Straight Hail Insurance Program Information 2024

Straight Hail Insurance provides protection for spot-loss damage to crops caused by hail, accidental fire or fire caused by lightning. This product is available to anyone with an interest in an insurable crop grown in Alberta, whether they are a producer, a tenant or a crop-share landlord. Cash-rent landlords are not eligible

Straight Hail Insurance

Producers can purchase Straight Hail Insurance on viable crops online at AFSC.ca and at any AFSC office prior to the application deadline of July 31.

- Insurance is purchased in one-dollar increments and comes into effect at noon on the day following the date of application.

- Straight Hail Insurance expires if the crop is put to another use, when harvest is complete or at midnight on October 31 of the year of application.

If damage was incurred on one or more fields prior to Straight Hail Insurance being purchased, those acres are not eligible for Straight Hail Insurance. Producers are required to report any previous damage, and effected fields will not be insured.

Viable annual or perennial crops (excluding pasture) are insurable under Straight Hail Insurance. A full list can be found in the Straight Hail Contract of Insurance, Schedule of Insurance posted on AFSC.ca.

To get an estimate of your premium based on your own crops, there are two options available:

- Log in to AFSC Connect at AFSC.ca/login to quickly populate your land and crop information from previous hail insurance and/or crop insurance

- Enter land and crop information from scratch using the Straight Hail Premium Calculator available on AFSC.ca

Dollar coverage per acre is limited to one-dollar increments, by crop category, and separately for dryland and for irrigation.

Coverage Available by Crop Category

Cereals, most oilseeds, pulse and forage (hay and perennial seed) crops can be insured to a maximum of:

- Dryland – $325 per acre;

- Irrigated – $575 per acre.

- Liability will be prorated on hay crops with more than one cutting

Chick peas and canola can be insured to a maximum of:

- Dryland – $425 per acre;

- Irrigated – $575 per acre.

Specialty crops, such as vegetables, herbs, spices and essential oils, can be insured to a maximum of:

- Dryland – $2,525 per acre;

- Irrigated – $2,900 per acre.

Potatoes, including chip, creamers, fry, seed and table can be insured to a maximum of:

- Dryland – $3,725 per acre;

- Irrigated – $4,150 per acre.

Market garden crops can be insured to a maximum of $19,050 per acre.

When more than one Policy is purchased on a field, whether by the same producer or a combination of producers who have an insurable interest in the crop, the combined dollar coverage per acre of all Policies cannot exceed the Straight Hail Insurance coverage limit.

Producers have the option to insure all or only a portion of their field, contact AFSC for further details.

Producers can choose full coverage or coverage with a 10 per cent or a 25 per cent deductible; the higher the deductible, the lower the premium rate.

Insurance protection begins when the crop emerges and continues until:

- The insurance is cancelled by the Insured (can only be cancelled if a claim has not been paid);

- The crop is put to another use;

- The acres have been abandoned due to no harvest value;

- The crop is harvested;

- Midnight October 31.

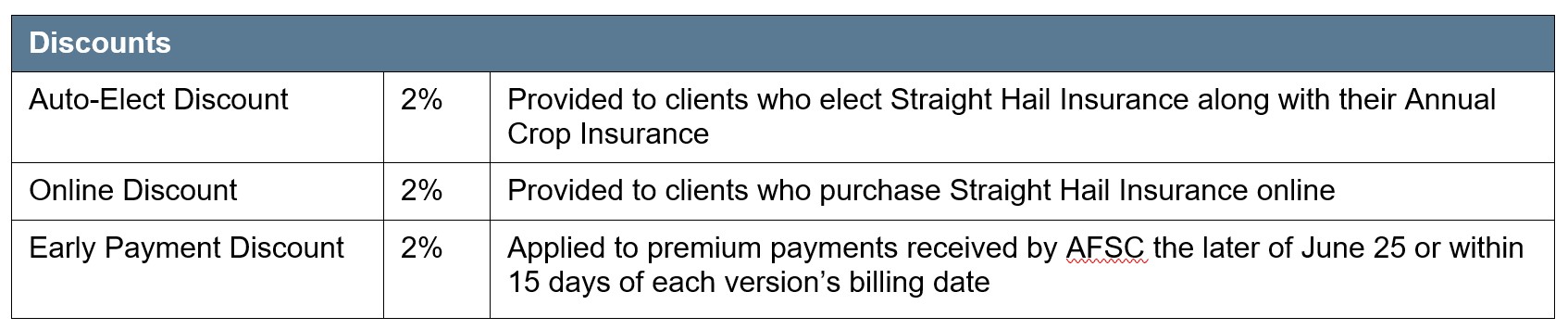

Auto-Elect Straight Hail: AFSC offers an option to purchase Straight Hail Insurance at the same time the Insured elects coverage under the majority of annual crop insurance Policies including Silage Greenfeed and Corn Heat Unit Insurance. The Insured receives a two per cent discount on the Auto-Elect Straight Hail Insurance premium.

