Frequently Asked Questions

The Advance Payments Program (APP) is a federal loan guarantee program which provides agricultural producers with easy access to low-interest cash advances.

Under the program, producers can access up to $1 million per program year in advances based on the value of their agricultural product, with the Government of Canada paying the interest on the first $250,000 advanced to a producer. Advances are repaid as the producer sells their agricultural product, with up to 18 months to fully repay the advance for most commodities (up to 24 months for cattle and bison).

As a producer, an APP advance can help you to meet your financial needs, such as farm input costs, immediate financial obligations, and product marketing costs. It can also allow you to make the decision to sell your agricultural products based on market conditions rather than the need for cash flow.

APP advances are available through more than 40 participating producer organizations, that is, APP Administrators, across Canada.

Toll Free Number: 1.866.367.8506 | Advance Payments Program website

The Advance Payments Program (APP) provides producers with a cash advance on the value of their agricultural commodities for a specified production period. The advances allow producers to meet their immediate financial obligations without having to market their commodities and give producers the necessary financial flexibility to market their commodities when the conditions are right for them.

To be eligible to receive a cash advance under the Advance Payments Program (APP), the producer must be:

1. a Canadian citizen or permanent resident;

2. a corporation, cooperative or partnership of which the majority interest is held directly or indirectly (through another corporation, a trust etc) by Canadian citizens or permanent residents

In addition, the producer or one of the producer’s individual interest holders:

3. must be of the age of majority in the province of operation;

4. must own the agricultural product;

5. must be responsible for its marketing

The Advance Payments Program is administered by approximately 60 producer organizations on behalf of Agriculture and Agri-Food Canada (AAFC). A full list of all the participating producer organizations in Canada is available on the Advance Payment Program website at www.agr.gc.ca/app. If you are interested in receiving an advance, you can use this list to find a participating producer organization near you.

The Advance Payments Program provides producers with cash advances on their commodity sales in order to improve business cash flow. These advances are provided at preferential interest rates, with the first $250,000 as interest-free, which affords producers the flexibility to market their products based on business strategy rather than a need for working capital.

Producers are eligible to receive an advance for up to $1 million per production period, with the first $250,000 of their advance being interest-free. The advance is based on an advance rate determined by the Minister which cannot exceed 50 per cent of the average price that in the Minister’s opinion will be payable to producers of the agricultural product in that area. This limitation on the advance rate helps to absorb price fluctuations that may naturally occur in the market.

To apply for an Advance Payment Program advance, producers typically have to pay an application fee to the Producer Organization administering the advance. Fee structures vary between the different administrators. Some administrators charge a one-time only fee, while other charge a fee for the initial application and lower fees for the second or third instalment, and others may use a pro-rated fee schedule based on the amount of money advanced.

Yes. The availability of cash advances is controlled to an extent by the agreement the administrator negotiates with AAFC. Under the program, a production period is usually 18 months, or 24 months for cattle and bison, and advances issued are always linked to a production period. The administrator, when considering the needs of producers it is serving, generally decides on the timing of advances based on producers’ production cycles.

Once a producer has reached their interest-free limit or their overall maximum eligible advance limit, they will not be eligible to receive another advance during the production period. The producer will however be eligible for another advance in the next production period as long as all outstanding advances remain within the maximum $1 million overall advance limit.

The Advance Payments Program advances on hundreds of crop and livestock products. Eligible products must meet the following criteria:

- An animal that is raised in Canada or the fur pelt of the animal

- A plant grown in Canada or the product of the plant, or

- Honey or maple syrup that is produced in Canada

The product must not be processed, and for perishable products such as fruit, it should not be processed beyond what is necessary to store it and prevent spoilage. The Minister must also be able to establish a market price for the purpose of determining the eligible advance rate.

If you are applying for an advance on a crop before the product is harvested, you will need one of the two programs to secure the advance until the product is harvested. You could, however, choose to wait until harvest to apply for the advance, and get an advance based solely on what you have in storage.

Currently, all shareholders of a corporation, members of a co-op, or partners in a partnership must sign and be held jointly and severally liable for the entire advance. A recent change was made to the legislation and regulation to allow for a guarantee in lieu of this joint and several guarantee requirements. An administrator may now accept a guarantee from a financial institution or from one or more individuals who can prove that they have the financial collateral issue such a guarantee. This could be one or more of the shareholders/members/partners, or a third party.

If you do not see your commodity listed on any of the Advance Payments Program administrator’s websites please contact one or more of the administrators directly. They will work to determine if your commodity is eligible for an advance and if not they will provide you with alternative suggestions.

