AgriStability Program Handbook 2020-2022

What is AgriStability?

AgriStability is one program in a suite of business risk management (BRM) programs that governments offer to help producers manage significant risks. Other programs in the suite include AgriInvest, AgriInsurance and AgriRecovery.

The purpose of the AgriStability program is to provide Canadian agricultural producers with an ongoing whole-farm risk management tool that provides protection against large declines in farming income that threaten the viability of their farm and are beyond their capacity to manage.

Why choose AgriStability?

- Whole farm protection – AgriStability protects your farm income based on all of your

- Unique coverage – Your coverage is based on your own farm

- Payments in times of financial distress – Provides assistance to producers who experience margin declines greater than 30 per cent due to production loss, adverse market conditions and increased

- Access to other credit options and programs – AgriStability can give you access to credit options such as the Advance Payments Program (APP), which provides cash advances through various farm commodity

- Affordable coverage – AgriStability is a low cost risk management program available to all

Program participation

To become a participant in the program, submit an Application for Fee Notice to AFSC by the enrolment notice deadline, April 30 of the program year you wish to participate. Upon notifying AFSC of the intention to participate, new participants will be asked for production information so that an Enrolment/Fee Notice can be issued. Upon receiving the Fee Notice, any producers who choose to not participate will be required to submit an Opt Out Form prior to the deadline.

To maintain eligibility in the program, existing participants are required to pay the fees and submit program information by the prescribed deadlines. For additional information, please refer to the Deadlines section.

AFSC now has a Projected Reference Margin Calculator available. This tool allows participants to more accurately estimate what their Reference Margin will be for a given program year. To access the calculator, visit our website at www.afsc.ca.

All of the following conditions must be met to be eligible for a program year:

- Carried on the business of farming in Canada

- Conducted a minimum of six consecutive months of farming activity

- Completed a production cycle (see below)

- Reported farming income (loss) for income tax purposes to the Canada Revenue Agency (CRA)

- Met all program requirements by the deadlines established by AFSC

A production cycle includes one or more of the following activities:

|

Other eligibility information

Eligible participants include individuals farming as sole proprietors or within a partnership, corporations, trusts, co-operatives, communal organizations and limited partnerships.

Landlords, including crop and livestock production share, are only eligible to the extent that they share proportionately in both the income and expenses, as a joint venture arrangement.

Participants are eligible to participate in the program based on the province of main farmstead. Participants may participate in the program in one province only.

Status Indians who carry on the business of farming on a reserve in Canada and who are exempt under the federal Indian Act from filing income tax returns are considered eligible provided they submit information that would have otherwise been reported for tax purposes for the program year and the reference years based on the requirements of the Income Tax Act.

For more information, please see related resources: AgriStability Program Guidelines – Part 1 Eligibility

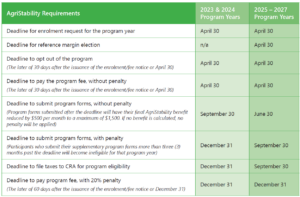

1 The later of 30 days after the issuance of the Enrolment/Fee Notice or April 30.

2 Program forms submitted after the September 30 deadline will have their final AgriStability benefit reduced by $500 per month to a maximum of $1,500. If no benefit is calculated, no penalty will be applied.

3 The later of 60 days after the issuance of the Enrolment/Fee Notice or December 31.

4 Participants who submit their supplementary forms more than three (3) months past the September 30 deadline will become ineligible for that program year.

Program forms include both supplementary forms and tax information – see Annual Filing Requirements section for additional information.

Other deadline information

If a participant does not pay the program fee by December 31 (or 60 days after the issuance of their Enrolment/Fee Notice, whichever is later), they will become ineligible to participate in that program year. Any outstanding fees along with the 20 per cent penalty are still payable.

Forms and fee payments must be received by AFSC by the deadline, or postmarked on or before that date. If the deadline is on a Saturday, Sunday or statutory holiday, the participant has until next business day to meet the deadline.

Deadline requirements may be waived under extenuating circumstances upon written request of the participant. Requests should be directed to the Manager of Processing and Verification.

For each program year, a participant must submit completed Supplementary Forms and tax information to AFSC by the deadline. For more information on how to complete the Supplementary Forms refer to the Supplementary Forms Guide available in the Resources section.

Individuals

- T1163 Statement A – AgriStability and AgriInvest Programs Information and Statement of Farming Activities.

