New Crop Insurance Initiative Insuring Agreement 2024

New Crops Insurance Initiative Insuring Agreement

AFSC will indemnify the Insured at the same percentage rate of the loss of the Insured’s Crop Insurance Policy using the Dollar Coverage pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

New Crop Insurance Initiative provides protection to new and non-traditional crops that are not insurable under other AFSC insurance programs.

“Insurable Crop” means any crop that AFSC deems to have a reasonable chance of harvest and is not eligible for any production-based or area-based insurance product offered by AFSC.

“Cost of Production” means specific costs associated with seed bed preparation, seeding, spraying, harvesting, irrigation, and Land Opportunity Cost Factor as determined by AFSC.

“Coverage” means the amount of production for a crop that AFSC insures based on the Insured’s Final Individual Normal Yield for Insurable Crops under this Insuring Agreement.

“Coverage Level” means 70 percent of the Final Individual Normal Yield.

“Declared Acres” means the number of acres seeded or intended to be seeded for New Crop Insurance Initiative in the current Crop Year that the Insured reports on the Election, for the purpose of eligible acreage determination for the Unseeded Acreage Benefit.

“Designated Peril” The Designated Perils listed under Article 1 of the Terms and Conditions do not apply to this insuring agreement.

“Dollar Coverage” means for an Insurable Crop, the Coverage multiplied by the Insurance Price, and if required, the Cost of Production.

“Establishment Year” means the year in which the perennial crop is seeded.

“Final Individual Normal Yield” means the yield upon which Coverage is offered to an Insured as calculated by AFSC.

“Land Opportunity Cost Factor” means a provincial value set by AFSC added to Cost of Production coverage to account for the lost value of seeding and insuring to an alternate crop that has higher Dollar Coverage.

Coverage is a fundamental part of any insurance Policy and is based upon the Insured’s average yield and Cost of Production for the specific crop insured.

a. Individual Coverage: will use the available yield records when the Insured has grown and insured the crop. Yields up to 10 years old can be used in the Coverage calculation.

b. Start-up: Missing yields will be filled in with the current year’s Cost of Production for the crop and land use. If the Insured does not have any yield records available, Dollar Coverage will be based entirely on the Cost of Production. As the Insured grows and insures the crop, the Cost of Production values will be replaced with actual yield produced multiplied by 70 percent, then multiplied by the current year’s market price for the Insured Crop.

c. Average Yield: An Insured’s average yield for a crop type is based on the average of the yield records AFSC has recorded for the crop. Yield records are gathered on Harvested Production Reports (HPR) provided by the Insured.

d. One-year lag: Actual yields are not available immediately for use as it takes time to gather and verify information. Yields produced and reported in the current year will not be available to calculate Coverage for the following year; it will first be used to set Coverage the second year.

Rules for yield records use:

i. The average of up to five of the most recent yield records for a crop when there are five or more yield records available. Yield records older than 10 years will not be used.

ii. AFSC will determine the minimum number of acres needed for the Harvested Production yield to be included in the calculation of the Insured’s Coverage for the specific crop.

a. Insurable Crop(s) grown on irrigated land are eligible for separate Coverage if:

i. those crops are declared as irrigated;

ii. there is an adequate source of water;

iii. the Insured has reliable irrigation equipment;

iv. adequate irrigation water is applied on a timely basis; and

v. the Insured maintains an up-to-date log showing the dates and approximate amounts of rainfall and irrigation water applied to each Insured Crop.

b. AFSC may reclassify the Insured Crop as grown on dryland if:

i. the Insured fails to fulfill all or part of the conditions in subsection (a) above.

c. Irrigated acres are insured separately from dryland acres of the same crop:

i. acres must be identified as irrigated or dryland on the Land Report; and

ii. Harvested Production from irrigated and dryland acres must be stored and reported separately.

