Silage Greenfeed Insuring Agreement – Lack of Moisture 2024

Silage Greenfeed Insuring Agreement - Lack of Moisture

AFSC will indemnify the Insured when Percent of Normal Moisture is less than 80 percent at the Selected Weather Station(s) for the Insured’s dryland crop pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

Silage Greenfeed Insurance is an area-based program that provides an alternative for silage crops and does not require pre-harvest or post harvest inspections. Since individual production does not trigger the loss, the list of crops that can be insured as silage under an area-based approach can be expanded from those eligible under a production-based program.

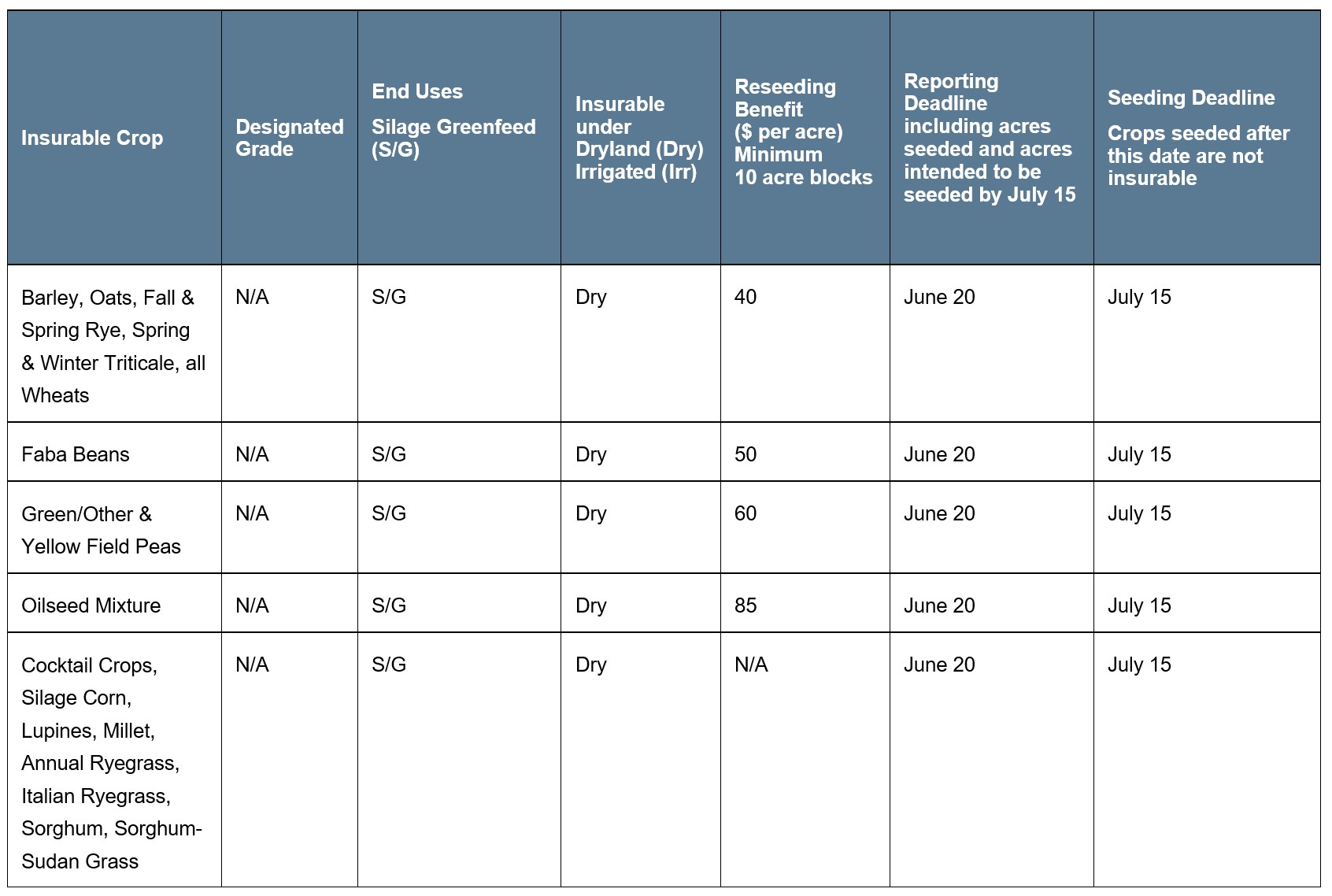

“Insurable Crop” means the following crops intended for Silage, Greenfeed or swath grazing on dryland: Barley, Cocktail Crops, Silage Corn, Faba Beans, Green/Other Field Peas, Yellow Field Peas, Lupines, Millet, Cereal Mixture, Oilseed Mixture, Pulse Mixture, Oats, Fall Rye, Spring Rye, Annual Ryegrass, Italian Ryegrass, Sorghum, Sorghum-Sudan Grass, Spring Triticale, Winter Triticale, Feed Turnips, Canada Northern Hard Red Wheat, Canada Prairie Spring Wheat, Canada Western Special Purpose Wheat, Durum Wheat, Extra Strong Red Spring Wheat, Hard Red Spring Wheat, Hard Red Winter Wheat, or Soft White Spring Wheat.