- T1163’s filed to the CRA will be forwarded to AFSC.

Corporations

- T2 Schedule 1 – as filed to the CRA

- Full financial statements including notes

- Statement A – Alberta Corporations/Co-operatives/ Other Entities*

- Other tax documents – as requested by AFSC

*Note: The Statement A Net farming income (loss), line 9946, must match the Net income (loss) for income tax purposes. An Accrual to Tax Worksheet may also be requested.

Information for accrual filers

Participants who file their taxes to the CRA on the accrual basis are still required to file Supplementary Forms to AFSC.

- Completed Schedules 2 and 3 are required at a minimum and, if necessary, any information that may be applicable for Schedule 1a, 1b and 1c for amounts that are not included in the financial statement accruals.

- Inventory changes related to breeding stock included on Schedule 3 will be adjusted to reflect the hybrid inventory adjustment methodology, i.e. change in quantity multiplied by price at the end of the year.

- The participant may be asked to provide inventory working papers to support the amounts reported as opening and closing inventory on their financial statements.

AFSC has several ways for you to submit your program information:

- Email: info@afsc.ca

- In person: Information can be dropped off at any AFSC branch office

- Fax: 403.782.8348 or 1.855.700.AFSC (2372)

- Mail: 5718 56 Avenue, Lacombe, AB T4L 1B1

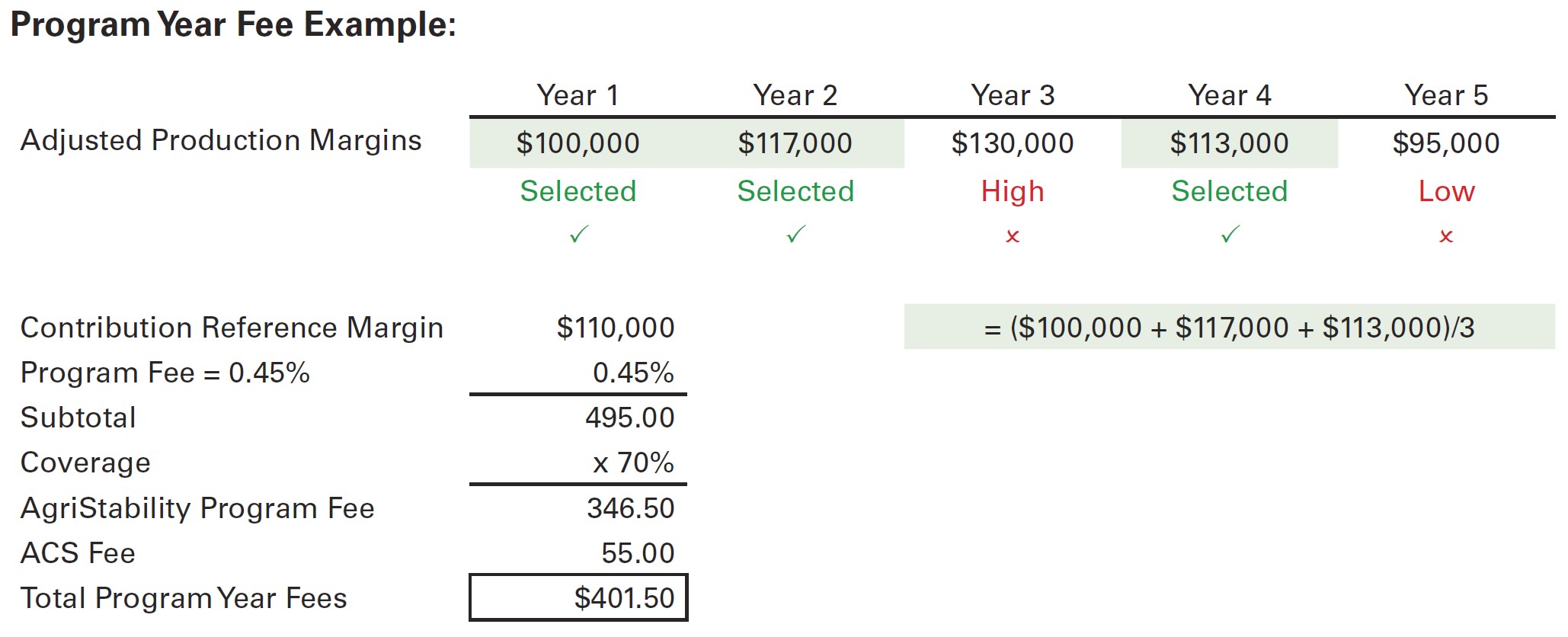

The annual program fee is calculated at 0.45 per cent of the contribution reference margin multiplied by 70 per cent. This results in an approximate fee of $315 for every $100,000 of reference margin. The minimum AgriStability program fee is $45.