Though application processing time can vary from administrator to the next, the length of time it that it will take for a producer to receive funds into their accounts after the submission of a complete application form is generally 10-14 business days. However, high application volumes and incomplete application forms may result in delays. For more information on service standards please contact the Advance Payments Program administrator to which you are applying for more detail.

The first $250,000 of your Advance Payment Program loan is interest free. Interest on the balance of your loan (over $250,000 to the maximum limit) is determined by your administrator, however, most administrators charge either prime or prime minus 0.25%.

No, the estimated value of the commodity for which you are seeking an advance cannot be appealed. The value of your advance is based on your estimated production multiplied by the commodity value as determined by the federal government and limited to your security (i.e. AgriInsurance, AgriStability).

If an administrator feels that the advance rate per production unit is incorrect, they can request that the Minister review the advance rate. The administrator would likely be asked to support any increase in advance rate by providing reliable market data.

AgriStability targets assistance to farm operations facing large margin declines caused by production loss, increased costs, or market conditions.

AgriStability calculates a production margin (current year) and a reference margin (Olympic average of your five most recent production margins). If your production margin falls below your payment trigger (70 per cent of your reference margin), AgriStability will pay you 80 per cent of the difference.

Your production and reference margin are unique for your operation as they are built using your income tax and supplementary information. AgriStability benefits are paid after your tax year is complete and you have submitted your tax and AgriStability supplementary forms.

AgriStability is a low cost program. The cost works out to an approximate fee of $315 for every $100,000 of your reference margin.

Sustainable Canadian Agricultural Partnership (Sustainable CAP) is the new five year federal-provincial-territorial agricultural agreement in effect as of April 1, 2023. The agreement covers AgriStability program years 2023-2027.

Under Sustainable CAP, the AgriStability compensation rate has increased to 80 per cent or 80 cents per dollar of support from the previous 70 per cent rate. This change is in effect for the 2023 program year.

What hasn’t changed is the benefit trigger point or how fees are calculated – benefits still begin to trigger at 70 per cent of the reference margin and it still costs only $315 for every $100,000 of reference margin support. Losses in excess of 30 per cent are now compensated at $0.80 for every dollar of decline.

1. Simplified enrolment for issuance of fees: if there is not enough information in AFSC records to calculate a fee, your fee will be calculated using industry benchmark information based on your estimated program year productive units.

2. Reduced information requirements for calculating a benefit: new participants or participants who have been out of the program for at least four years prior to the program year can choose to supply three years of tax and supplementary information rather than five years. If they choose to submit only three years, their reference margin will be the average of the last three years rather than the five-year Olympic Average.

A minimum payment of $250 was introduced for the program years 2018-2022. Essentially, if a producer’s benefit calculates to less than $250, it will not be paid to the producer.

Example:

Version 1 of a benefit calculates to $150. No benefit is paid.

Version 2 is processed and the benefit amount is now $300. $300 is paid to the participant.

Version 3 is processed and the new benefit amount is $350. An additional $50 is paid to the producer. Note that the net benefit on version 3 is less than $250 but the gross benefit is greater than $250.

Late participation will only be offered in program years that have experienced a significant agricultural disaster and whereby both the federal and provincial governments have agreed jointly to extend the deadline for participation. This provision includes a 20 per cent penalty on any benefits.

AgriStability is a whole farm program that covers all commodities produced on your farm whereas AgriInsurance provides coverage on a crop by crop basis, and offers spot loss coverage for specific perils.

Although both programs cover production loss, AgriStability also covers other risks such as rising input costs, price volatility and commodity loss due to fire or spoilage.

AgriStability, when combined with AgriInsurance, can help manage your overall risk.

If you have not participated in AgriStability before or are wishing to rejoin the program, either complete the AgriStability Application for Fee Notice or provide a written request indicating your intent to participate by April 30 of the Program Year in which you wish to participate.

Pay the fee. The fee is approximately $315 per $100,000 of your reference margin. There is a minimum Enrolment Fee of $45 and an Administrative Cost Share fee of $55. Fees must be paid by April 30 to avoid a 20% penalty. Fees can be paid up to December 31 of the Program Year with penalty.

File your income taxes by the deadlines established by CRA.

Submit your application forms. Participants must submit completed Supplementary forms by the established deadlines. The deadline is September 30 of the following calendar year. Supplementary forms will be accepted until December 31, subject to a penalty.

AFSC receives a high volume of claims in the month of September. Participants are encouraged to file their information early.