“August Moisture” is the amount of precipitation, as determined by AFSC, for the month of August, for a Selected Weather Station(s).

“Cocktail Crops” means an Insurable Crop that:

a. is comprised of a minimum of three different crop types;

b. the Primary Crop is an Insurable Crop under this Insuring Agreement excluding Cereal Mix, Cocktail Crop or Oilseed Mix;

c. the Primary Crop is 35 percent or more of the Cocktail Crop’s total plant stand; and

d. no single crop type, that is not an Insurable Crop, composes more than 20 percent of the Cocktail Crop’s total plant stand.

“Designated Peril” means lack of moisture at the Selected Weather Station(s). For greater clarity, this is the only Designated Peril under this Insuring Agreement, and the Designated Perils listed under Article 1 of the Terms and Conditions do not apply to this Insuring Agreement.

“Dollar Coverage per Acre” means 80 percent of the Township Normal Yield for barley multiplied by the Spring Insurance Price.

“Elected Acres” means the number of acres intended to be insured as Silage, Greenfeed or swath grazing.

“July Moisture” is the amount of precipitation, as determined by AFSC, for the month of July, for a Selected Weather Station(s).

“June Moisture” is the amount of precipitation, as determined by AFSC, for the month of June, for a Selected Weather Station(s).

“May Moisture” is the amount of precipitation, as determined by AFSC, for the month of May, for a Selected Weather Station(s).

“Normal Moisture” for each Period of Moisture is the long-term average amount of moisture, as determined by AFSC, for a Selected Weather Station(s).

“Payment Rate” means the rate of compensation at which the Insured is indemnified, as determined by AFSC.

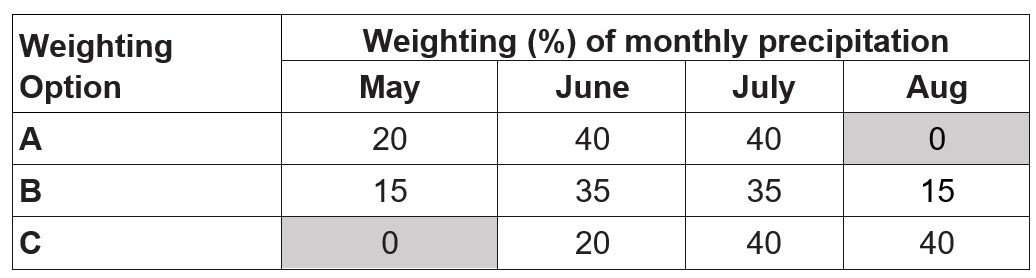

“Percent of Normal Moisture” means, for the Selected Weather Station(s) for the current year, the sum of the May Moisture, June Moisture, July Moisture and August Moisture, and expressed as a percent of their respective Normal Moisture, with each Period of Moisture weighted by the Weighting Option elected by the Insured.

“Period of Moisture” is the period for which moisture is measured under this Insuring Agreement. There are four different periods: May, June, July and August.

“Primary Crop” means the largest single crop type or variety in a stand of multiple crop types or varieties.

“Selected Weather Station” means eligible weather station(s) elected, to a maximum of three, by the Insured and approved by AFSC.

“Threshold Moisture” is the Percent of Normal Moisture for a Selected Weather Station(s) below which insurance payments begin.

“Weighting Option” is the option elected by the Insured to apply specified percentages to the Percent of Normal Moisture for each Period of Moisture.

a. In the case of Silage Corn, the Dollar Coverage per Acre is increased by $85.

a. AFSC will use precipitation data provided by the Alberta Government ministry responsible for Agriculture. If AFSC is not able to complete the assessment due to insufficient data being provided, this Insuring Agreement will cease to be enforceable against AFSC and cease to have any effect against AFSC. AFSC will then return to the Insured all paid Premiums.

b. Coverage is limited to plus or minus 10 percent of the Elected Acres based on the number of actual seeded acres.

a. Spring Insurance Price: In the spring, AFSC forecasts expected crop prices for the coming Crop Year, and for this Insuring Agreement it is equal to the Spring Insurance Price for Barley (1 CW).

