Producers can expect to see higher dollar coverage due to higher commodity prices

Annual Insurance Perennial InsuranceProducers can expect to see higher premiums for the 2022 crop year. These increases to premium costs are mainly due to higher commodity prices as a number of forces, including low yields in 2021, have pushed commodity prices higher.

“In 2021, AFSC programs supported producers who faced the challenges of extreme dry conditions and prolonged heat. This year, we’re seeing the consequences of that challenging year,” said CEO Darryl Kay.

“The investment producers will have in the ground this year will be higher than ever, due to rising input costs and the expected value of the crop. This means producers are insuring a more valuable crop this spring and will have higher coverage as a result.

“Total AgriInsurance coverage for 2022 is expected to exceed $8.1 billion on 16.2 million annual acres. That means the average coverage is estimated at $501/acre, up significantly from $365 in 2021.

“This substantial increase in coverage reflects the expectation of continued strength in commodity prices into the 2022 crop year,” Kay shared.

For 2022, AgriInsurance spring insurance prices for annual crops (dollar coverage) will increase by an average of 37 per cent, while pasture and hay crops will increase by approximately 15 per cent, also increasing premium costs. Producers’ coverage levels will increase by the same percentage.

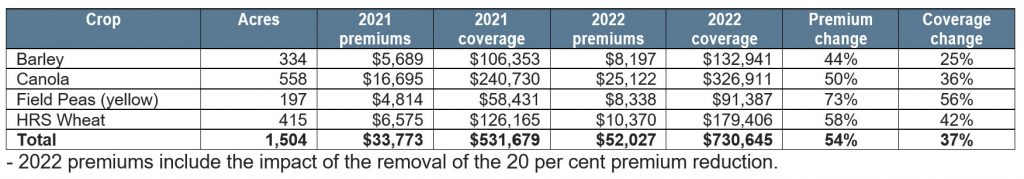

For example, an average 1,500-acre Alberta farm growing a mixture of crops will see increased premium costs of approximately 54 per cent for annual insurance and Hail Endorsement, the majority of which is from increased coverage. The average farm that insures pasture acres under the Moisture Deficiency Insurance (MDI) program will see premium costs increase by $834 or 27 per cent.

However, while producers will be paying more for their insurance due to increased coverage caused by high commodity prices, the cost to insure has not risen as dramatically.

Annual and perennial premium rates will increase by an average of 10 per cent. With Hail Endorsement, although premium rates have decreased, clients will see an overall premiums increase by 11 per cent due to removal of last year’s Alberta Premium Reduction discount.

“This is the first year premium rates for annual insurance will see such a widespread increase, reversing a downward trend in average premium rates,” said Kay.

Major weather events of 2021 and record claim payments, the highest in AFSC’s history, have resulted in a significant decrease in the fund reserve, contributing to the cancellation of the 2021 premium discount and the increase to premiums for 2022.

Other factors impacting premiums

An individual’s loss experience will also impact the overall premium costs.

“Adjustments are also applied to production insurance premiums to reflect an individual’s insured history with AFSC, ” explained Emmet Hanrahan, Vice President, Product Innovation.

“These adjustments are based on the claims paid and premiums collected from the individual. These adjustment are updated annually and can increase or decrease premiums by as much as 38 per cent.”

Managing premium costs

AFSC recognizes the impact increased premium costs have on producers, and annual rates increases are held to a maximum of 10 per cent. Clients have options when it comes to controlling their perennial and annual crop insurance premium costs. Price options are available under the production-based insurance for hay as well as Moisture Deficiency, Satellite Yield and Corn Heat Unit insurance products. Coverage level options, from 50 to 80 per cent, are available for most commodities insured under AFSC’s production-based insurance products. AgriStability is also an option to consider, as it provides a whole farm margin protection for producers.

AFSC also provides a two per cent discount on accounts paid within 15 days of billing. Unpaid balances start accruing interest in September.

“We know there’s good news that producers will receive increased coverage this year, but recognize this is balanced with individual business circumstances,” said Hanrahan.

“We encourage clients to contact their Relationship Manager Insurance to discuss their specific situation and options for how to handle any increases while managing their risk.”

To learn more about the factors pushing premiums high in 2022, please check out Episode 18: 2022 Insurance Premiums of our podcast. If you have questions or would like to discuss your situation, please use Live Chat on our website or AFSC Connect, call our Client Service Centre at 1.877.899.2372 or contact your branch office.