Moisture Deficiency Insuring Agreement 2025

Moisture Deficiency Insuring (MDI) Agreement

AFSC will indemnify the Insured when Percent of Normal Moisture is less than the Threshold Moisture at the Selected Weather Station(s) for the Insured’s dryland pasture pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

Moisture Deficiency Insurance (MDI) is an area-based program that provides Coverage on specific pasture types. This program uses precipitation information from a network of weather stations across the province to reflect moisture conditions. Conditions at the weather stations may not reflect conditions on the insured fields.

“Insurable Crop” means Native Pasture, Improved Pasture, Bush Pasture, or Community Pasture.

“August Moisture” is the amount of precipitation, as determined by AFSC, for the month of August, for a Selected Weather Station(s).

“Bush Pasture” means dryland Native Pasture on which at least

60 percent of the area is covered by trees, as determined by AFSC.

“Community Pasture” means Native or Improved Pasture on dryland that is communally grazed and for which insured acreage is determined by the number of animal units allocated by grazing season.

“Designated Peril” means lack of moisture at the Selected Weather Station(s). For greater clarity, this is the only Designated Peril under this Insuring Agreement, and the Designated Perils listed under Article 1 of the Terms and Conditions do not apply to this Insuring Agreement.

“Dollar Coverage” means 80 percent of the long-term average yield for the Insurable Crop for the Risk Area, multiplied by the Insurance Price elected by the Insured, multiplied by the number of acres insured.

“Full Season” means all Periods of Moisture in the Weighting Option elected by the Insured.

“Improved Pasture” means dryland perennial grasses and legumes growing on fenced land for the purpose of grazing livestock and where at least 60 percent of seeded species are still represented.

“July Moisture” is the amount of precipitation, as determined by AFSC, for the month of July, for a Selected Weather Station(s).

“June Moisture” is the amount of precipitation, as determined by AFSC, for the month of June, for a Selected Weather Station(s).

“May Moisture” is the amount of precipitation, as determined by AFSC, for the month of May, for a Selected Weather Station(s).

“Native Pasture” means dryland vegetation growing on fenced land for the purpose of grazing livestock and where at least 40 percent of grass species on that land are native to the surrounding area.

“Normal Moisture” for each Period of Moisture is the long-term average amount of precipitation, as determined by AFSC, for a Selected Weather Station(s).

“Payment Rate” means the rate of compensation at which the Insured is indemnified, as determined by AFSC.

“Percent of Normal Moisture” means, for the Selected Weather Station(s) for the current year, the sum of the May Moisture, June Moisture, July Moisture, and August Moisture, expressed as a percent of their respective Normal Moisture, with each Period of Moisture weighted by the Weighting Option elected by the Insured.

“Period of Moisture” is the period for which moisture is measured under this Insuring Agreement. There are four different periods: May, June, July, and August.

“Selected Weather Station” means eligible weather station(s) elected, to a maximum of three, by the Insured and approved by AFSC.

“Threshold Moisture” is the Percent of Normal Moisture for a Selected Weather Station(s) below which insurance payments begin.

“Weighting Option” is the option elected by the Insured to apply specified percentages to the Percent of Normal Moisture for each Period of Moisture.

a. Each Risk Area has a long-term average yield for each pasture type based on recommended cattle-carrying capacity. Eighty percent of the Risk Area long-term average yield is used as the base yield for each Insured Crop. Dollar Coverage is determined by multiplying the base yield by the elected price option.

b. For Community Pastures, coverage is based on the Risk Area cattle-carrying capacity and the Insured’s allocation for that pasture.

a. AFSC will use precipitation data provided by the Alberta Government ministry responsible for Agriculture. If AFSC is not able to do the assessment due to insufficient data being provided, this Insuring Agreement will cease to be enforceable against AFSC and cease to have any effect against AFSC. AFSC will then return to the Insured all paid Premiums.

a. Spring Insurance Price: this Insuring Agreement has the option of two Spring Insurance Prices, a low and a high price, based on forecasted hay market price and transportation costs for the year.

b. Fall Market Price: this Insuring Agreement uses hay as a proxy crop and is based on Alberta Government ministry responsible for Agriculture’s hay price from the Farm Input Survey for the month of October.

c. Variable Price Benefit: is offered to protect against price fluctuations between the Spring Insurance Price and the Fall Price. See Benefits document for information.