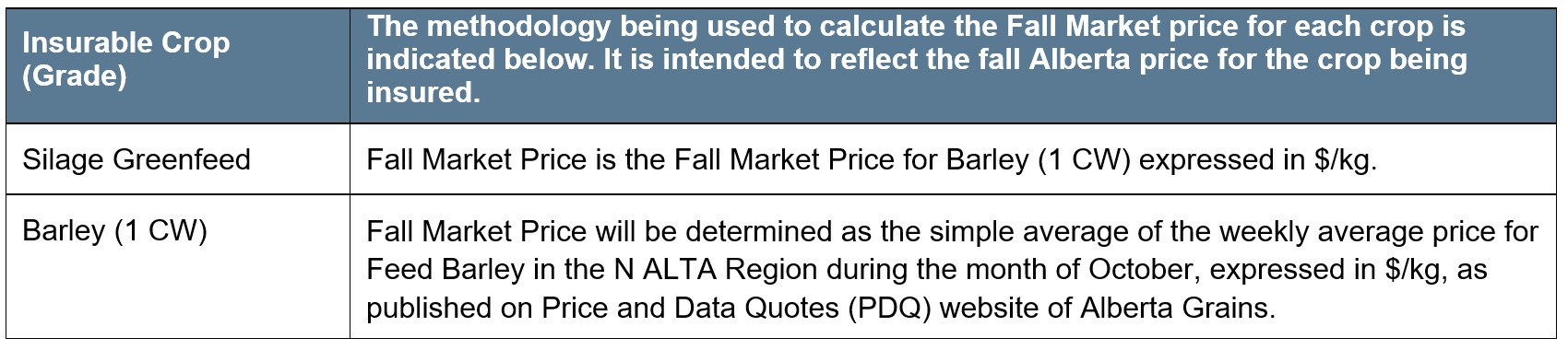

b. Fall Market Price: In the fall, AFSC reviews the pricing using specific methodologies as described in the table below, to determine whether the crop’s Fall Market Price is substantially lower or higher than the Spring Insurance Price and sets Fall Prices accordingly.

c. Variable Price Benefit: is offered to protect against price fluctuations between the Spring Insurance Price and the Fall Price. Refer to the Benefits document for information.

| The Variable Price Benefit triggers when the Fall Price of an eligible crop increases by a minimum of 10% above the Spring Insurance Price, and compensates when the eligible crop is in a Production Loss. |

Market Price Methodology Table

In the event that price information originating from published Fall Market Price methodology for an Insurable Crop(s) is not available or stops being available during the Fall Market Price period, at its best discretion, AFSC maintains the right to develop and implement an alternate price methodology for Fall Market Price determination to replace or augment pricing for that crop(s) in that year.

a. Minimum Premium: There is a minimum $25 of total Premium required per insurance Policy.

b. Rates: Premium rates are set annually and reflect AFSC’s risk of future losses. For the Lack of Moisture option, premium rates are based upon long-term weather station data. Premium rates vary by weather station. The Insured’s Premium is calculated by multiplying the Dollar Coverage per Acre by the Insured’s share of the premium rate and applying any applicable discounts.

c. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

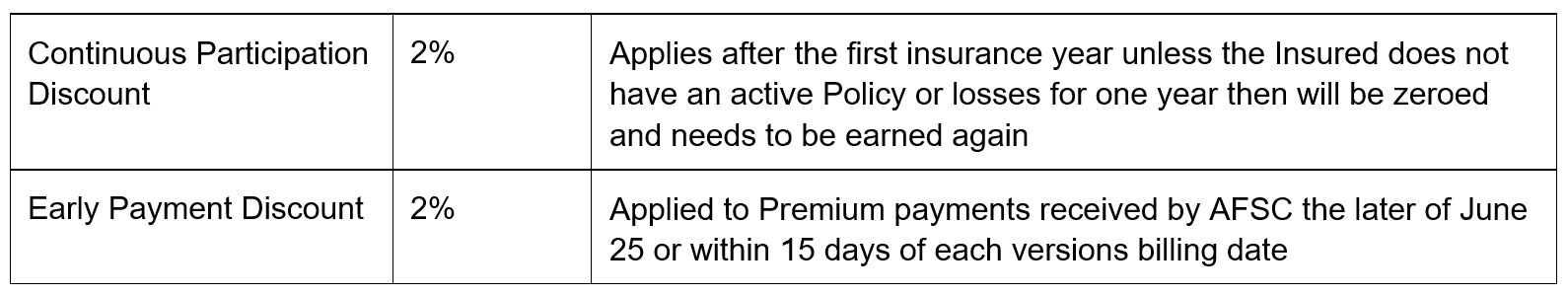

d. Adjustments & Discounts:

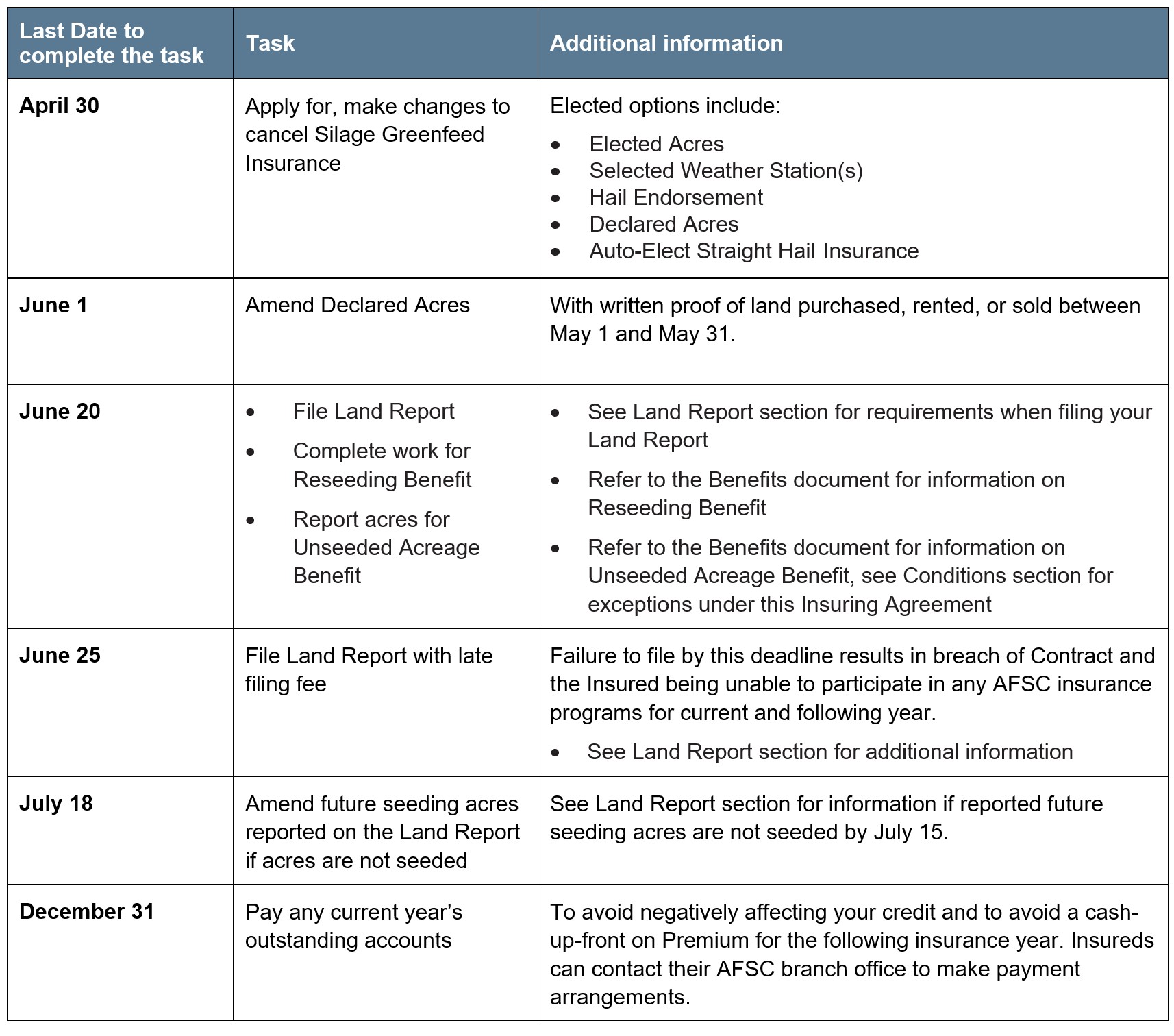

a. Application: New clients must apply for insurance on or before April 30 and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial and operational independence, and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect from year to year therefore an Insured who elected Silage Greenfeed Insurance in the previous year will be automatically renewed based upon the previous year’s information, excluding the number of Elected Acres. Personalized renewal notices are available in March. The Insured is responsible to review the information, and if changes are required, complete a change request form online or return the form to an AFSC insurance representative by mail, fax, email, in person, or request changes by phone by April 30.

c. Elected Acres: The Insured is required to elect the number of acres they intend to insure under this Insuring Agreement. Coverage is limited to plus or minus 10% of the Elected Acres.

| Policies are renewed with ‘0’ Elected Acres each year as the number of insured acres can change from year to year. The Insured is required to update their Elected Acres prior to April 30 each year. |

d. Declared Acres: are the total number of acres seeded and those intended to be seeded to Silage and Greenfeed Crops, including crops intended to be combined, whether the acres are to be insured or uninsured.

e. Hail Endorsement: offers spot-loss coverage and may be elected with Silage Greenfeed Insurance by April 30. Refer to the Hail Endorsement Insuring Agreement for additional information.