a. AFSC, in its discretion may limit, restrict, exclude or deny Coverage, in whole or in part, for the following:

i. in the event AFSC determines by the application deadline that an Insured has a high risk of Production Loss;

ii. where the land is subject to repeated flooding or where excess moisture is a recurring problem;

iii. major changes are made in management practices, acreage, land location, confirmed yields or experience;

iv. the Insured makes a change that increases AFSC’s risk without notifying AFSC thereof and AFSC accepting the same risk; or

v. any other practice or action taken by the Insured that would prove detrimental to or limit production of the Insured Crop.

a. Spring Insurance Price: In the spring, AFSC will determine the commodity price for the Insurable Crop for the coming Crop Year.

b. Cost of Production: The specific costs are:

i. fertilizer, pesticide, herbicide;

ii. seed and seed treatment;

iii. fuel;

iv. utility and water cost associated with irrigation; and

v. Land Opportunity Cost Factor, and

vi. any other costs deemed appropriate by AFSC.

a. Minimum Premium: There is a minimum $25 of total Premium required per insurance Policy.

b. Rates: Premium rates are set annually based on historical losses of a select number of crops. Premium rates vary by practice, dryland versus irrigated. All Insurable Crops have the same premium rate regardless of where they are grown in the province. The Insured’s Premium is calculated by multiplying the Dollar Coverage by the Insured’s share of the premium rate and applying any applicable premium adjustments.

c. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

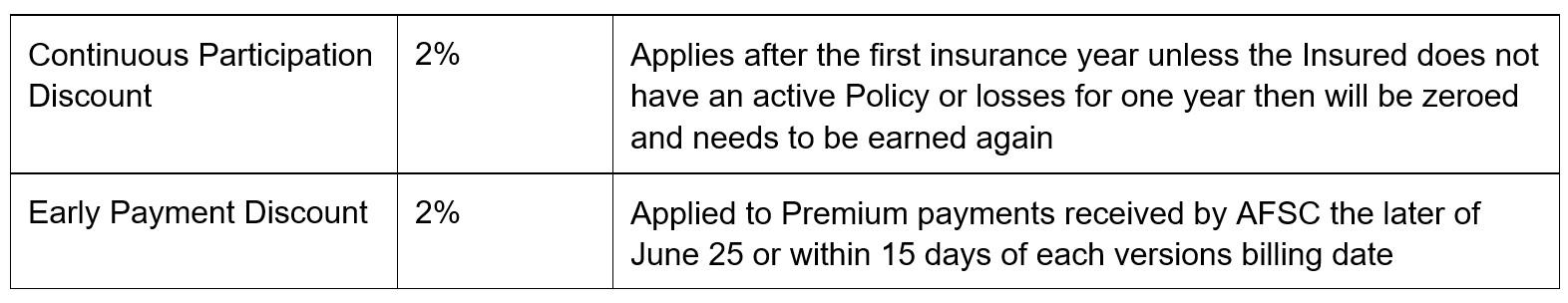

d. Adjustments & Discounts:

a. Application: New clients must apply for insurance on or before April 30 and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial and operational independence, and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect from year to year therefore an Insured who elected insurance in the previous year will be automatically renewed based upon the previous year’s information, excluding the number of Declared Acres. Personalized renewal notices are available in March. The Insured is responsible to review the information and if changes are required, complete a change request form and return the form to an AFSC insurance representative by mail, fax, email, in person, or request changes by phone, no later than April 30.

c. Declared Acres: the Insured is required to declare the total number of acres seeded and those intended to be seeded to NCII crops.

d. Hail Endorsement: offers spot-loss coverage and may be elected on a crop by crop basis by April 30. AFSC reserves the right to not provide Hail Endorsement on crops that hail damage cannot be accurately assessed by AFSC Claims Adjusting Services. Refer to the Hail Endorsement Insuring Agreement for additional information.

| Straight Hail Insurance can be purchased on a field by field basis until July 31. Refer to the Straight Hail Contract of Insurance for additional information. |

a. Acres of Insured Crops will be limited to the acres insured under the client’s active Crop Insurance Policy for the current Crop Year.

