Livestock Feed Assistance Initiative Q&As

The 2021 Canada-Alberta Livestock Feed Assistance Initiative compensates Alberta's producers for the extraordinary feed costs incurred due to drought and extreme high temperatures in 2021. It also supports the management and maintenance of Alberta’s breeding animals.

Q&As

PROGRAM BASICS

Q: What does this initiative cover?

This initiative provides compensation for the extraordinary feed costs incurred by Alberta’s livestock producers due to dry conditions and extreme high temperatures in 2021. It also supports the management and maintenance of Alberta’s breeding animals.

Q: What are the eligibility requirements for the initiative?

To be eligible to participate in the initiative:

Participants must:

- Be an individual who is at least 18 years of age; either a Canadian citizen or a permanent resident of Canada; and resident in Alberta; or be a corporation whose majority of voting shareholders are resident in Alberta.

- Report farm income and expenses in Alberta for income tax purposes. Applicants who are not required to file farm income tax must provide documentation that demonstrates the production and sale of agricultural commodities;

- Be responsible for feeding and primary care of the eligible animals or bee colonies or hives located in Alberta. Landlords in a cow/calf share arrangement will not be considered eligible applicants in respect to those animals; and

- Apply to the program as specified in the Terms and Conditions.

Animals must, with the exception of bees:

- Be breeding female animals;

- Be grazing animals including, but not limited to:

- Horses

- Cows/bison

- Elk/Yak/Musk Ox

- Deer/Llamas

- Sheep/Goats/Alpacas.

For beekeepers: Bees must be part of an operation with a minimum of 100 colonies/hives placed and cared for within Alberta.

Q: Are breeding males or cull breeding stock eligible under the initiative?

No. Market animals, culled breeding stock, breeding males and animals owned in whole or in part by a federally licensed or provincially licensed slaughter facility are not eligible under this initiative. Animals that were or are being fed for weight gain on pasture or in a confined feeding operation are also not eligible under this initiative.

Q: Are hogs, poultry and dairy cows eligible?

No. Hogs, poultry and dairy cows for commercial milk production are not eligible for this initiative.

Q. Why are dairy cattle excluded from this AgriRecovery initiative?

Dairy cattle are not presently considered grazing animals. As the dairy industry does not typically use grazing in their practices for breeding/milking animals, they have been excluded from the AgriRecovery.

The dairy industry in governed by supply management, which allows this sector other avenues to compensate for items such as increase feed costs.

Q. I have horses. Are they eligible for this initiative?

Breeding mares that are used for the purposes of producing offspring as part of your farming operation would be considered eligible. Horses used for pleasure – rodeo stock, race horses and working ranch horses – are not considered eligible. As a reminder, a minimum of 10 breeding mares are required to be eligible for the initiative.

Q. I own animals where the breeding cycle would not require breeding females to be exposed to breeding males on or before August 6, 2021. Are my animals eligible?

Breeding females are eligible if the intent is to have those animals be bred as part of the coming breeding cycle.

For example, if you have sheep and have ewes that will be put with a ram in October 2021, any of the ewes or replacement ewe lambs that will be exposed to the ram and were on pasture in your care as of August 6, 2021 are eligible.

Q: I own/care for animals jointly with another person or entity. How do I apply for the livestock feed assistance initiative?

If you own/care for animals jointly, there are two ways you can apply for assistance through to this initiative:

- One person or corporation would apply for 100 per cent of the breeding females being cared for by the group.

- Each person or corporation would apply independently for their share of the breeding females being cared for by the group. Your application must only include your ownership share stated in number of animals (eg. If two individuals own 21 eligible animals jointly, one individual would apply for 10 animals, and the other for 11 animals.) Fractional ownership applications will not be accepted).

Livestock Feed Assistance Initial Payment

Q: What is covered under the initial payment?

Eligible participants can apply for a feed assistance payment based on a minimum of 10 eligible animals per category of livestock on hand as of August 6, 2021.

