represent all the livestock as one entity (ex. home residence) is acceptable for all line items.

Q: The livestock I am responsible for were pastured on a traditional territory; how do I represent that on the application?

In the dropdown menu, select the municipality nearest to the traditional land where the eligible livestock were pastured.

Q: I’ve signed into AFSC Connect, but the Apply for AgriRecovery icon/button is greyed out. What do I do?

If you see a greyed-out Apply for AgriRecovery icon box during your AFSC Connect session, please contact AFSC. Please use Live Chat on AFSC Connect or our website for immediate service.

Q: I’ve clicked the Apply for AgriRecovery icon and I see two or more AgriRecovery subscriptions. How do I know which subscription I should use to apply for the 2023 Canada Alberta Drought Livestock Assistance Initiative?

You should apply using the subscription related to the legal entity responsible for the care of the eligible animals and reports farming income and expense associated with those animals for tax purposes.

Q: I have completed the online application. How will I know my application has been received by AFSC?

Once you have submitted your application you will receive a confirmation email. You can view, download and print a PDF of your submitted application by logging into AFSC Connect and on the home page, navigate to the Stabilization section. Click on the View Details/statements button and select the applicable business.

Q: I already applied between October 30 and January 15; can I reapply to get more funding?

No, applicants can apply only once.

Proof of Expense

Q: Why do I need to select change in management practice activity(s)?

Selecting one or more changes in management activities indicates the type of extraordinary expenses incurred or intended to be incurred due to the 2023 drought. Understanding the actions you took during the grazing season of 2023 assists in the verification of your application.

Q: How do I know which management practice activity(s) to select?

Select as many of the management practices listed that were over and above normal activities, that were due to managing feed due to drought. These management practice activities may include self or custom work activities to be completed. There are two lists of activities to select from:

Extraordinary management changes made in 2023 due to drought with receipts available

- Purchases of hay/greenfeed bales;

- Purchase of pitted/bagged silage/haylage;

- Custom transport of forage/livestock;

- Rented additional pasture land between May 1 – October 31;

- Purchased standing hay land for baling (self/custom harvested);

- Purchased additional hay land for haylage (self/custom harvested);

- Purchased additional cereal cropped land for silage (self/custom harvested);

- Modifications to make alternative land more suitable for grazing;

- Other: provide detailed description of change activities if not listed above.

Extraordinary management changes made in 2023 due to drought with no receipts available

- Self-hauled transport of forage/livestock;

- Baled additional forage land of owned land (self/custom harvested);

- Baled cereal crops of owned land (self/custom harvested);

- Modifications to make alternative land more suitable for grazing;

- Usage of on-hand feed as extraordinary measure to extend pasture grazing;

- Other: provide detailed description of change activities if not listed above.