b. In the event that the Insured has two or more active Crop Insurance Policies, the NCII acreage will be limited to the acres insured under the active Crop Insurance Policy that AFSC determines the NCII Policy is associated with.

a. The Insured is required to have an active Crop Insurance Policy with insured acres for the current year and:

i. When the Insurable Crop is on irrigated acres, the Insured’s Crop Insurance Policy is required to have insured irrigated acres; and/or

ii. When the Insurable Crop is on dryland acres, the Insured’s Crop Insurance Policy is required to have insured dryland acres.

a. Perennial seed crops are not eligible for Coverage in the Establishment Year.

b. Acres of Insurable Crops must be located within a reasonable distance from the insured acres under the Insured’s active Crop Insurance Policy, as determined by AFSC.

c. AFSC reserves the right to not provide Coverage on crops when the request for Coverage does not provide AFSC the necessary time to gather agronomic information for a new crop type, or to determine Coverage and Premium for the new crop type.

d. AFSC reserves the right to deny Coverage for crops that are not considered to have a reasonable chance of harvest or where the Cost of Production cannot be determined for the crop.

a. Seeding deadlines will be determined by AFSC and set on a crop by crop basis.

a. The Variable Price Benefit, Reseeding Benefit, and Unharvested Acreage Benefit are not available under this Insuring Agreement.

b. If the Insured transfers water allocation to irrigated crops insured under this Insuring Agreement from irrigated crops insured under the Insured’s active Crop Insurance Policy for the current Crop Year, the irrigated crops from which water allocation was transferred will be excluded from the Indemnity calculation for this Insuring Agreement.

i. In the event that all crops insured under the client’s active Crop Insurance Policy for the current Crop Year are excluded from the Indemnity calculation for this Insuring Agreement, no Indemnity will be calculated.