In addition to the program fee, an administrative cost share (ACS) fee of $55 is payable to cover a portion of program administrative costs.

A participant may opt out of the Program upon written notice to AFSC. Written notice must be received by the enrolment notice deadline, April 30 of the Program Year you wish to opt out. A Participant will be ineligible for benefits for the Program Year in which the opt out occurs.

Opt out forms are available on our website at www.afsc.ca.

| IMPORTANT: If a participant does not opt out by the April 30 enrolment deadline, they will still be required to pay all fees and applicable penalties for that program year. |

Opting out and how that impacts other programs

AFSC collects and submits corporate tax data to Agriculture and Agri-Food Canada (AAFC) for purposes of the AgriInvest program. Corporations that still wish to participate in AgriInvest must continue to submit their tax information to AFSC by the applicable deadline. If a participant is participating in AgriInvest only, then they should clearly write “AgriInvest Only” on the top of the first page of their Statement A. There is no requirement to submit financial statements or T2 Schedule 1.

Individuals who file their taxes to the CRA on a T1163 Statement A will have their information sent to the AgriInvest Administration directly from the CRA.

Opting out of AgriStability may affect eligibility for the Advance Payments Program (APP), also known as the Cash Advance Program; check with your APP administrator prior to opting out.

How the program works

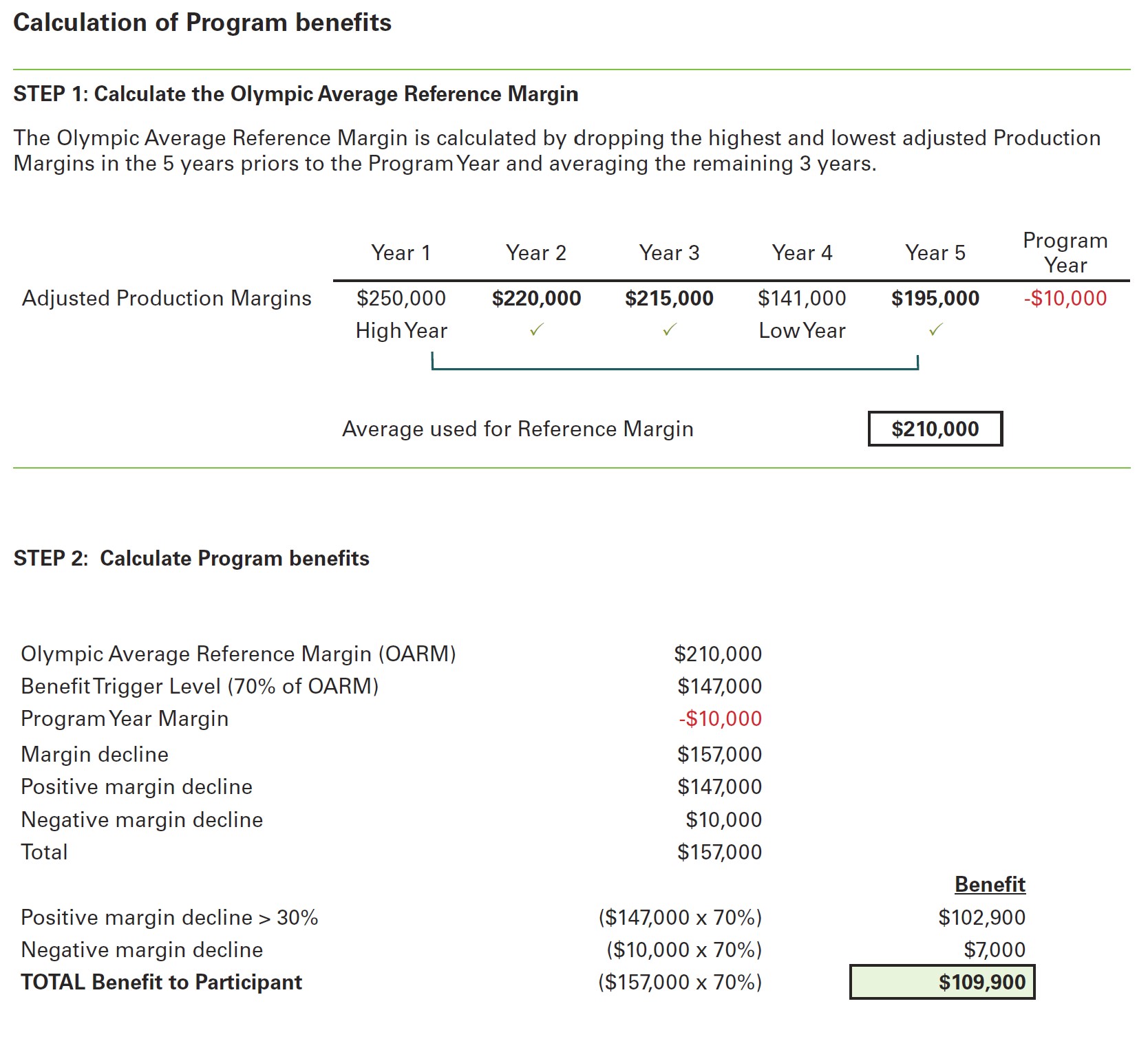

AgriStability program benefits are calculated by comparing a participant’s current year financial information to historical years to determine if there has been a shortfall.

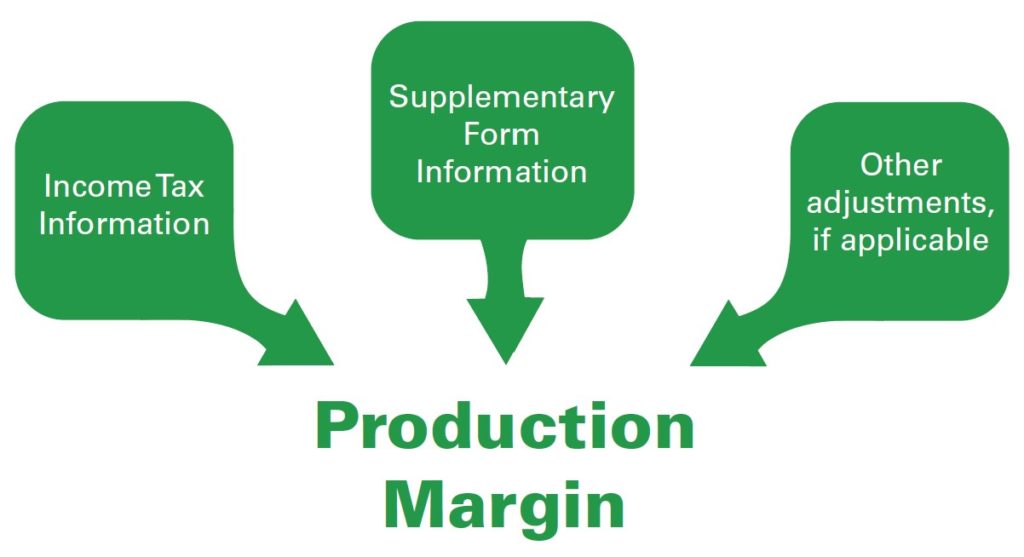

For all years, whether current or historical, a Production Margin is calculated using tax and Supplementary Form information supplied by the participant. AgriStability allowable income less allowable expenses as reported for tax is the starting point. This net margin, which is usually cash basis, is adjusted to include accrual information from the Supplementary Forms and if applicable, other margin adjustments as determined by the Administrator.

Supplementary Form adjustments include accounts receivable and deferred income, accounts payable, purchased inputs and crop and livestock inventories. Crop and livestock inventories are valued using hybrid inventory valuation method.

For more information, please see the related technical information circulars:

What beginning farmers need to know

| AFSC may establish Production Margins based on a participant’s farming operation for any of the three years immediately prior to the program year by multiplying the farm’s productive units by industry average income/ expense information. |

Allowable income is generally limited to the sale of agricultural commodities and production insurance payments. Allowable expense items are generally limited to input costs directly related to the production of agricultural commodities.