The Variable Price Benefit triggers when the Fall Price increases by a minimum of 10% above the Spring Insurance Price and compensates when the eligible crop is in a Production Loss.

a. Rates: Premium rates are set annually based upon long-term weather station data and reflect AFSC’s risk of future losses. Premium rates vary by weather station. The Insured’s Premium is calculated by multiplying the Dollar Coverage by the Insured’s share of the premium rate and applying any applicable discounts. If more than one weather station is elected by the Insured, the premium rate will be based on the average of the premium rates for the Selected Weather Station(s).

b. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

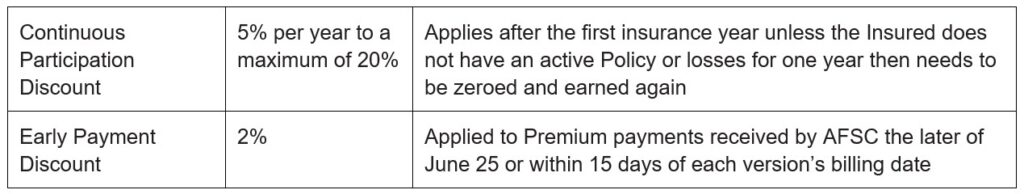

c. Adjustments & Discounts:

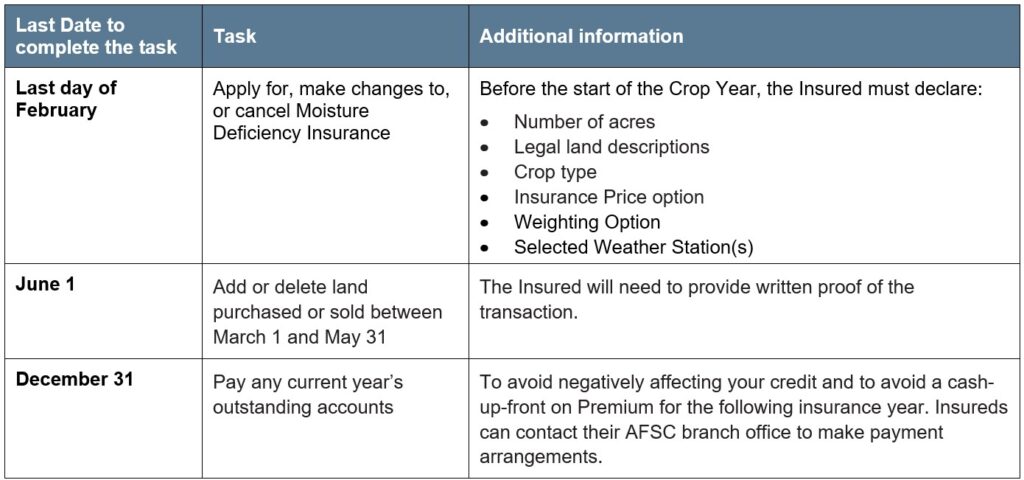

a. Application: New clients must apply for insurance on or before the last day of February and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial and operational independence and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect year to year therefore an Insured who elected Moisture Deficiency Insurance in the previous year will be automatically renewed based upon the previous year’s information. Personalized renewal notices are available in January. The Insured is responsible to review their information and if changes are required, complete a Change Request form and return the form to an AFSC insurance representative by mail, fax, email, online, in person or request changes by phone by the last day of February.

c. Crop Information: Land locations and crop type(s) by field, the date the field was seeded for Improved Pasture, and the number of acres in the field. If insuring Community Pasture, the Community Pasture name, type of animal, average animal weight, number of animals on pasture, and number of grazing months.

d. Price Options: The Insured has the option of electing a high price or low price option.

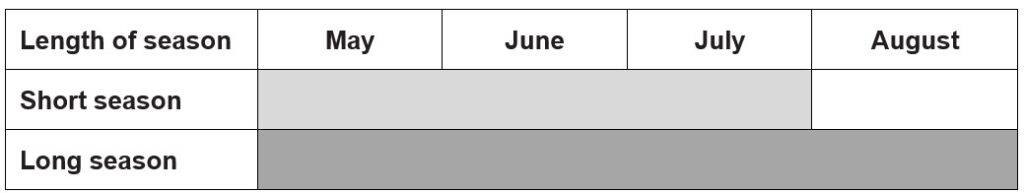

e. Length of Season: The Insured chooses the length of season that best represents pasture growth and supports their management strategies:

i. Short season option: includes precipitation from May, June, and July.

ii. Long season option: includes precipitation from May, June, July and August.