f. Auto-Elect Straight Hail Insurance: may be elected with Silage Greenfeed Insurance by April 30. When elected, a two percent premium discount will be applied on the Straight Hail Statement of Coverage and Premium.

| Straight Hail Insurance can be purchased on a field by field basis until July 31. Refer to the Straight Hail Contract of Insurance for additional information. |

g. Weighting Options: The Insured has the choice of different Weighting Options within the growing season. Based on the weighting percentages, there are three Weighting Options available to select:

| Weighting the precipitation in each month allows you to select the Weighting Option that best reflects your area, crop type, and management practices. |

h. Selected Weather Stations: The Insured can choose up to three weather stations from the network of eligible weather stations that best represent the conditions on their farm and within proximity of their land base. The Insured is not allowed to skip a weather station, and Selected Weather Station(s) are subject to approval by AFSC.

a. A network of weather stations is established across the province. Rainfall for the current year is compared to historical rainfall (Normal Moisture) for the same growing period at the Selected Weather Station(s) to determine a claim.

b. Precipitation in millimeters (mm) is recorded at the Selected Weather Station(s) and is compared to the Normal Moisture in mm recorded for the same weather station(s). For each month, both the actual and normal amounts are weighted based on the Weighting Option selected. This comparison describes a ‘percentage of normal’, which, if less than the allowable Threshold Moisture percent of normal, initiates a claim payment.

c. When extreme temperatures are recorded at a Selected Weather Station(s), the following deductions will be made from the monthly recorded precipitation of the Selected Weather Station(s):

i. 1.0 mm for each day the temperature is 30 Celsius or higher;

ii. an additional 2.0 mm (3.0 mm total) for each day the temperature is 35 Celsius or higher.

d. Precipitation used to calculate a claim payment for the current year is limited by the following rules:

i. Daily recorded precipitation at a Selected Weather Station(s) is capped at an amount equal to the Normal Precipitation for the month;

ii. Monthly recorded precipitation at a Selected Weather Station(s) is capped at an amount equal to one and a half times the Normal Precipitation for that month;

iii. Daily precipitation measurements under 1.0 mm will be considered 0.0 mm, and will not be included in determining the precipitation for the month.

a. Only Silage, Greenfeed or swath grazing acres in Alberta are insurable under this Insuring Agreement.

a. The Insured must elect the number of acres they intend to insure as Silage, Greenfeed, or swath grazing by

April 30 and will be billed within plus or minus 10 percent of the Elected Acres whether the acres are seeded or not.

b. If the seeded acres are:

i. within 10 percent of Elected Acres (plus or minus), the Insured is billed and Coverage is provided for the number of acres seeded.

ii. less than 90 percent of Elected Acres, the Insured will be billed for 90 percent of the Elected Acres and Coverage is provided only for the seeded acres.

1) See Insured Acres section for additional information.

iii. more than Elected Acres, Coverage is limited to 110 percent of the Elected Acres and the Insured is billed for 110 percent of the Elected Acres.

1) If the Insured has Crop Insurance and the Insurable Crop is elected, the acres above 110 percent of the Elected Acres can be mapped and insured under the Crop Insurance Policy; or

2) If the Insured does not have a Crop Insurance Policy or does not have the Insurable Crop elected, the acres above 110 percent must be mapped and will be uninsured.

a. The information for the Unseeded Acreage Benefit in the Benefits document applies under this Insuring Agreement with the following exceptions:

i. If the Insured has not completed seeding on or before July 15 due to excessive moisture, and has initiated a request for inspection on or before June 20, AFSC shall pay Indemnities to the Insured if eligible on the eligible acres at the lesser of:

1) the determined compensation level; or

2) the 50 percent Coverage Level multiplied by the Spring Insurance Price for the predominant dryland crop(s) insured by the Insured the previous year. If the Insured did not have Coverage the previous year, the predominant dryland and irrigated Insured Crops(s) in the Risk Area will be used.

ii. Acres are not eligible for the Unseeded Acreage Benefit when they are seeded for harvest in the current Crop Year, unless they have qualified for a Reseeding Benefit and could not be reseeded on or before July 15 due to excessive moisture.

a. If an Insured Crop intended for Silage or Greenfeed is pastured, the insurance Coverage and Premium will remain in effect.

a. A person who has direct or indirect conflict of interest with precipitation data provided at one or more Selected Weather Station(s) used for Silage Greenfeed Lack of Moisture Insurance shall not purchase insurance based upon the data from the Selected Weather Station(s) for which the person may have a conflict. A person may be in conflict of interest if the person is involved in providing, either directly or indirectly, precipitation data for the Selected Weather Station(s).

a. The Unharvested Acreage Benefit is not available under this Insuring Agreement.