Q: How do I apply?

Participants are strongly encouraged to apply online using AFSC Connect for faster service. Individuals who need assistance with applying should contact the AFSC Client Service Centre at 1.877.899.2372 or call an AFSC branch office to discuss their options.

Q: I am not a current AFSC client, and I do not have an AFSC Connect account. What do I need to do to participate?

Producers who are not currently AFSC clients will need to be set up as AFSC clients.

Q: I am a current AFSC client, but I do not have an AFSC Connect account. What do I need to do so I am ready for the application?

Producers who are current AFSC clients should ensure they have an AFSC Connect account and are signed up for direct deposit to receive program payments as quickly as possible.

- Instructions for creating an AFSC Connect account are available on the AFSC website How to Create, Login, and Update Your AFSC Connect Account.

- Instructions for setting up direct deposit for payments are also available on the AFSC website Receiving a Payment from AFSC by Direct Deposit

Q: What information will I need to provide on application?

You will need to provide your premises ID and the number of animals you had on hand as of August 6, 2021.

Q. I realize I have made an error on the application I submitted. How do I get my information updated?

Reach out to an AFSC branch office or call the AFSC Client Service Centre at 1.877.899.2372 to discuss the required changes.

Q: Do feed and water expenses need to be submitted for the initial payment?

No, records of expenses do not need to be submitted for the initial payment. Eligible participants can apply for the initial payment based on the number of eligible animals on hand as of August 6, 2021.

Q: What is the deadline to apply for the initial payment?

The application deadline was November 1, 2021.

Q: How will the payment be calculated?

Eligible participants will receive a per head payment for eligible animals to assist with the costs incurred due to lost pasture/grazing days. Eligible breeding animals and compensation rates are:

- Horses $113/head

- Cattle and bison $94/head

- Elk, yak, and musk ox $47/head

- Deer and llamas $24/head

- Sheep, goats and alpacas $19/head

Q: I have breeding females that do not fall into any of those categories. Am I still eligible for the initiative?

The eligibility and payment rate for animals not specifically mentioned in the initiative’s terms and conditions will be reviewed by the initiative’s administration. Producers should complete the application to start the review process.

Livestock Feed Assistance Secondary Payment

Q: What is covered under the secondary payment?

The secondary payment covers additional extraordinary cost over and above the initial payment. These payments will be based on the number of eligible animals on hand as of December 31.

Q: I did not participate in phase one of this initiative. Can I still participate in phase two?

Yes, producers who did not participate in phase one are eligible for phase two.

Q: Can I access the full $200/head compensation?

Yes, producers who did not receive an initial payment of $94/head can apply for compensation of up to $200/head under the second phase. Producers who received the initial $94/head payment can apply for up to a maximum of $106/head for additional extraordinary costs.

The $200/head payment amount is based on cattle and bison. A conversion rate of 1.2 for horses; 0.5 for elk, yak and musk ox; 0.25 for deer and llamas; and 0.2 for sheep, goats and alpacas is applied to arrive at the compensation rate for those species of grazing livestock.

Q: How do I apply?

The application for the secondary payment will be available in early January 2022. Please watch the AFSC website and social media platforms for updates.

Q: How will the secondary payment be calculated?

The secondary payment will be calculated using a feed-need calculation, supplemented by proof of eligible expenses. Proof of expense can include receipts or other supporting documentation deemed acceptable by the initiative’s administration.

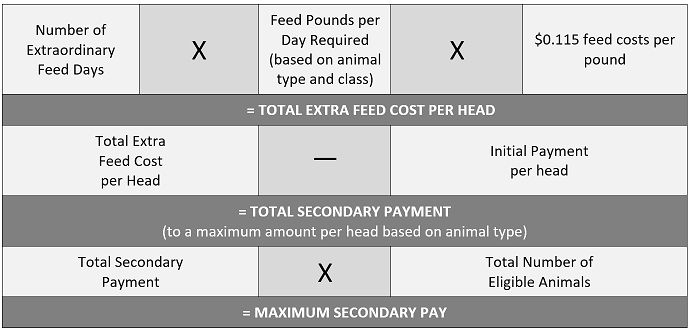

Payments will be calculated as follows:

Q: How will the number of extraordinary feed days be calculated?