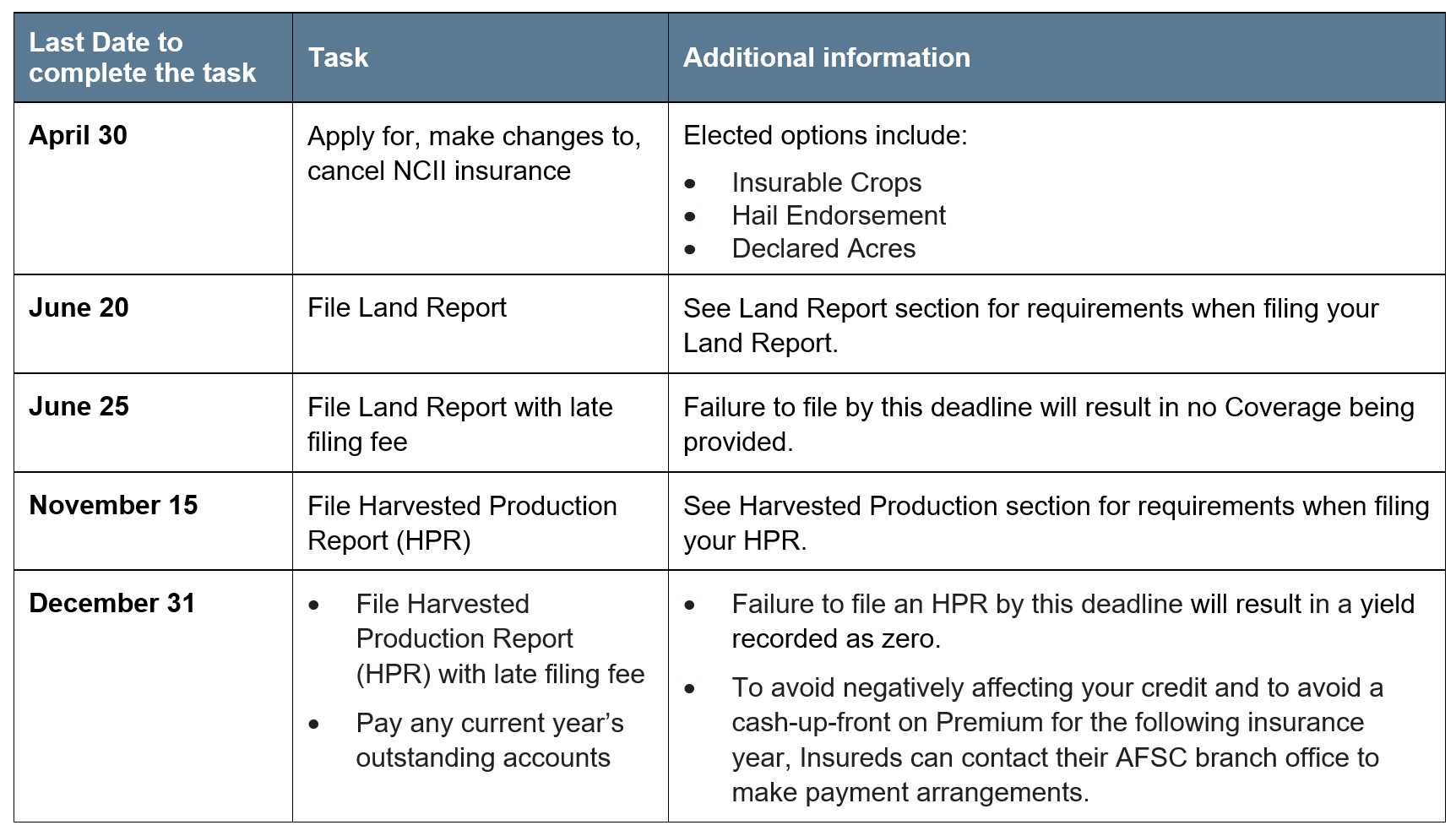

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

a. All eligible acreage and seeded acreage of an elected Insurable Crop, whether owned, rented or crop-shared, must be insured up to a maximum of the equivalent of insured acreage under the associated Crop Insurance Policy. Acres insured under this Insuring Agreement are not insurable under any other crop insurance program, except for applicable Endorsements or where AFSC has consented in writing.

| Cash rent and crop share landlords are not eligible for insurance as they are not responsible for the agronomic decisions and do not receive the majority of the proceeds from the sale of the crop. |

b. Maximum eligible acreage of NCII Insured Crops is limited to the acreage of Insured Crops under the associated active Crop Insurance Policy.

c. If AFSC determines total acres of NCII Insured Crops exceed the total acreage of the Insured Crops under the associated active Crop Insurance Policy, the following will apply:

i. AFSC will require the identification of acres of NCII Insured Crops which will be included in the Policy, up to an acreage equal to the acreage of the active Crop Insurance Policy.

ii. AFSC will issue a Statement of Coverage and Premium based on the qualifying seeded acres and any Indemnity calculation shall be based on the qualifying acres determined.

d. AFSC is not required or in any way obligated to revise or adjust its calculation of insured acres for any preceding year.

a. A Land Report must be filed once seeding is finished and no later than June 20.

b. The Insured must report all annual spring and fall crops on land that is owned, rented, or crop-shared and include the following information for each field:

i. legal land description for the location including the part;

ii. number of seeded acres, or the number of acres intended for Summerfallow in the current year;

iii. whether the field is to be insured or uninsured;

iv. crop type and variety seeded;

v. whether the acres are seeded on Stubble or Summerfallow; and on dryland or irrigated land;

vi. seeding date;

vii. cropping and tillage practice;

viii. report acres too wet to seed by quarter section, including whether fertilizer had been incorporated or not, and if the land is irrigated or not; and

ix. summary of insured acres for each crop.

c. AFSC reserves the right to reject requests for changes to the Land Report after the June 20 filing deadline.