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

a. All eligible and seeded acreage of an Insurable Crop, whether the land is owned, rented or crop-shared, grown for the intent of Silage or Greenfeed must be insured up to a maximum of 110 percent of the Elected Acres. Acres insured under this Insuring Agreement are not insurable under any other crop insurance program, except for applicable Endorsements or where AFSC has consented in writing.

| Cash rent and crop share landlords are not eligible for insurance as they are not responsible for the agronomic decisions and do not receive the majority of the proceeds from the sale of the crop. |

b. If the Insured intends to combine some of the acres for grain and manage the remaining acres as Silage, Greenfeed, or swath grazing, they can insure acres of the same Insurable Crop under both Crop Insurance and Silage Greenfeed Insurance.

c. If AFSC determines acres of an Insured Crop and the crop type and/or acres differ from those reported by the Insured, the following will apply:

i. When completing reseed inspections or unseeded inspections or acreage verifications, AFSC will issue a revised Statement of Coverage and Premium based on the crop type and actual number of seeded acres calculated by AFSC and any Indemnity calculation shall be based on the crop type and actual acres determined.

d. AFSC is not required or in any way obligated to revise or adjust its calculation of insured acres for any preceding year.

a. If the seeded acreage of Insurable Crop(s) grown for the intent of Silage, Greenfeed, or swath grazing is less than 90 percent of the Elected Acres, the Insured will be subject to a penalty equal to:

(90% of Elected Acres – seeded acreage) x (average Premium per acre for the seeded acreage).

i. This penalty will display on the Statement of Coverage and Premium and increase the Premium up to 90 percent of the Elected Acres.

ii. Exception: if the Insured reports less than 90 percent of the Elected Acres and is eligible for an Unseeded Acreage Benefit, the Elected Acres will be reduced by the number of actual unseeded acres.

a. When finished seeding, and not later than July 18, if the seeded acres differ from the acres reported as future seeded on the Land Report, the Insured must contact AFSC to revise the seeded acres and the Statement of Coverage and Premium.

i. For reported future seeding acres, AFSC reserves the right to reject requests for changes after July 18.

a. A Land Report must be filed once seeding is finished and no later than June 20, reporting seeded acre information as well as acres that are intended to be seeded by the July 15 deadline.

b. The Insured must report all annual spring and fall crops on land that is owned, rented, or crop-shared and include the following information for each field:

i. legal land description for the location including the part;

ii. number of seeded acres, or the number of acres intended for Summerfallow in the current year;

iii. whether the field is to be insured or uninsured;

iv. type of crop seeded;

v. insured end use (e.g. Silage/Greenfeed);

vi. whether the acres are seeded on Stubble or Summerfallow;

vii. seeding date or future seeding date;

viii. cropping and tillage practice;

ix. report acres too wet to seed by quarter section, including whether fertilizer had been incorporated or not, and if the land is irrigated or not; and

x. summary of insured acres for each crop.

c. Failure to file a Land Report will result in all insurance Policies being cancelled and restrictions on future year’s program participation. Where the Insured fails to file a Land Report by the June 20 deadline AFSC may, in its discretion:

i. accept the Land Report, if received by June 25, and assess a late filing fee to be paid by the Insured in full before the start of the next Crop Year;

ii. if due to extenuating circumstances, AFSC has the discretion to determine the acreage seeded by the Insured and file a Land Report for the Insured which shall be binding on the Insured; or

iii. cancel this Contract or any part thereof for the current Crop Year, in which case the Insured will be unable to participate in any AFSC insurance programs for current and following year with the following exceptions:

1) Livestock Price Insurance can be purchased in the current year; and

2) Straight Hail Insurance can be purchased in the following year.

d. AFSC reserves the right to reject requests for changes to the seeded acres reported on the Land Report after the June 20 filing deadline.