The number of extraordinary feed days will be calculated by taking the normal number of grazing days (days on pasture) and subtracting the number of days the participant was able to follow normal grazing practices in 2021.

Producers may need to provide evidence of changes to their normal practices to verify their feed-need calculation.

Q: How do I know what to enter for the changed feeding practice start date on the secondary payment application?

The changed start date does not reflect when you decided to change your normal grazing practices; rather, it is when you actually made the change.

Q: Does the same changed feeding practice start date apply for all eligible animal types?

The changed feeding practice start date on your application should reflect the date that you changed normal grazing practices for that animal type. This date may be the same or different for each animal type you feed, depending on when you made the change to your feeding practices.

For example, if you rotated your cows to a new pasture earlier than expected, the date you changed feeding practices would be considered the start date for your cows. If you also have sheep, the date you started supplementing their ration with extra feed would be the changed feeding practice start date for your sheep.

Q: Does the same changed feeding practice start date apply for all my animals of one animal type (i.e. cows (beef)?

This date may be the same or different for each group of the same animal type you feed. If you have the same animal type at multiple PID locations, the changed feeding practice feeding start date should reflect the date you altered the feeding practice in the location the animals were being kept. This date may be the same for all groups or may vary.

Q: How does choosing to harvest my own crop for feed affect the secondary payment?

If you decided to change your intention for your crop due to requiring additional feed because of the drought, the day that you started harvesting that crop for feed could be considered the changed feeding practice start date. In essence, the day your herd management changes, the feed need count begins, including if that change is the harvesting of a crop for a different use than was intended.

Q: What is the price of feed and how was it determined?

The blended average price is $0.115 per pound for feed. The price is based on the estimated average feed cost using Alberta forage and grains for a blended feed mix and the August 2021 price per pound. The blended feed price includes a mix of alfalfa, mixed and lowland hay, greenfeed, silage, cereal straw, oats, and barley.

Q: How do I know if my feed purchases qualify as a feed expense for the extraordinary eligible expenses section of the 2021 Canada-Alberta Livestock Feed Assistance Initiative secondary payment?

Feed purchases would be considered an eligible expense if you needed to purchase a higher quantity of feed than usual for the same number of animals. The expenses associated with the additional quantity of feed would be considered eligible.

However, if you purchased the same amount as you would normally require for the number of animals in your care, but it was more expensive than usual, that feed purchase would not eligible as an extraordinary expense. AgriRecovery programs do not compensate for changing commodity pricing as that falls under normal risk and is considered in other programs like AgriStability.

Q: What is the maximum per head secondary payment?

- Horses: $127/head

- Cattle and Bison: $106/head

- Elk/Yak/Musk Ox: $53/head

- Deer and Llamas: $27/head

- Sheep/Goats/Alpacas: $21/head

Q: I have additional extraordinary expenses due to the drought, which are not included in the feed-need calculation. Are they covered under this initiative?

Eligible expenses not included in the feed need calculation may include:

- Feed

- Temporary water provision (not covered by the CAP Water Program)

- Temporary fencing

- Transportation costs related to hauling feed, water or animals

- Pregnancy Tests

- Other activities required to secure Feed supplies or maintain the breeding herd.

Eligible expenses will be paid at up to 70 per cent. The combined payment will not exceed the per head maximum by animal type set out in the initiative’s terms and conditions.

Q: How do I know if my purchases would qualify as a temporary water expense for the extraordinary eligible expenses section of the 2021 Canada-Alberta Livestock Feed Assistance Initiative secondary payment?