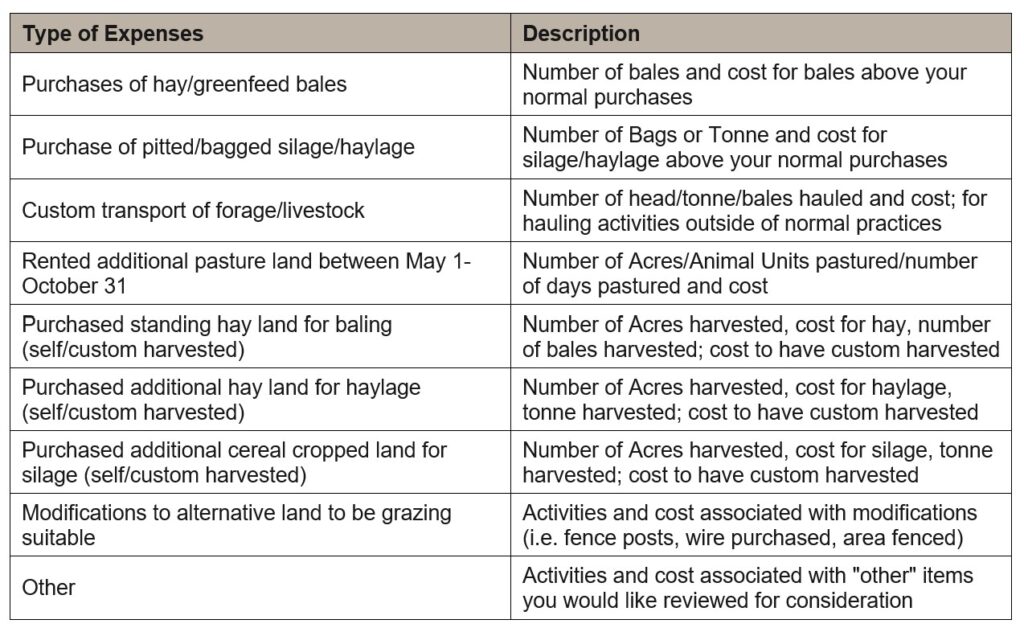

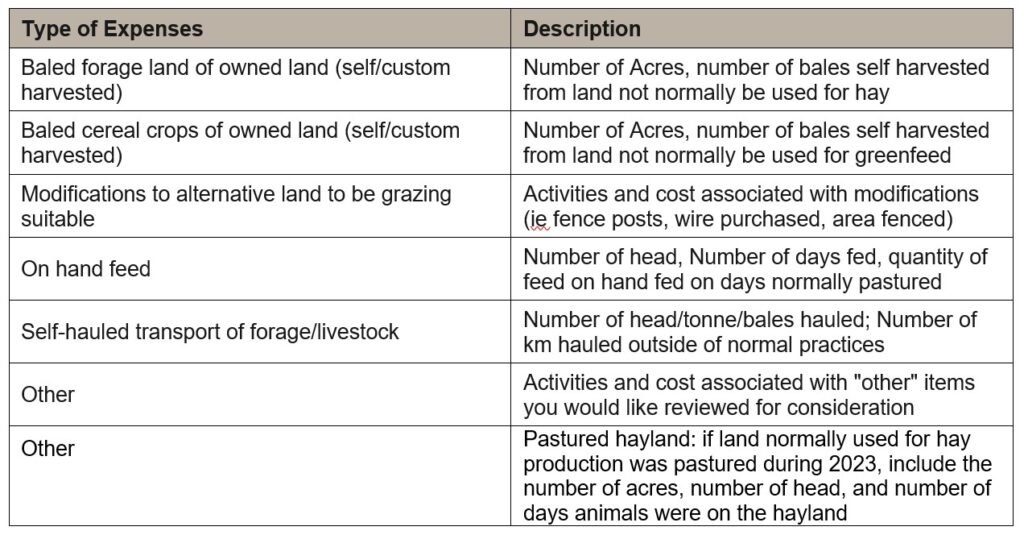

Q: In the Proof of Expenses section of the application, what should I include in the “Description” field?

The application has two sections, one for management changes with receipts and one for management changes without receipts. Please see the tables below for suggested details to include when filling out these sections.

Management changes made in 2023 due to drought with receipts available

Note: Select all the expenses from the list that you have or intend to incur due to management changes that exceeds normal business practices.

The benefits calculated using the feed need model cannot exceed 70% of the cumulative total from proof of expenses for extraordinary costs incurred due to changing management practices.

Management changes made in 2023 due to drought with no receipts available

Note: Select all the expenses from the list that you have or intend to incur due to management changes that exceeds normal business practices.

The benefits calculated using the feed need model cannot exceed 70% of the cumulative total from proof of expenses for extraordinary costs incurred due to changing management practices.

Q: What types of expenses could be considered under modifications to alternate land to be grazing suitable?

This could include, but not limited to:

- Fencing

- Labour

- Water provisions for livestock

Q: How will AFSC determine an expense value for activities where no receipt is available?

AFSC will use current industry rates and prices.