As all applications are subject to review, you may be contacted for additional information. Upon completion of processing, participants will receive a Calculation of Program Benefits (COPB). You will have 18 months from the date on the COPB to request adjustments to your information.

Participants facing a financial crisis may contact AFSC to have their file prioritized; however, they will be required to outline their circumstances in writing via email, fax, or mail.

Changing what I produce

If you change commodities, expand or downsize your operation, AgriStability will adjust your reference margins to reflect your current operation. This is referred to as “structural change”. For more information on structural changes, please refer to Technical Information Circular (TIC) #6 – Structural Change

Changing my legal structure

If you change the legal structure by incorporating, your fee, reference margins and production history will be transferred to the corporation. Corporations must submit Financial Statements, T2 Schedule 1 and an accrual to tax in the format of Statement A. Beginning in 2018, corporations must submit the tax information using the Alberta Statement A for Corporations/Co-operatives/Other Entities.

The transfer of fees, margins and production history is facilitated by submission of the CRA Form T2057, more commonly referred to as a Section 85 rollover tax document, which outlines the effective date of when and how assets are transferred from individual tax filer name(s) into the corporation. If a Section 85 has not been completed or filed with CRA, then we will need a legal agreement (i.e. sales agreement) that includes details such as effective date of the transaction, seller/purchaser names, and assets/inventories sold.

Changing circumstances due to death of a participant

The executor/beneficiary is responsible to ensure the estate meets AgriStability deadlines and requirements.

To help explain the steps that need to be followed when handling estate issues for AgriStability claims, refer to Technical Information Circular (TIC) #2 – Estates and Deceased Individuals.

If you no longer want to participate, you may opt out of the Program by providing written notice to AFSC. Written notice must be received by the enrolment notice deadline, April 30 of the program year you wish to opt out or 30 days after the issuance of your enrolment/fee notice. By opting out, you will be ineligible for benefits in the program year in which the opt out occurs. If you do not opt out by the deadline, your fees will still be owing and payable.

You can get back in by sending an Application for Fee Notice or a written request to enroll by April 30th of the program year in which you wish to participate.

Yes. Individuals who file their taxes on a T1163 Statement A will have their information sent to the AgriInvest Administration directly from CRA.

Corporations that participate in the AgriInvest Program should continue to submit their tax information to AFSC by the deadline of September 30. Beginning in 2018, corporations must submit their tax information on the Alberta Statement A for Corporations/Co-operatives/Other Entities. Clearly identify “AgriInvest only” on the first page.

Once enrolled you are considered to be participating until we receive an opt out request form. If you did not “opt out” of the program, your fees are still owed even though you may not have participated in the program. You will be sent a new enrolment/fee notice for the current year because you have not opted out of the program.

AgriStability and AgriInvest are tax-based programs. If you are ready to submit your information to AFSC prior to a Statement A being available, you can use the most recent Statement A available and adjust the year on the top of the form.

For example, if the farm’s fiscal year end is April 30, 2024, then the fiscal year reported would be May 1, 2023 – April 30, 2024, and both the tax year and AgriStability program year would be 2024. Your tax year and program year reflect the same year that the fiscal period ends in. That is, if the fiscal year ends in 2024, then the program year is also 2024.

- Call the Client Service Centre at 1.877.899.2372. Staff can assist with questions, forms, AFSC Connect, and can forward your call directly to staff working within the AgriStability Program.

- Producers and authorized representatives can login to AFSC Connect for 24 hour access to:

- Update contact information

- View historical information

- Check the status of their AgriStability application.

- Visit any AFSC office. There are offices throughout Alberta. Find an office on the Contact page.

Agriculture Financial Services Corporation (AFSC) insurance clients can choose from the following payment options:

- Payment in person. Bring a cheque, money order or bank draft to any AFSC office or mail to the AFSC Central Office (Lacombe).

- Payment at your bank. Be sure to bring your subscription number.

- Internet banking. Add Agriculture Financial Services Corporation as a payee and use your subscription number for the account information. The payee name which your bank recognizes may vary, such as “Agriculture Financial Services” or “Agriculture Financial Services Corp”. If you have multiple subscriptions, you will need to setup a separate AFSC payee for each subscription.

- Telephone banking. Contact your bank and provide your subscription number.

When AFSC receives payments by June 25 or within 15 days of the billing date, a 2 percent early payment discount is credited to the client. AFSC will also accept cheques that are postmarked to June 25. This does not apply to the Western Livestock Price Insurance Program (WLPIP).