Clients could be eligible for an insurance payment for one month, regardless of what happens in the other months.

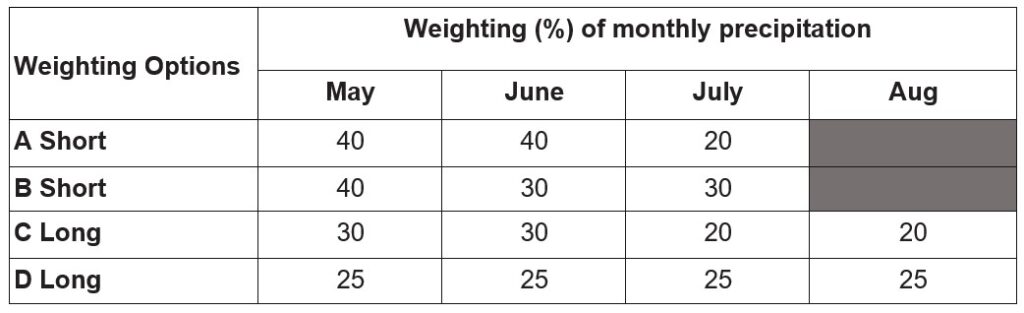

f. Weighting Option: The Insured has the choice of different Weighting Options within the growing season. Based on the weighting percentages, there are four Weighting Options available to select:

Weighting the precipitation in each month allows you to select the Weighting Option that best reflects your area, crop type and management practices.

g. Selected Weather Stations: The Insured can choose up to three weather stations from the network of eligible weather stations that best represent the conditions on their farm and within proximity of their land base. The Insured is not allowed to skip a weather station, and Selected Weather Station(s) are subject to approval by AFSC.

a. A network of weather stations is established across the province. Rainfall for the current year is compared to historical rainfall (Normal Moisture) for the same growing period at the Selected Weather Station(s) to determine a claim.

b. Precipitation in millimeters (mm) is recorded at the Selected Weather Station(s) and is compared to the Normal Moisture in mm recorded for the same weather station(s). For each month, both the actual and normal amounts are weighted based on the Weighting Option selected. This comparison describes a ‘percentage of normal’, which, if less than the allowable Threshold Moisture percent of normal, initiates a claim payment.

c. When extreme temperatures are recorded at a Selected Weather Station(s), the following deductions will be made from the monthly recorded precipitation of the Selected Weather Station(s):

i. 1.0 mm for each day the temperature is 30 Celsius or higher

ii. an additional 2.0 mm (3.0 mm total) for each day the temperature is 35 Celsius or higher

d. Precipitation used to calculate a claim payment for the current year is limited by the following rules:

i. Daily recorded precipitation at a Selected Weather Station(s) is capped at an amount equal to the Normal Moisture for the month;

ii. Monthly recorded precipitation at a Selected Weather Station(s) is capped at an amount equal to one and a half times the Normal Moisture for that month;

iii. Daily precipitation measurements under 1.0 mm will be considered 0.0 mm, and will not be included in determining the precipitation for the month.

a. Only pasture land in Alberta is insurable under this Insuring Agreement.

a. A person who has a direct or indirect conflict of interest with precipitation data provided at one or more Selected Weather Stations(s) used for Moisture Deficiency Insurance shall not purchase insurance based upon the data from the Selected Weather Station(s) for which person may have a conflict. A person may be in a conflict of interest if the person is involved in providing, either directly or indirectly, weather data for the Selected Weather Station(s).

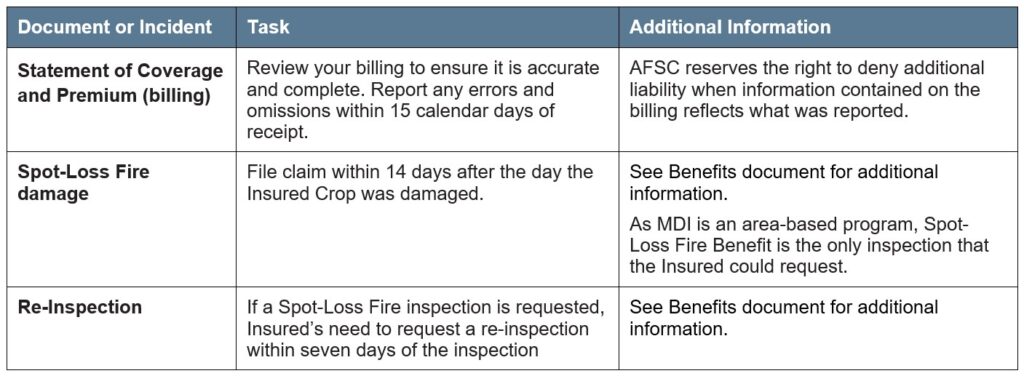

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

a. All eligible acres of an elected Insurable Crop, whether the land is owned, rented or leased, must be insured, and there is a minimum of 20 acres for this Insuring Agreement. Acres insured under this Insuring Agreement are not insurable under any other crop insurance program, except where AFSC has consented in writing.