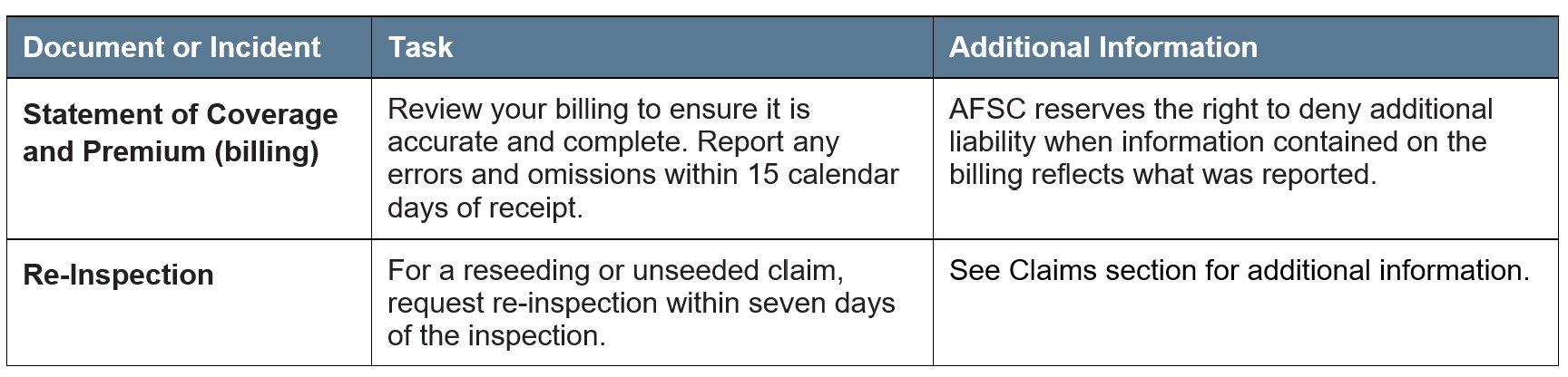

a. Information provided by the Insured is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is reported on the Land Report.

a. The Insured is not required to submit a Notice of Loss to initiate a claim for lack of moisture at the Selected Weather Station(s).

b. For the following claims, the Insured is required to submit a Notice of Loss and the deadline to initiate a claim are as follows:

i. Reseeding Benefit: contact AFSC prior to taking acres intended for reseeding out of production. Refer to Benefits document for information.

ii. Unseeded Acreage Benefit: via the Land Report on or before June 20.

c. If the Insured is late in filing a Notice of Loss AFSC may reject the claim.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

ii. where AFSC’s process is to conduct an inspection, following the inspection, AFSC will serve the Insured with a copy of the Inspection Report.

b. If the calculation of a claim for loss results in no payment, the Statement of Loss will be considered the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

c. If the Inspection Report results in no payment, or if as a result of the Inspection Report the claim for loss is withdrawn by the Insured, the Inspection Report will be considered to be the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

d. If the Insured does not, within seven days of service of the Inspection Report, advise AFSC of the Insured’s disagreement with the report or does not request a re-inspection, AFSC will issue the Statement of Loss according to the Inspection Report.

a. After an inspection, pursuant to Section 8.02 (c) if the Insured, within seven days of service of the Inspection Report:

i. advises AFSC of the Insured’s disagreement with the report; and

ii. requests a re-inspection:

AFSC will conduct a re-inspection, and no Statement of Loss will be issued until after the re-inspection has been conducted. AFSC reserves the right to charge a fee for Insured requested re-inspection of crops, or re-grading of samples.

a. The procedures set out in AFSC’s adjusting procedure manuals shall be used in the assessment of an insurable loss of an Insured Crop.

| AFSC recommends the Insured or Authorized Representative accompany adjusters during on-farm inspections. |

a. Service of the Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop loss, service of the Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. Stage 1 on or Before June 20 (Refer to the Benefits document)

b. Stage 2 on or After June 21

i. An Indemnity shall be calculated as follows:

[Dollar Coverage x Payment Rate]

The maximum Indemnity payable shall be 100% of the Dollar Coverage.

ii. The Payment Rate is based on the average of the Payment Rate(s) for the Insured’s Selected Weather Station(s).