The income and expenses, as reported to CRA, that are considered allowable for the Program include, but are not limited to, the following:

Allowable income

- Agricultural commodity sales

- AgriInsurance proceeds

- Canadian Food Inspection Agency (CFIA)

- Commodity future gains

- Custom feeding*

- Insurance and other proceeds for allowable income and expense items

- Rebates for allowable expenses

- Specified program payments**

- Wildlife damage compensation

Allowable expenses

- Agricultural commodity purchases

- AgriInsurance premiums

- Commissions and levies (related to commodity sales)

- Commodity future losses/ transaction fees

- Containers and twine

- Custom feeding*

- Electricity

- Fertilizer and lime

- Freight and shipping (to and from market)

- Heating fuel

- Machinery (gasoline, diesel fuel, oil)

- Minerals and salts

- Other insurance/premiums for allowable

income and expense items - Pesticides

- Point of sale adjustments

- Prepared feed

- Salaries (arms length as defined by CRA)

- Storage/drying

- Veterinary fees, medicine, breeding fees

*Custom feedlot income and expenses are allowable if the feedlot makes an appreciable contribution to the growth and maturity of the livestock. For example in the case of cattle, the animals must be fed for more than 60 days or have an average gain of at least 90 kgs (200 lbs).

**To determine whether or not to include a program payment in allowable income in the program year and/or Reference Period, participants reporting tax in Alberta should refer to the Canada Revenue Agency’s RC4060 Farming Income and the AgriStability and AgriInvest Program Guide.

For more information, please see technical information circular TIC 3: Allowable vs Non Allowable and Part 4 of AgriStability Program Guidelines

The reference margin limit has been removed from AgriStability for 2021 and 2022. This change will have a significant impact for many producers and is retroactive to the 2020 program year. The 2020 program year has not been re-opened for enrolment.

Indemnity payments from private insurance programs that are fully producer-funded are non-allowable in the program year margin and allowable in the reference margin where they relate to:

- price or revenue insurance associated with the sale of allowable commodities

- price insurance associated with the purchase of allowable expenses

- production insurance covering the production of allowable commodities (e.g. private hail insurance)

- other income insurance, such as margin-based or guaranteed minimum income insurance

Indemnity payments from private insurance programs not outlined above, that compensate participants for the replacement of eligible agricultural commodities or allowable expense items, are included as allowable income in both the program year margin and the reference margin (e.g. payments for inputs destroyed by fire).

Structural Change assessments are a routine part of the annual Program Year benefit calculation. If applied, structural change adjustments are intended to adjust historical production margins to reflect changes in a participant’s current farming operation. Typically, these adjustments result from a change in the size of the farm or the commodities being produced. In situations where productive units have not had a material change, structural change adjustments will not be applied.

As an example: Producer A normally seeds 1,000 acres but has decided to rent additional land and now seeds 2,000 acres. The income and expense structure on a 1,000 acre farm compared to a 2,000 acre farm is very different and Producer A’s historical margins would need to be adjusted to reflect this change.

A copy of your structural change calculation can be provided upon request by calling our Client Contact Centre.

For more information, please see TIC 6 Structural Change and Part 4 of the AgriStability Program Guidelines

When an AgriStability claim is completed, the participant will receive a Calculation of Program Benefits package. Participants should review the information in the package for accuracy. If an amendment is required, refer to the Revisions and Amendments section of this Handbook.

Other information about program benefits

Participants may be combined by AFSC to determine program benefits if it is determined that they are operating as a whole farm. Participants who are combined will have the benefit cap of $3,000,000 applied to the combined operation. Each participant will have their benefit determined by the per cent of the whole farm interest held at the end of the program year.

Beginning farmers with less than five years of tax and supplementary information will have their applied reference margin calculated using the three years immediately preceding the program year until such time that there are five years available to calculate an Olympic average reference margin.

If the applied reference margin is negative and more than one of the three selected years is negative, the participant’s claim will not be eligible for that program year.

Participants who did not participate in an AFSC administered AgriInsurance program at the minimum level (70 per cent coverage) for an insurable commodity, will have their negative decline benefit amount reduced by 70 per cent of the deemed production insurance benefit calculated for that commodity, based on information provided by AgriStability.

Interim benefits

Interim benefit calculations give participants the option to receive an advance payment prior to the end of their program year in situations where they have suffered large income declines.

A participant may apply for an interim benefit upon completing six months of farming and up to 90 days after the completion of their program year.

To reduce the risk of overpayment, benefits are paid at 50 per cent of an estimated final benefit and benefits are limited to positive margin declines only; no payment of benefits on negative margins. Any interim benefits received will reduce final program benefits for that program year.