Payment Calculation

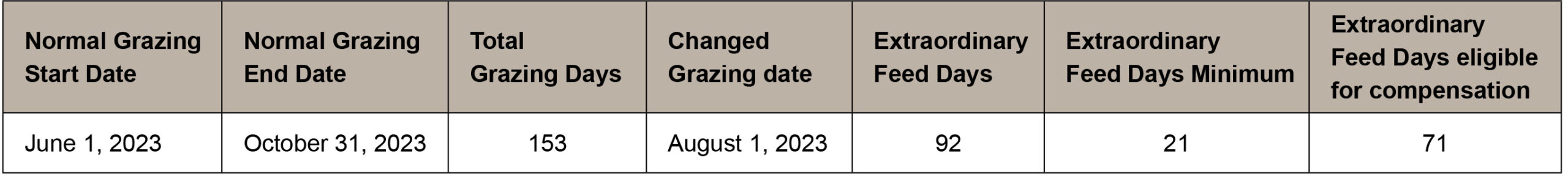

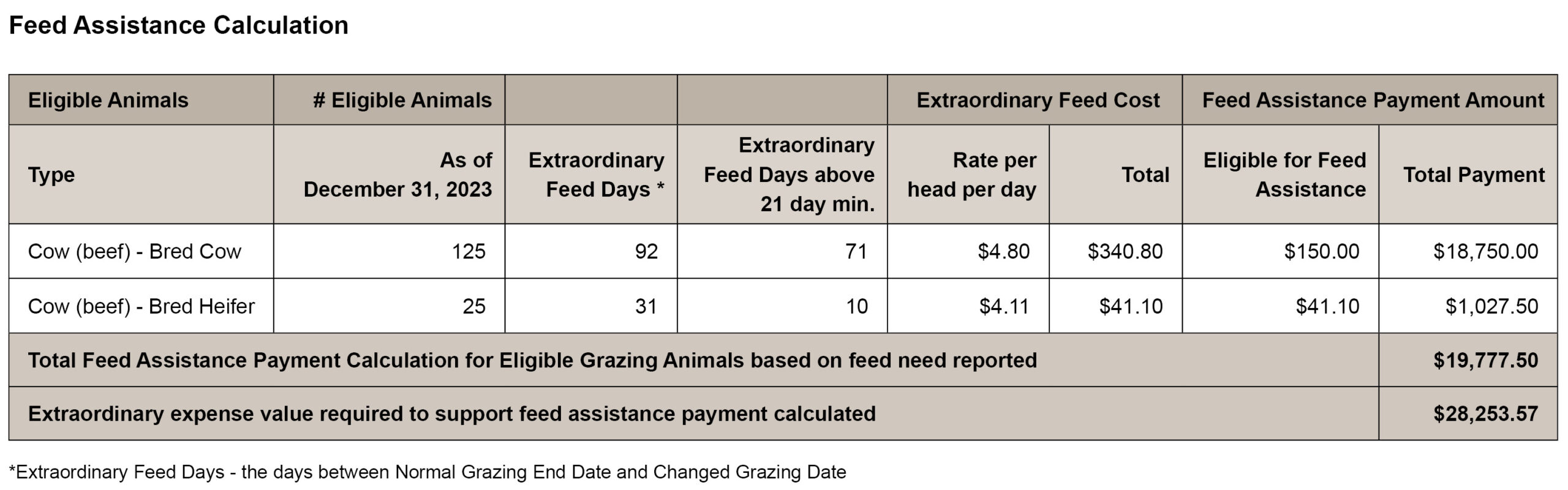

Q: How will the number of extraordinary feed days be calculated?

The number of extraordinary feed days can be calculated by taking the days between your normal grazing end date and your changed grazing date. This captures the number of grazing days in the 2023 season impacted by a change you made due to drought conditions. You must exceed 21 extraordinary feed days to be eligible for benefits under this Initiative.

Q: How do I calculate the number of extraordinary feed days eligible for compensation?

Extraordinary feed days are the number of days you had to alter your grazing practices due to drought. You will need to exceed the extraordinary feed days threshold of 21 days to be eligible for compensation under this initiative.

To arrive at the number of extraordinary feed days eligible for compensation, take the difference between your normal grazing end date and the date you made a change to you due to the drought conditions (changed grazing date) less the 21-day minimum.

Q: How do I know what to enter for the changed feeding practice start date on the application?