Follow these steps to assign insurance for collateral with Agriculture Financial Services Corporation (AFSC). Assignees must be an AFSC client.

- Complete the Assignment of Indemnity Form for Insurance and attach to the form a $45 non-refundable fee for each assignment that is submitted.

- Ensure all information is correct, and signatures (including a witness signature) are provided.

- Mail the form to:

Agriculture Financial Services Corporation

Finance

5718 56 Avenue

Lacombe, Alberta T4L 1B1

When completed documents are received, the assignment will then be registered by AFSC and sent to the insured and the assignee. Applications are processed on a first come, first served basis.

AFSC only accepts the receipted grade on sales from buyers that have a primary elevator or terminal elevator license from the CGC.

Grain buyers can be licensed in several classes by the Canadian Grain Commission (CGC) and the requirements differ for each grain class. Only in the terminal elevators and primary elevator classes are the licensees required to sample upon receipt and resolve grade and dockage issues through the CGC.

The following link shows the class of license for the individual grain companies www.grainscanada.gc.ca.

If grain is sold to a grain dealer, private buyer or process elevator before an AFSC on-farm inspector (OFI) performs a post-harvest inspection, AFSC may use the client’s samples based on the following conditions:

1. Clients need to contact their AFSC branch office and obtain approval to collect samples for AFSC grading purposes prior to the grain being removed. If clients do not receive approval before the grain is removed, AFSC will use the designated grade of the grain.

If grain is sold directly off the field:

- if the sample is acceptable, AFSC will grade it and use the actual grade.

- if the sample is not acceptable, AFSC will use the designated grade of the grain.If grain is sold from the bin and there is a minimum of 400 bushels remaining in the bin, OFI will compare the client’s sample to the grain in the bin to determine if the sample is acceptable:

- if the grain sample is acceptable, it will be graded accordingly.

- If the sample is not acceptable, a new sample will be taken from the bin.

- if the sample is not acceptable and there are less than 400 bushels remaining in the bin, AFSC will use the designated grade of the grain. If the bin is being emptied, or if there will be less than 400 bushels remaining, clients can contact their branch prior to moving the grain for AFSC to come sample the grain before it is moved.

2. If approval is obtained, AFSC must receive a representative grain sample per truckload if sold off the field, or per bin. Sampling requirements are as follows:

- Grain must be collected in a five-gallon pail that preserves moisture content, maintains sample integrity, and keeps out rodents and insects.

- The sample needs to be obtained intermittently, such as while the grain is loaded into trucks for sales directly from the field or from each truck while unloading into bins.

- Samples are to be stored in a manner acceptable to AFSC, and represent the quality of the crop that was sold.If a client saves a sample and AFSC determines that it is unrepresentative, AFSC will assign the grain its designated grade.For more information about this process, visit a local branch, send an email to info@afsc.ca or call 1.877.899.2372.

Indemnity payments can be deferred for up to one year. If you would like to defer payment, please tell your adjuster during the inspection process. For area based programs, please ensure you have notified AFSC if you want your indemnity payments deferred prior to the payment window. If your cheque has already been issued, Canada Revenue Agency rules state that your payment cannot be deferred.

Deferred indemnities will not be issued before the deferral date. Outstanding amounts owed to AFSC will be deducted from your indemnity. Interest begins to accrue on September 1 on any outstanding amount until your deferral is issued.

An Appeal Committee reviews an appeal by an insured individual who challenges a decision made by Agriculture Financial Services Corporation (AFSC).

To initiate an appeal:

- Complete the Notice of Appeal and ensure all information is correct.

- Attach the $300 appeal fee to the form. This fee will be refunded should the appeal be decided in your favour.

- Deliver it to any AFSC office or mail it to:

Agriculture Financial Services Corporation

Finance

5718 56 Avenue

Lacombe, Alberta T4L 1B1

- Upon review of the application, AFSC may request to meet with you to explain relevant corporate policies.

- If unresolved, and if the matter is one that the Appeal Committee has the authority to hear, the application will be submitted to an Appeal Committee.

- The appeals secretary will be in contact to arrange a date and location of the appeal.

Additional information may be found in the Appeal Brochure

Agriculture Financial Services Corporation (AFSC) annually conducts production audits to verify the accuracy of our clients Harvest Production Reports. We do this in order to ensure we maintain the Annual Crop Production Insurance Program’s integrity and accuracy of the insurance coverage provided to our clients. Each year, a five per cent sample of AFSC clients who have purchased production insurance for that crop year is randomly selected for audit. This fundamental process has been in effect for a number of years.