Participants who submit an interim application and receive benefits must submit a final application by the required deadlines. Failure to do so will result in a full overpayment of interim benefits.

For additional information about how to apply for an interim benefit, please refer to the Interim Application and Interim Guide.

Late Participation

Late participation may only be provided in program years that have experienced a significant agricultural disaster, whereby both the federal and provincial governments have agreed jointly to extend the deadline for participation.

This change does not allow for late participation due to a disaster on an individual farm, only in special circumstances (industry wide or province-wide disaster).

Late participants must comply with all program requirements and deadlines.

Payments to late participants, including interims, will be reduced by 20 per cent prior to applying any other deductions or penalties.

For more information, please see related resources: AgriStability Program Guidelines Part 3.7 and Annex D

Revisions & Amendments

Participant may request, in writing, an adjustment to information pertaining to the program year and its related benefits within 18 months following issuance of the original Calculation of Program Benefits statement. Adjustments requested after this time may not result in any changes to benefits for the program year.

A participant may request, in writing, an adjustment to amended information within 90 days following issuance of an amended Calculation of Program Benefits statement. All adjustments require supporting documentation and are subject to verification, audit and/or inspection by AFSC.

The participant must inform AFSC within 30 days of the discovery of any changes or errors in the information provided, including amendments or reassessments by the CRA of income tax information. AFSC is not responsible for notifying participants or the CRA of incorrect tax reporting.

The Administrator may initiate adjustments to information used in calculating program benefits for a program year (including information used in calculating the Reference Margin for that program year) for up to six years after notification of the original calculation of program benefits for that program year.

Participants will be required to repay any overpayment of benefits to AFSC. Interest will commence 30 days after the date of notification of overpayment is issued. The interest rate used is the CIBC prime rate plus 2 per cent per annum.

For more information, please see Technical Circular 1: Information on Reprocessing Claims

Appeals

If a producer feels the AgriStability program rules were not applied correctly during the processing of their file, they may request an appeal.

Producers may request a review of their AgriStability program year file, if:

- they feel the AgriStability program rules were not correctly applied to their file

- they missed a deadline because of circumstances beyond their control

Disagreeing with the program rules is not a valid reason for an appeal.

Requesting an appeal

A participant who is of the opinion that program rules were not correctly applied in the processing of their program year file may request a review by the Administrator. The Administrator may refer matters raised by participants to an Appeals Committee.

| Appeals shall be subject to a deadline of 90 days from the date that the participant is notified by AFSC of the decision which is subject to appeal.

Appeals must be submitted in writing to: AgriStability Appeal Committee |

The written appeal must:

- Clearly identify the nature of the appeal

- Provide sufficient information and documentation to substantiate the appeal, and

- Specify the remedy being sought

The AgriStability Appeal Committee must make recommendations in accordance with the agreements and legislation governing AgriStability.

Download the 2020-2022 AgriStability Program Handbook

Grow your business with AFSC

AFSC provides cost-shared production based and area based insurance covering a variety of commodities, including annual and perennial crops as well as honey and bee overwintering.

Learn more about Crop Insurance

Livestock Price Insurance is a risk-management tool available in British Columbia, Alberta, Saskatchewan and Manitoba. It provides producers with protection against an unexpected drop in prices for cattle and hogs over a defined period of time.

Learn more about Livestock Price Insurance

AFSC supports primary agricultural producers and agribusinesses in Alberta through its lending programs. Through partnerships with producers and businesses, AFSC helps maintain a profitable agriculture sector in the province and stimulates healthy rural communities.

Learn more about AFSC Lending

AgriInvest is a matching deposit-based program for participants who face small margin declines. The program is administered by the Agriculture and Agri-Food Canada (AAFC). AgriInvest funds, including the government contribution, can be withdrawn at any time with no pre-existing withdrawal requirements. The program is simple, responsive, predictable, and bankable. AFSC collects tax information for corporations, cooperatives and other entities and forwards this information to AAFC for the AgriInvest program.

Learn more about AgriInvest

AgriRecovery is a disaster relief framework to help participants with the cost of activities necessary for recovery following natural disaster events. The program must be declared jointly by the federal and provincial governments. AgriRecovery is intended to respond in situations where participants do not have the capacity to cover the extraordinary costs, even with the assistance available from other programs.

Learn more about AgriRecovery