The changed start date does not reflect when you decided to change your normal grazing practices; rather, it is when you actually made the change.

Q: Does the same changed feeding practice start date apply for all eligible animal types?

The changed feeding practice start date on your application should reflect the date that you changed normal grazing practices for that animal type, in the municipal district selected. This date may be the same or different for each animal type you feed, depending on when you made the change to your feeding practices. Changed feeding practice start date is to be indicative of each pasture location and recorded on the application as separate line items.

For example, if you rented additional pasture for your cows, the date you moved your cows to this new pasture would be your changed feeding practice start date for your cows. If you also have sheep, the date you started supplementing their ration with extra feed would be the changed feeding practice start date for your sheep.

Q: What is the price of feed and how was it determined?

The blended average price is $0.137 per pound for feed. The price is based on the estimated average feed cost using Alberta forage and grains for a blended feed mix price per pound.

Q: How will feed need model calculate payment?

Payments will be calculated as follows:

Q: How do I calculate the extraordinary expense value required to support the feed assistance payment calculated?

Take the feed payment calculated and divide by 0.70.

50 ewes X maximum amount per head $30 = $1,500

$1500/0.70 = $2,142.86

$2,142.86 is the expense value needed to have been incurred to support a maximum payment per head on 50 ewes.

Q: What is the maximum benefit per head?

Note: for applications submitted during the expanded deadline, payment per head may be prorated

| Animal Type | Maximum payment per head | Proof of Expense value per head to support maximum payment |

| Cattle and bison | $150 | $215 |

| Horses | $150 | $215 |

| Water buffalo | $150 | $215 |

| Elk/yak/musk ox | $75 | $108 |

| Deer and llamas | $37.50 | $54 |

| Sheep/goats/alpacas | $30 | $43 |

| Homestead grazing pigs (Kunekune) | $52.50 | $75 |

Q: Will I need to provide receipts or other supporting proof of expense?

Participants may need to provide proof of expense to validate the extraordinary costs incurred due to changing management practices. This may be in the form of a receipt or other supporting documentation, depending on the item. Producers unable to provide proof of expense will be required to pay back any funds not supported.

Q: Are breeding livestock housed in non-pasture feeding areas (e.g. drylots) over the typical grazing period allowed to apply under this program?

If as normal practice, you house breeding livestock over the summer months in dry-lot or confined feeding, these animals are not eligible for assistance from the 2023 program. If you typically graze these breeding animals but due to limited pasture this summer, moved breeding livestock into a confined location for feeding after June 1, 2023, but before October 31, 2023, these animals are eligible.

Q: How do I apply?

For faster service, please apply using AFSC Connect. The AFSC Connect online application is an easy, system-guided process. Applying online helps immediately identify errors or missing information. It also helps process your application faster.

Please note: Your application must be completed and submitted in one session.

General Questions

Q: What should I do if I realize I made an error on the information I have submitted on the application?

If you realize you have made an error on the information you have submitted, email AgriRecovery@afsc.ca and include the following information in your email:

- Applicant name and AFSC ID, if known.

- Details of information that requires updating.

- An AFSC team member will reach out to you if any additional clarification is required.

Q: When will my application be processed?

Processing and payment of applications is a priority for AFSC. If you applied before January 15, your application is being processed as swiftly as possible. The AFSC team will reach out to you if additional information is needed. Applications may take up to the middle of March to be reviewed, with payment flowing upon verification. Due to application volumes, clients are asked to wait to contact AFSC regarding status of their application.

If you apply between January 29 and February 22, please be advised that all applications in this timeframe will be processed after the February 22 deadline, and with expected volume, may be processed into April. AFSC will reach out if additional information is required.

Q: Will I be audited?

All applications may be subject to an audit. Participants selected for audit will be notified of the information required to complete the audit.

Q: Who do I contact for more information?

For additional information, contact AFSC using online chat on AFSC.ca or in AFSC Connect, call our Client Care Centre at 1.877.899.2372, email AgriRecovery@afsc.ca or contact your preferred branch office. AFSC is available to answer your questions and assist you.