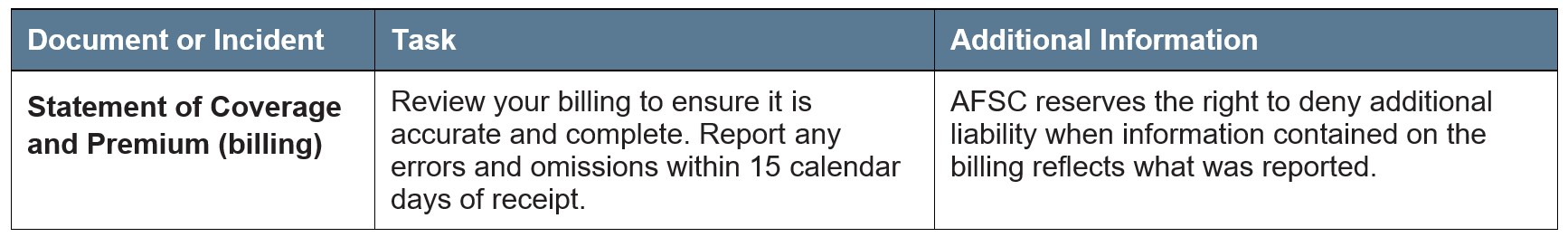

a. Information provided by the Insured is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is reported on the Land Report.

a. The Insured is required to submit a Notice of Loss to initiate a claim. The required timeframes for the Notice of Loss and the deadline to initiate a claim are as follows:

i. Harvested Production Report (HPR): on a form acceptable to AFSC once harvest is complete and not later than November 15.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

a. Service of the Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop loss, service of the Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. An HPR must be submitted online or to an AFSC branch office when harvest is complete, and no later than November 15.

b. A late filing fee will be applied for HPRs submitted after the November 15 deadline.

c. For each Insured, Crop, the Insured is required to provide:

i. Field documentation information including:

1) legal location,

2) acres insured,

3) whether the field is fallow, stubble or irrigated,

4) harvested yields including:

a) acres harvested,

b) yield per acre, and

c) total yield;

5) variety of crop;

ii. Date harvest was completed and method of harvest;

iii. Unharvested and abandoned acre information including number of acres, reason, and yield estimate;

iv. Agronomic information including seeding rate, seed treatment, fertilizer applications, and spraying information.

d. If the HPR is not submitted by the Insured before December 31, the yield will be recorded as zero.

e. The Insured may request corrections or revisions to the existing HPR record for a Crop Year, up to August 15 of the next Crop Year for annual crops, by providing supporting documentation that is satisfactory to AFSC.