When clients secure crop insurance, they agree to AFSC’s Contract of Insurance. The contract entails the obligation that clients allow AFSC immediate access to production records, lands and grain storage facilities for the purpose of an audit. Failure to meet this obligation is deemed a breach of the Contract of Insurance. The consequences of a breach are:

- the insured production level for the crop year in question will be recorded as zero, and;

- the client becoming ineligible to secure crop insurance with AFSC for the next two years.

When clients file their Harvested Production Report (HPR), they are declaring their reported production for that crop year.

The HPR must be filed by November 15 for annual crop insurance, and gives the first indication if the client is in a production shortfall and eligible for a claim. HPRs filed between November 16 and December 31 will be charged a late filing fee. HPR will not be accepted after this date.

Clients can file their Harvested Production Report (HPR) online via AFSC Connect, by email to info@afsc.ca, by mail or fax. The deadline to file your annual crop HPR without penalty each year is November 15.

AFSC uses the information to determine the total production for each insured crop for two reasons: first, to determine if the crop is in a production shortfall and what level of compensation you are owed; and second, to determine your ongoing individual coverage and premium for each insured crop

Each client has individual coverage based on their reported history for each insured crop. When the harvested production is less than the insured coverage, the crop is in a production shortfall and the client is eligible for compensation.

For payment by declaration AFSC uses the reported information on your HPR, including grade, weight and dockage, as the basis to calculate the level of payment owed to you — without an adjuster going out to your farm to measure and sample the harvest.

You may be selected for a random production review at a later date. If you are selected for a review, an adjuster will contact you to make an appointment. AFSC conducts these reviews to ensure continued program integrity.

Yes. AFSC offers two advance payment options that allow you to receive a portion of your claim prior to an adjuster completing an on-farm visit. If eligible, you can choose which advance type you want and which crops you want the advance on. As well, to help facilitate your tax planning you can defer both of the advance types.

Yes, in order to ensure the integrity of the insurance programs, AFSC performs a specific percentage of random production reviews each year.

If you are selected for a production review, you will be contacted by an AFSC adjuster to set up an appointment. During that appointment, all of the crops you insured will be measured and sampled to determine grade. If you have sold any production, AFSC asks that you have your receipts available for the adjuster during the on-farm visit.

If you previously received payment by declaration and are now selected for a production review, only the crops that were in a production shortfall will be measured and sampled.

If you are going to be away for a time period or have another need to assign someone as your Authorized Representative, you must complete the Third Party Authorized Representative Form by logging in to AFSC Connect and uploading the form or returning it to your AFSC branch.

If you would like additional information, go online to AFSC.ca, log in to AFSC Connect and chat, or call our Client Service Centre at 1.877.899.2372 or your local branch. Staff can assist you with any questions related to forms or the use of AFSC Connect.

After a storm, take the following steps:

Step 1 Check your insured fields to identify damaged areas prior to filing a hail claim. Assessing your fields following a hail storm will help speed up the process. Having non-damaged fields on your claim can impact wait times and will be subject to Hail Claim fees.

Step 2 Submit your hail claim online to AFSC within 14 calendar days following the storm occurrence date. Hail damage reports filed after 14 days will not be accepted.

Fees may apply for client-requested re-inspection or client-requested hail inspections where the damage is less than 10 per cent available. Please refere to the AFSC Schedule of Fees for more information.

AFSC will complete one count per crop/field before the client is charged. Claims that have had a count completed and it is determined there is little to no damage will be withdrawn or a No Claim indicated.

If the client insists on looking at more areas or fields, the client will be subject to an $80 per hour inspection fee (rounded up to the nearest half hour) plus mileage to a maximum of $500 per day.

You can now file a hail claim online via AFSC Connect for Hail Endorsement, Straight Hail or both.

If you need help filing a claim, there is a ‘how to’ video available in our library AFSC Connect Help Resources

Alternatively, clients or their Authorized Representative can call 1.877.899.2372, contact AFSC through chat, email info@afsc.ca or visit any AFSC branch office.

AFSC requires the following information when filing a report of hail damage:

- legal location, crop type and number of acres affected;

- date of the storm;

- estimate of the percentage of damage for each crop after checking your fields;

- and notification if you are considering putting this crop to an alternate use (silage, bale or plough down)

After the claim is submitted, an AFSC Adjuster will contact you or your Authorized Representative to make an appointment to conduct the inspection.

If fields are hit by a subsequent hail storm you will need to file an additional damage report before fields are inspected.