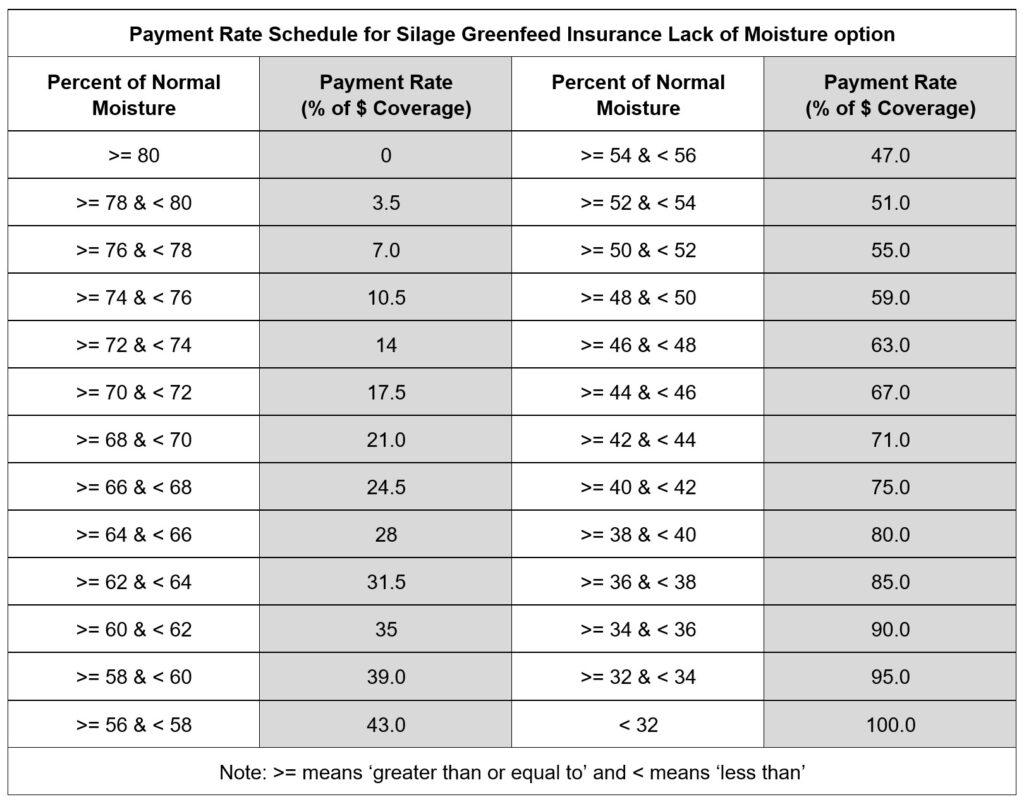

1) The Payment Rate for the Selected Weather Station(s) will be zero when the Percent of Normal Moisture is greater than or equal to 80 percent.

2) Where the Percent of Normal Moisture is below 80 percent, the Payment Rate will be based on the Payment Rate Schedule below.

iii. Except at the discretion of AFSC, no changes will be made to the May Moisture, June Moisture, July Moisture or August Moisture values after an Indemnity has been paid.

c. In no case shall the combined Indemnities under any Insuring Agreement (including Hail Endorsement) exceed total Dollar Coverage under this Contract.

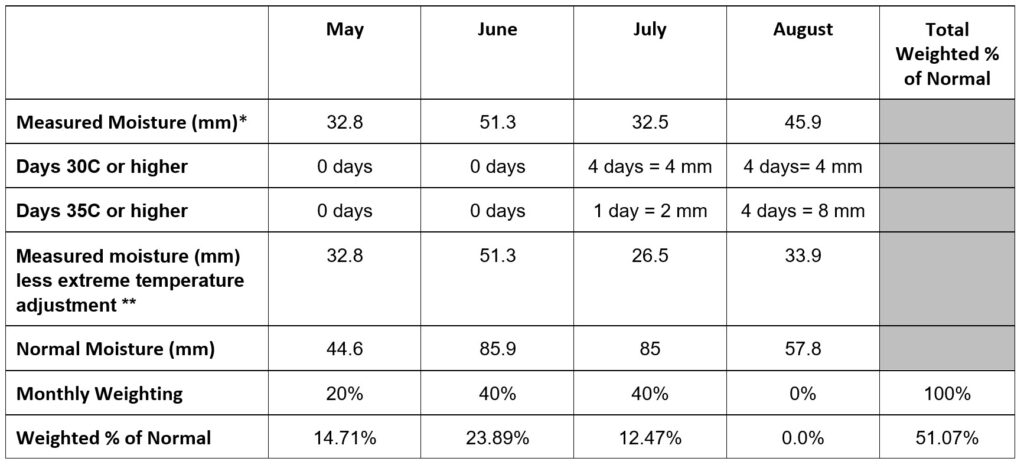

Indemnity: Calculation Example for Lack of Moisture

Assumption: elected Weighting Option A, coverage is $150 per acre on 200 acres of silage for $30,000 total coverage.

Coverage is weighted across the months of May to July: 20% May; 40% June; 40% July.

* Daily moisture is capped at an amount equal to the normal moisture for the month.

** Monthly moisture is capped at 150 percent of the normal moisture for the month after extreme temperature adjustments are applied.

a. Calculate the monthly weighted percent of normal using the information in the table above.

Weighted percent of normal = (measured moisture less extreme temperature adjustment / normal moisture) x monthly weighting:

1) Weighted percent of normal for May = 14.71%

2) Weighted percent of normal for June = 23.89%

3) Weighted percent of normal for July = 12.47%

b. Calculate the total weighted percent of normal

Total weighted percent of normal = weighted percent of normal for (May + June + July + August)

= 14.71% + 23.89% + 12.47% +0.00% = 51.07% rounded down for payment calculation is 51% percent of normal

c. Calculate the indemnity using the total weighted percent of normal

1) Using the Payment Schedule for Silage Greenfeed Lack of Moisture, rounding the percent of normal moisture down, determine the payment rate

2) 51% of normal = 55%.payment rate

d. Indemnity = total dollar coverage x payment rate

= $30,000 x 55% = $16,500

Precipitation measurements that are less than 1.0 mm will be considered 0.0 mm and will not be included in determining the precipitation for the month.

Disclaimer: Daily precipitation received from the Alberta Government ministry responsible for Agriculture will be rounded to the nearest 0.1 mm.