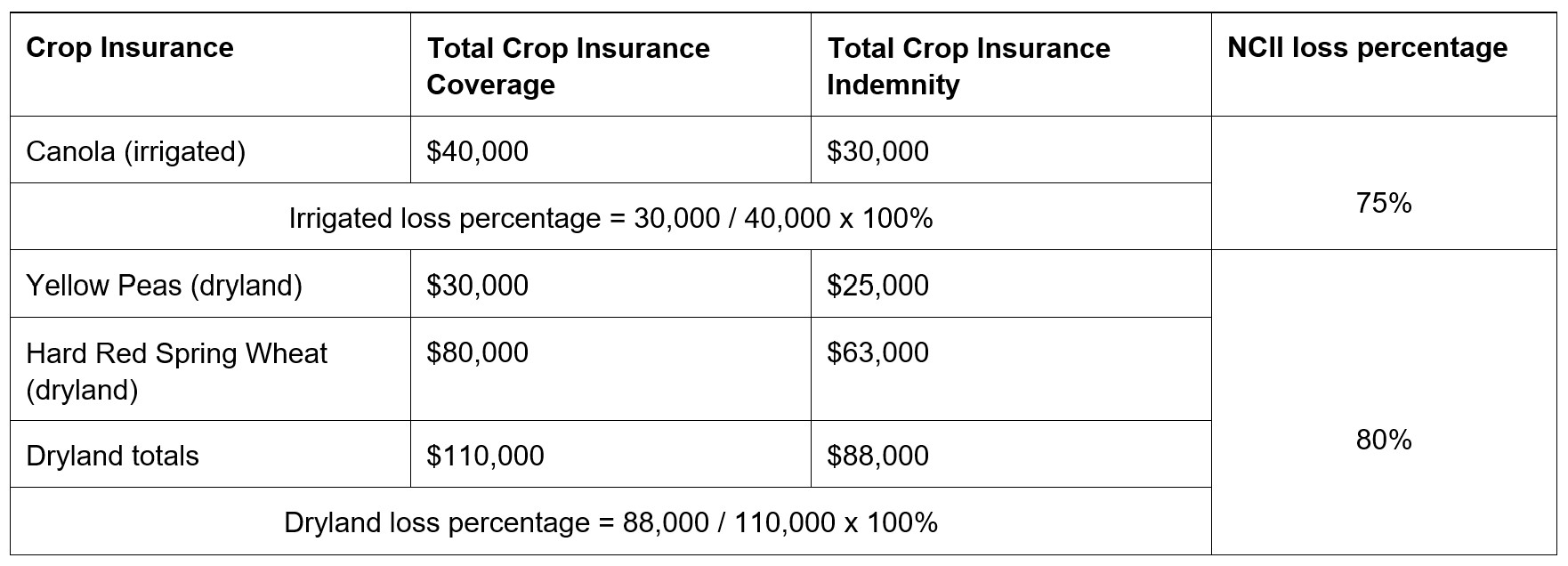

a. The total Indemnity and the total Dollar Coverage, including Variable Price Benefit and Quality Loss, from the associated Crop Insurance Policy are used to calculate the loss percentage for the insured dryland and insured irrigated acres separately. The Indemnities that are used for the calculation will be the gross awards from the pre-harvest Statement of Loss and post harvest Statement of Loss. The loss percentages for will be calculated as follows:

i. Loss percentage on dryland acres = (Pre-harvest gross award on dryland acres + Post harvest gross award on dryland acres) / Total Dollar Coverage on dryland acres

ii. Loss percentage on irrigated acres = (Pre-harvest gross award on irrigated acres + Post harvest gross award on irrigated acres) / Total Dollar Coverage on irrigated acres

iii. The loss percentages from the Insured’s Crop Insurance Policy will be multiplied by the total Dollar Coverage for the New Crop Insurance Initiative (NCII) Policy to calculate the Indemnity as follows:

1) NCII Indemnity = (Loss percentage on dryland acres x NCII Dollar Coverage on dryland acres) + (Loss percentage on irrigated acres x NCII Dollar Coverage on irrigated acres)

iv. In no case shall the combined Indemnities under any Insuring Agreement (including Hail Endorsement) exceed total Dollar Coverage under this Contract.

b. If the Indemnity rate or loss percentage for the Insured’s Crop Insurance Policy is not available or insufficient to calculate the payment rate, this Contract will cease to be enforceable against AFSC and cease to have any effect against AFSC. AFSC will then return to the Insured all paid Premium, less any applicable discount.

Indemnity example

The Indemnity for NCII crops shall be calculated separately for dryland and irrigated land and will be the average loss rate of all crops insured under the Insured’s Crop Insurance Policy. An Indemnity for each Insured Crop shall be calculated separately for dryland and irrigated land as follows:

[Dollar Coverage x loss percentage]

Assumptions: Under the NCII Policy there is $20,000 of irrigated Dollar Coverage and $40,000 of dryland Dollar Coverage. Loss percentage is equal to total crop Indemnity divided by total crop Dollar Coverage.

Under the Insured’s Crop Insurance Policy, there are three crops insured, one as irrigated and two as dryland.

NCII Indemnity calculations:

- Irrigated Indemnity = $20,000 x 75% = $15,000

- Dryland Indemnity = $40,000 x 80% = $32,000

- Total NCII Indemnity = $47,000