Sign in to the Online Hail Claim report on AFSC Connect and create a Hail Claim report with the second storm details.

AFSC Adjusters are following safe distancing protocols to ensure clients, adjusters and their families are safeguarded during the Alberta Relaunch strategy.

Clients should plan to accompany the Adjuster when they arrive, and follow safety protocol guidelines.

You must be able to show the Adjuster where the damage is, how to access the fields or exactly where to direct them.

AFSC’s Adjusters perform inspections in accordance with the AFSC Adjusting Procedure Manual, the Contract of Insurance, AFSC’s Code of Conduct, Freedom of Information and Protection of Privacy (FOIP) and directives issued by Inspection Services thus ensuring provincial consistency.

Our Claims Adjusters are committed to providing a fair assessment that compensates our clients for the insurable losses suffered, while maintaining the integrity of the program through:

- Professionalism: as described in AFSC Code of Conduct

- Transparency: clients are invited to accompany Adjusters during the inspection and hear the results and explanation of the assessment

- Openness: Adjusters are able to answer any questions about how they determined their findings

- Fairness: Adjusters will select locations in the field that accurately represent the field.

- Integrity: Adjusters will assess any loss using established methods based on scientific research as described in our Adjusting Manual

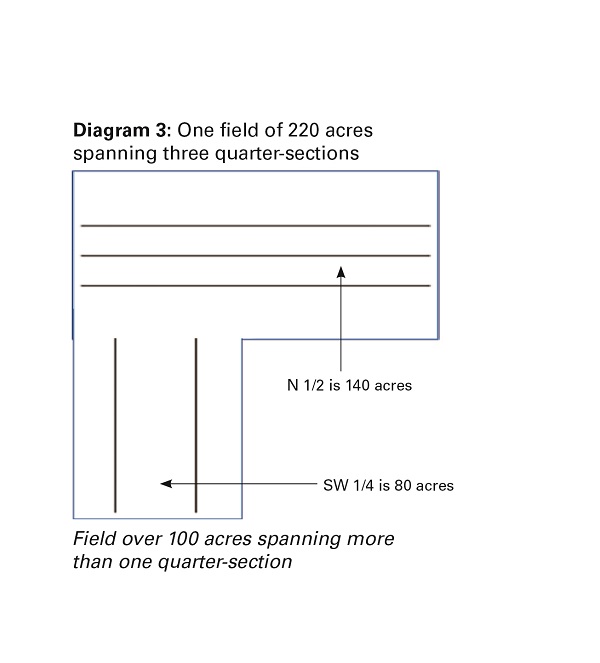

If your crop has not been inspected and you are ready to begin harvest, please contact your AFSC office to obtain approval to leave representative inspection strips. Inspectors will use these strips to assess your crop’s damage, while still allowing you to begin or continue to harvest or swath. These strips are your responsibility to maintain, and they must meet the following criteria:

- Leave a strip in from the field’s edge at a distance of one-third the width of that field.

- Each strip should be a minimum of 10 feet wide and span the full length of the field.

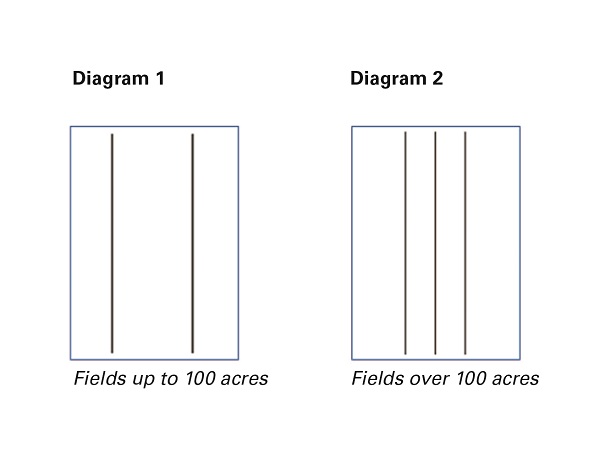

- Fields less than 100 acres require 2 strips.

- Fields over 100 acres require an additional strip, for a total of 3 strips.

- Fields that span multiple quarter sections require each quarter section to be treated as separate fields.

Once the Adjuster has completed the inspection it is will be processed. When the inspection is finalized an indemnity will be issued.

Indemnity payments can be deferred for up to one year. If you would like to defer payment, please tell your adjuster during the inspection process. If your cheque has already been issued, Canada Revenue Agency rules state that your payment cannot be deferred.