b. Insured acreage for Community Pasture will be based on the Risk Area livestock carrying capacity as determined by AFSC.

i. Community Pastures are optional to insure.

c. AFSC is not required or in any way obligated to revise or adjust its calculation of insured acres for any preceding year.

a. Information provided by the Insured is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is reported by the last day of February.

a. The Insured is not required to submit a Notice of Loss to initiate a claim for lack of moisture at the Selected Weather Station(s).

a. Upon calculation of an assessment, AFSC will serve the Insured with a Statement of Loss.

b. If the assessment results in no payment, the Statement of Loss will be considered the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

a. If Insured pasture acres are Put to Another Use and subsequently seeded to an elected annual crop, these acres can be transferred to an annual crop Policy, subject to the Terms and Conditions, and the Insuring Agreement for the annual Insurable Crop.

b. If the acres are not seeded to an elected annual crop, AFSC will continue to view those acres as insured under this Policy with Premium and Coverage remaining in force.

a. Service of the Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop for which a loss has been made, service of the Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

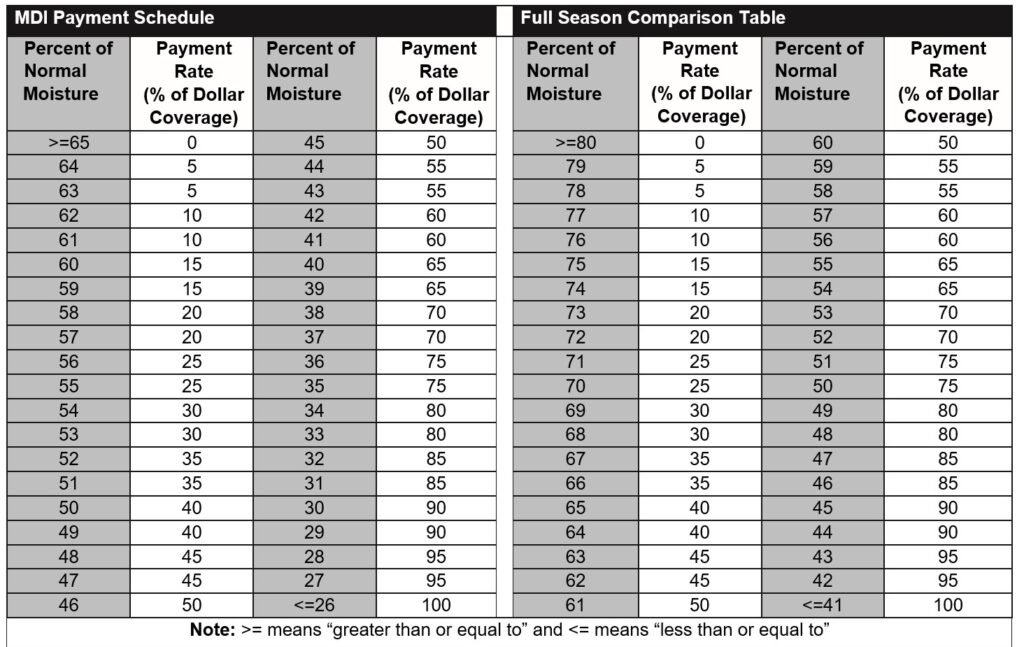

Losses are paid when accumulated precipitation at the Selected Weather Station(s) falls below the Normal Moisture for the Selected Weather Station(s) according to the payment schedule.

a. An Indemnity is calculated as follows:

i. [Dollar Coverage x Payment Rate]

The maximum Indemnity payable is 100 percent of the Dollar Coverage.

b. The Payment Rate will be based on the average of the Payment Rates for the Insured’s Selected Weather Station(s).

i. The Payment Rate for the Selected Weather Station(s) will be zero when the Percent of Normal Moisture is equal to or more than the Threshold Moisture.

ii. For each two percent decrease that the Percent of Normal Moisture is below the Threshold Moisture, the Payment Rate will increase by five percent.

c. Indemnities are calculated and paid monthly based on the elected Weighting Option.

d. The Full Season payment is calculated using the elected Weighting Option to determine if the Full Season Indemnity is greater than the combined monthly Indemnities.

e. The total Indemnity paid is the greater of the combined monthly Indemnities or the Full Season Indemnity.

f. Except at the discretion of AFSC, no changes will be made to the May Moisture, June Moisture, July Moisture or August Moisture values after an Indemnity has been paid.