To be considered as an eligible expense the item must not be covered by other government programs, such as the Canadian Agricultural Partnership water program, which provides money for new wells and dugouts. To be eligible under this AgriRecovery initiative, the expense must relate to temporary solutions to the drought challenges. Generally, pumps and pipe would be eligible. Cleaning out a dug out would not be eligible as that is a long-term benefit rather than a temporary change.

Q: How do I know if my purchases would qualify for a temporary fencing expense for the extraordinary eligible expenses section of the 2021 Canada-Alberta Livestock Feed Assistance Initiative secondary payment?

Fencing installed to allow access to more grazing feed due to drought is eligible. Fencing projects that were planned or are not designed to allow for more grazing area are not eligible.

Q: What are some expenses that do not qualify for the extraordinary eligible expenses section of the Canada Alberta Livestock Feed Assistance Initiative Secondary Payment?

Generally, the following items would not be eligible for compensation under the extraordinary eligible expenses section of the 2021 Canada-Alberta Livestock Feed Assistance Initiative secondary payment:

- Labour

- Additional fuel and maintenance costs for equipment.

However, a per kilometer expense would be eligible if you used your own equipment to haul extraordinary feed and water or for the extraordinary transportation of animals due to drought (having to haul animals to new locations/moving more times that would normally be required throughout the grazing season). Changes in fuel expense is covered by AgriStability - Custom work related to harvesting your crop

- Large capital purchases (feeding equipment such as tub grinders, tractors)

Q: What type of expenses are NOT allowable as “other” expenses for the 2021 Canada Alberta Livestock Feed Assistance Initiative Secondary Payment?

- Pasture rent or land rent of any kind

- Feeding equipment/tools (e.g. tub grinders, grain rollers, feed bunks, feeders, trailers, feed wagons)

- Custom work associated with putting up feed or preparing feed (e.g. custom cutting, baling, silaging, grinding)

- Fertilizer or seed purchases for crop or pasture lands

- Wrap or twine for feed (e.g. silage tarps, bale wrap)

- Hiring of additional labour

- Vaccines or herd health medications for animals

- Irrigation costs

- Fuel and maintenance costs on equipment

- Purchase of standing crop

- Feeding of carryover feed inventory (value of inventory)

- Value of own crop used for feed versus cash sale

- Equipment rental

Q: Where do I include mineral/salts/protein tubs that are over and above normal quantities I would normally use?

These purchases should be included under the Feed Expense Category.

Q: Will I need to provide receipts?

Participants will need to be able to provide proof of expense. This can be in the form of a receipt or proof of additional expenses for feed. Producers unable to provide proof of expense will be required to pay back any funds paid out.

Q: How do I apply?

The application for the secondary payment will be available in early January 2022. Please watch the AFSC website and social media platforms for updates.

Livestock Feed Assistance: Bee Feed Assistance

Q: What is covered under the secondary payment for bees?

Participants will receive one payment for up to 70 per cent of the extraordinary costs association with preparing eligible bees for winter. They will receive up to $7.50 per hive to assist with the costs to purchase pollen patties and syrup.

Q: Will I need to provide receipts?

Participants will need to provide proof of expense. This can be in the form of a receipt or proof of additional expenses for feed (syrup and pollen patties). Producers unable to provide proof of expense will be required to pay back any funds paid out.

Q: How do I apply?

The application for the secondary payment will be available in early January 2022. Please watch the AFSC website and social media platforms for updates.

GENERAL QUESTIONS

Q: I am using Internet Explorer (IE) 11 to log into AFSC Connect, but I keep getting an error. What is happening?

Internet Explorer (IE) 11 is not a supported browser, as it is nearing end of life. We suggest clients use a more modern browser such as Edge, Chrome or Safari.

Q: Will I be audited?

All audits will be random. Participants selected for audit will be notified of information required to complete the audit.

Q: Who do I contact for more information?

For additional information, please call the AFSC Client Service Centre at 1.877.899.2372, use AFSC online chat, or contact a branch office. AFSC is available to answer your questions and assist you.