Deferred indemnities will not be issued before the deferral date. Outstanding amounts owed to AFSC will be deducted from your indemnity. Interest begins to accrue on September 1 on any outstanding amount until your deferral is issued.

Filling out a loan application does not entitle applicants to a loan, we encourage applicants to contact a Lending Specialist to discuss their proposal before completing any forms. Please call 1.877.899.2372 or visit an AFSC office.

1. Agriculture Financial Services Corporation (AFSC) requires that you gather:

a. Three years financial statements/income tax history

b. Birth certificate or proof of Canadian citizenship for non-corporate applicants

c. A certificate of owner/shareholders

d. Information regarding products/services offered, key clients/industries serviced. View Elements of a Financial Proposal to guide you.

2. Complete the following forms:

a. Application for Loan Business

b. Personal Financial Statement (complete for all shareholders)

c. Personal History (complete for all key management personnel)

d. Projection of Income and Expenses

e. Schedule of Ownership and Management

f. Credit Information Request

3. Bring all of the above to an AFSC office near you.

Filling out a loan application does not entitle applicants to a loan. We encourage applicants to contact a Lending Specialist to discuss their proposal before completing any forms. Please call 1.877.899.2372 or visit any AFSC office.

1. Agriculture Financial Services Corporation (AFSC) requires that you gather:

a. Three years financial statements/income tax history

b. Birth certificate or proof of Canadian citizenship for non-corporate applicants

c. Bill of sale/offer to purchase for asset purchases

2. Complete the following forms:

a. Application for Loan

b. Personal History (complete for all key management personnel)

c. Statement of Assets and Liabilities

d. Credit Information Request

e. Farm Operating Statement: Farm Operating Statement Instructions Farm Operating Statement

3. Bring all of the above to an AFSC office near you.

Filling out a loan application does not entitle applicants to a loan. We encourage applicants to contact a Lending Specialist to discuss their proposal before completing any forms. Please call 1.877.899.2372 or visit any AFSC office.

1. Agriculture Financial Services Corporation (AFSC) requires that you gather:

a. Three years financial statements/income tax history

b. Birth certificate or proof of Canadian citizenship for non-corporate applicants

c. Bill of sale/offer to purchase for asset purchases

2. Complete the following forms:

a. Application for Loan

b. Personal History (complete for all key management personnel)

c. Statement of Assets and Liabilities

d. Credit Information Request

e. Farm Operating Statement: Farm Operating Statement Instructions Farm Operating Statement

3. Bring all of the above to an AFSC office near you.

Loan program participants have several options to make loan payments:

- Pre-authorized payments

Set up an automatic bank account withdrawal for the 1st or 20th of each month. Contact your lending relationship manager to set up automatic withdrawal. - Bank/financial institution

Make your payment in person or by internet or telephone banking. When submitting your payment, use your seven to nine digit loan number provided on your payment notice, not your AFSC ID number. - In person or by mail

Return your Notice of Payment Due along with a current or post-dated cheque. Your branch information is included on your payment notice.

Choose the solution that works for you. Download Sending a Payment to AFSC to learn more.

Agriculture Financial Services (AFSC) staff are ready to help make loan payments as easy as possible. Call 1.877.899.2372, email info@afsc.ca or visit any AFSC office for more information.

Yes, you can access your annual and year-to-date statements of loan online through AFSC Connect. You can instantly view your information, including when your next payment is due, as well as other important loan details. You can also see a history of your statements for the past three years, based on your fiscal year. You can also generate a year-to-date statement of loan whenever you need.

To access online lending information and statements

- Log into AFSC Connect

- Click on My Lending

- Under Lending Subscription, find the subscription and select View Details

- The Subscription Details page will open. Loan information, including next payment due details, will be displayed

If you have any questions or need assistance, please contact AFSC via Live Chat on AFSC Connect or AFSC.ca or call our Client Care Centre at 1.877.899.2372.

Monitoring the LPI premium tables is a prudent strategy to making sound business decisions. As the markets fluctuate, producers are able to capitalize on coverage advantageous to their operation. Additionally, purchasing multiple policies over a period of time distributes risk, as opposed to buying coverage for all animals at once.

Insuring animals with different policy expiry dates can be a beneficial way to split marketing and price risk, particularly if producers sell animals over a few weeks of time.

When a producer purchases a LPI insurance policy, it protects the producer’s investment on calves, feeders, fed cattle and hogs. This program allows producers to retain the increase in the market price while still having peace of mind of protection from a potential market downturn.

Premiums are strongly influenced by market volatility. Premiums are most economical when market volatility is relatively low.