The Threshold Moisture for the monthly calculation is 65 percent; the Threshold Moisture for the Full Season comparison is 80 percent.

Indemnity: Calculation Example for Moisture Deficiency Insurance

Assumption: elected Weighting Option C Long; coverage is $100 per acre on 100 acres of improved pasture for $10,000 total coverage

Coverage is weighted across the months of May to August: 30% May; 30% June; 20% July; 20% August

Monthly Indemnity Calculation

* Daily moisture is capped at an amount equal to the normal moisture for the month.

** Monthly moisture is capped at 150 percent of the normal moisture for the month after extreme temperature adjustments are applied.

a. Calculate the monthly percent of normal using the information in the table above.

Percent of normal = actual moisture less extreme temperature adjustment / normal moisture:

i. Percent of normal for May = 32.8 / 44.6 x 100% = 73.54%

ii. Percent of normal for June = 51.3 / 85.9 x 100% = 59.72%

iii. Percent of normal for July = 26.5 / 85 x 100% = 31.18%

iv. Percent of normal for August = 33.9 / 57.8 x 100% = 58.65%

b. Using the MDI Payment Schedule table, rounding the percent of normal moisture down, determine the payment rates:

i. May = 73% of normal = 0% payment rate

ii. June = 59% of normal = 15% payment rate

iii. July = 31% of normal = 85% payment rate

iv. August = 58% of normal = 20% payment rate

c. Calculate the monthly dollar coverage using the monthly weighting for option C.

Monthly dollar coverage = total dollar coverage x monthly weighting percent:

i. May dollar coverage = $10,000 x 30% = $3,000

ii. June dollar coverage = $10,000 x 30% = $3,000

iii. July dollar coverage = $10,000 x 20% = $2,000

iv. August dollar coverage = $10,000 x 20% = $2,000

d. Calculate the monthly indemnities using the monthly dollar coverage and corresponding payment rates.

Monthly indemnities = Monthly dollar coverage x payment rate for month:

i. May indemnity = $3,000 x 0% = $0

ii. June indemnity = $3,000 x 15% = $450

iii. July indemnity = $2,000 x 85% = $1,700

iv. August indemnity = $2,000 x 20% = $400

v. Total monthly payments = $2,550

Full Season Indemnity Calculation

Once the monthly Indemnities are calculated, then the payment for the Full Season is calculated and if it is higher than the sum of the monthly payments, the client will receive the additional Indemnity at the end of the season.

*** Rounded down for payment calculation

a. Calculate the weighted percent of normal using the determined percent of normal for the weather station selected and the weighting percentage for option C.

Weighted percent of normal = percent of normal x monthly weighting:

i. Weighted percent of normal for May = 73.54% x 30% = 22.06%

ii. Weighted percent of normal for June = 59.72% x 30% = 17.92%

iii. Weighted percent of normal for July = 31.18% x 20% = 6.24%

iv. Weighted percent of normal for August = 58.65% x 20% = 11.73%

v. Total weighted percent of normal

= Weighted percent of normal for (May + June + July + August) = 57.95%

b. Calculate the full season indemnity using the total weighted percent of normal

i. Using the MDI Full Season Comparison table, rounding the percent of normal

moisture down, determine the payment rate:

1) 57% of normal = 60% payment rate

ii. Full season indemnity = total dollar coverage x full season payment rate:

= $10,000 x 60% = $6,000

As the full season comparison is higher than the combined monthly payments, an additional indemnity of $3,450 ($6,000 – $2,550) is made at the end of the season to bring the total indemnity to $6,000.

Precipitation measurements that are less than 1.0 mm will be considered 0.0 mm, and will not be included in determining the precipitation for the month.

Disclaimer: Daily precipitation received from Alberta Government ministry responsible for Agriculture will be rounded to the nearest 0.1 mm.