The Insured’s Auto-Elect Straight Hail Insurance is renewed each year when the annual crop insurance Policy is renewed. The Insured is responsible to review the renewal information, and if changes are required complete a Change Request form online or return the form to an AFSC insurance representative by mail, fax, email, in person, or request changes by phone, no later than April 30. If the elected crop is not seeded, premium is not charged.

a. An Insured who elected Auto-Elect Coverage in the previous year will be automatically renewed with the AgriInsurance for annual crops based on the previous year’s information. Refer to the applicable Insuring Agreement for details.

Straight Hail Insurance is not subsidized by any government. Premium and administration costs are funded completely

Hail premium base rates are set annually based upon the historical hail loss by township. These rates vary by crop depending on the crop’s susceptibility to hail damage. The Schedule of Insurance, found within the Straight Hail Contract of Insurance on AFSC.ca, presents the rates by crop as a base rate, ¾ times base rate, 1½ times base rate, 1¾ times base rate and 2 times base rate.

There is a minimum $25 of actual calculated premium per insurance subscription.

Straight Hail Insurance provides spot-loss coverage for damage to crops due to hail, accidental fire, fire by lightning. When the insured crop suffers a loss of 10 per cent or more, the client is eligible for a payment based on the percentage of loss on the damaged acres.

When purchasing Straight Hail Insurance, producers are advised to appoint an authorized representative who can act on their behalf. An authorized representative has the same authority as the Insured in their absence, to not only report but also accept damage assessed to crops.

Acres are not eligible for Straight Hail Insurance if the acres have incurred damage prior to Straight Hail being purchased.

The deadline to apply for Straight Hail Insurance is July 31.

Reporting a loss: Submit your hail claim to AFSC within 14 calendar days following the date on which the storm occurred. Late reporting of hail damage after 14 days will not be accepted.

AFSC Connect online hail claim reporting provides a simplified way to report by prepopulating your land and crop information. Claims can be submitted online through AFSC Connect at AFSC.ca/login or by phone.

Insureds are to check insured fields to identify the damaged areas prior to filing a hail claim and are expected to take the adjuster to damaged fields when the damage assessment is completed.

AFSC requires the following information when a report of hail damage is filed:

- The legal location, crop type and number of acres effected;

- The date of the storm; and

- Estimate of the percentage of damage for each crop.

Insureds are required to accompany the adjuster during a claim inspection and to take the adjuster to the damaged areas of each field. Adjusters may wait to adjust a claim so that damage is more accurately identified. Claims may be deferred if crops are not sufficiently mature for accurate damage to be assessed.

If the crop is damaged when mature enough to swath or harvest, once authorized by AFSC, the Insured may leave representative Inspection Strips or swaths for adjusters to use to assess damage. Additional information on Inspection Strips can be found on the AFSC website.

Cancellations: An Insured may cancel insurance on a parcel of land if there has not been an indemnity paid, by completing and signing the Request for Cancellation section at the bottom of the Statement of Coverage and Premium. Cancellations are effective immediately upon receipt by AFSC, or, if it is forwarded by registered mail, the effective date of cancellation is the postmark date.

Policies cancelled may be eligible for a percentage of premium refund, as per the Cancellation and Premium Refund Schedule in Straight Hail Contract of Insurance for either spring seeded crops or fall seeded crops posted on AFSC.ca.

A minimum of 10 per cent damage is required to initiate a claim, and there must be at least 10 per cent hail damage on each spot-loss area for those areas to qualify for payment.

Indemnity Calculation Examples

Assumption

- 100 acres insured

- $200 Straight Hail Insurance coverage per acre

Example A

70 per cent hail damage to the entire acreage of crop.

Indemnity = Acres x $ coverage per acre x % of damage

= 100 acres x $200 x 70%

= $14,000

Example B

When crops are damaged between 71 and 89 per cent, the Insured will receive a harvesting allowance. The harvesting allowance is equal to the percentage the damage exceeds 70 per cent to a maximum of 10 per cent. Crops that are damaged equal to or greater than 90 per cent are paid at 100 per cent.

Example 75% damage: 75% + 5% = 80% loss paid

Assume: 75 per cent hail damage to the entire acreage of crop.

Indemnity = Acres x $ coverage per acre x (% of damage + % harvesting allowance)

= 100 acres x $200 x (75% + 5%)

= 100 acres x $200 X 80%

= $16,000

Example C

When deductible coverage is purchased, the Insured will be paid the difference between the assessed hail damage percentage and the deductible level selected. Deductible coverage is eligible for harvest allowance.

Assume: $200 coverage per acre with a 25 per cent deductible and 75 per cent hail damage to the entire acreage of crop.

Indemnity = Acres x $ coverage per acre x [(% damage + % harvesting allowance) – % deductible]

= 100 acres x $200 x [(75% + 5%) – 25%]

= 100 acres x $200 x 55%

= $11,000