LPI offers a wide range of coverage, which allows producers to tailor their level of protection to the risk they want to insure and the premium within their budget.

No. If you wish to cancel and forfeit your premium to buy again, contact your local LPI office.

In the event of a border closure, pandemic, or other market disruption, policies already in effect will be honoured. There may be a delay in calculating the indemnity until such time when sufficient data is received to calculate a settlement index. (Some policies may be settled retroactively). The ability to purchase further policies will be assessed by the Insurers at time of event.

If insured cattle or hogs die, there is no adjustment made to a producer’s policy. LPI advises producers when calculating their weight for a policy to account for potential death loss during the policy. All LPI policies are subject to random audit by their Insurer. Producers may want to consider calculating a weight variance to insure below their total target weight to ensure audit compliance is met in the case of unforeseen death loss or overestimated weight gain on insured animals.

LPI is not designed to insure mature breeding stock. The available insurance products do not represent the value or market price of breeding stock.

No, unlike other crop insurance programs, there is no government cost-sharing of LPI premium or indemnity. The program is solely producer funded. LPI is designed to comply with trade agreements; therefore, over the long-term, the premiums collected will fund the indemnities paid. However, the federal government funds program development and administration costs, as well as provide deficit financing.

If the fund goes into a deficit position, the Government of Canada and indemnity from a reinsurance policy will cover the program. Existing policies will be honoured even in the case of a border closure or similar catastrophic market event.

The Sustainable Canadian Agricultural Partership, also known as Sustainable CAP, is a five-year program (2023-2028) and includes a $3.5 billion investment by federal, provincial and territorial governments to strengthen competitiveness, innovation and resiliency in the agriculture, agri‐food and agri‐based products sector. This investment includes $1 billion in federal programs and $2.5 billion in cost-shared programs funded 60 per cent federally and 40 per cent provincially-territorially.

Many of AFSC’s programs and initiatives are offered as part of the Sustainable CAP agreement between the province and the federal government.

All wildlife damage is reported online through AFSC Connect.

If you have an AFSC Connect account, log in to your account, select My Insurance and click the Report Wildlife Damage

You should report your wildlife damage a minimum of three days prior to the intended harvest date.

If you have any questions while you complete the online process, use AFSC’s Live Chat feature or contact the AFSC Client Care Centre at 1.877.899.2372.

If you are an existing AFSC client, you can create an AFSC Connect account by going to the Login page, click on Login to AFSC Connect. You will then see an option to create an account.

If you have not done business with AFSC previously and do not have an AFSC ID, you will need to contact AFSC to set up a client profile for you before you can create an AFSC Connect account.

For help creating your AFSC Connect account, please see our step-by-step guide on creating an AFSC Connect account

If you have questions during the set-up process, use the AFSC’s Live Chat feature or contact the AFSC Client Service Centre at 1.877.899.2372 to help you get set up.

There are several benefits to filing online, including 24/7 access so you can file when it’s convenient for you.

- With online reporting, you will receive a case number for tracking and inquiries.

- Online reporting ensures your information is submitted efficiently and accurately.

- Producers who have AFSC insurance will have their insured information prepopulated to select during the wildlife application process.

For wildlife damage to unharvested crops, you will need to provide land locations of the damaged fields, the type of crop and end use, the number of seeded acres and number of damaged acres, an estimate of the percent of wildlife damage, the cause of damage (wildlife or waterfowl), and your planned harvest date.

For wildlife damage to stacked hay, and silage or haylage in pits and tubes, you will need to have contacted Fish & Wildlife prior to submitting a claim.

For wildlife excreta damage, you will need to provide the land location where the damaged crop is stored, the type of crop and type of damage (wildlife, waterfowl), as well as the year the crop was harvested.

After submitting your information, you will receive a confirmation email regarding next steps.

AFSC will arrange to have an adjuster assess the wildlife-damaged crops. Damaged acres harvested before AFSC completes an assessment are not eligible for compensation. Undamaged acres can be harvested at any time.

For additional information, please contact AFSC using online chat, call our Client Service Centre at 1.877.899.2372 or contact a branch office. We are ready and available to answer your questions and assist you.

Payments are based on the losses to yield and grade from eligible wildlife. Wildlife compensation is based on the highest insurable dollar value for the crop in the current crop year.

For producers with production-based insurance, payments will be processed once the Harvested Production Report has been finalized and after the fall prices are available around mid-November.

For producers with area-based insurance and non-insured producers, payments will be processed based on the area average for the crop which will be determined early in the New Year.