Processing Vegetable Insuring Agreement 2024

Processing Vegetable Insuring Agreement

AFSC will indemnify the Insured against damage caused by Designated Perils to vegetables used for processing pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

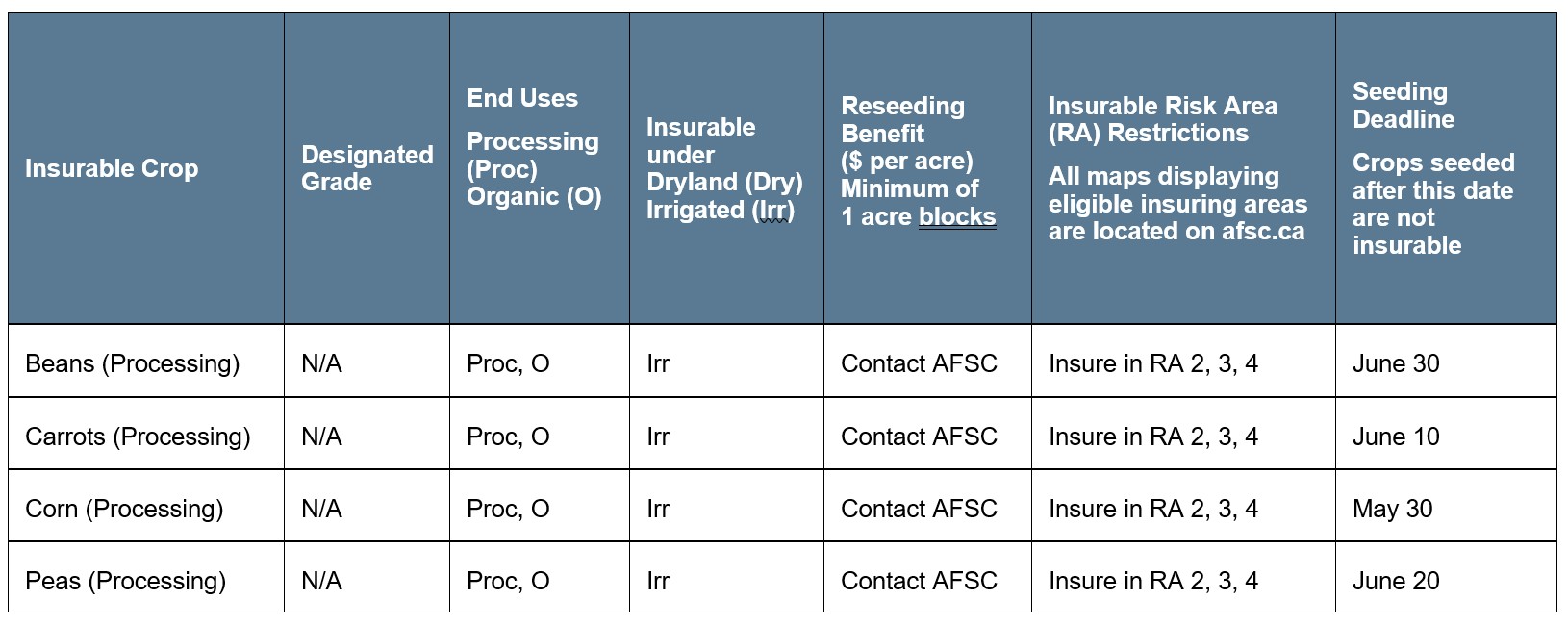

“Insurable Crop” means Beans (green or wax), Carrots, Corn or Peas used for processing.

“By-passed Crop” means an Insured Crop that is harvestable but is not harvested at the option of the Licensed Processor because of harvesting delays caused by weather or any other Designated Peril.

“Dollar Coverage” means for an Insurable Crop, the Dollar Coverage per Acre multiplied by the number of insured acres.

“Dollar Coverage per Acre” means the dollar amount per acre provided by Nortera or a processor approved by AFSC for the Insurable Crop, as calculated by AFSC, and elected by the Insured.

“Harvesting Allowance” means an amount calculated by the Licensed Processor to cover harvesting costs and agreed to by the Licensed Processor, the Alberta Vegetable Growers (Processing), and AFSC.

“Licensed Processor” means Nortera or a processor approved by AFSC.

“Percentage of Acreage By-passed” means the total insured acres of a crop that is by-passed by the Licensed Processor expressed as a percentage of the total insured acres of that crop under contract with the Licensed Processer.

“Production Value” means the value of production harvested by the Licensed Processor after deducting dockage and reported to AFSC.

a. The Dollar Coverage per Acre is adjusted each year depending on contract prices determined by negotiations between Alberta Vegetables Growers (Processing) and the Licensed Processor.

b. Separate Dollar Coverage per Acre is available for processing vegetables grown using conventional farming practices, and processing vegetables grown using organic farming practices.

a. Insurable Crop(s) grown on irrigated land must meet the following conditions:

i. those crops are declared as irrigated;

ii. there is an adequate source of water;

iii. the Insured has reliable irrigation equipment;

iv. adequate irrigation water is applied on a timely basis; and

v. the Insured maintains an up-to-date log showing the dates and approximate amounts of rainfall and irrigation water applied to each Insured Crop.

b. AFSC may apply Uninsured Causes of Loss if:

i. the Insured fails to fulfill all or part of the conditions in subsection (a). above; or

ii. drought is considered by AFSC to be a contributing cause of loss.

a. AFSC, in its discretion may limit, restrict, exclude or deny Coverage, in whole or in part, for the following:

i. in the event AFSC determines by the application deadline that an Insured has a high risk of Production Loss;

ii. where the land is subject to repeated flooding or where excess moisture is a recurring problem;

iii. major changes are made in management practices, acreage, land location, confirmed yields or experience;

iv. the Insured makes a change that increases AFSC’s risk without notifying AFSC thereof and AFSC accepting the same risk; or

v. any other practice or action taken by the Insured that would prove detrimental to or limit production of the Insured Crop.

a. Spring Insurance Price: In the spring, AFSC is provided with expected crop prices for the coming Crop Year, based on Alberta Vegetable Growers (Processing) negotiations with the Licensed Processor.

a. Minimum Premium: There is a minimum $25 of total Premium required per insurance Policy.

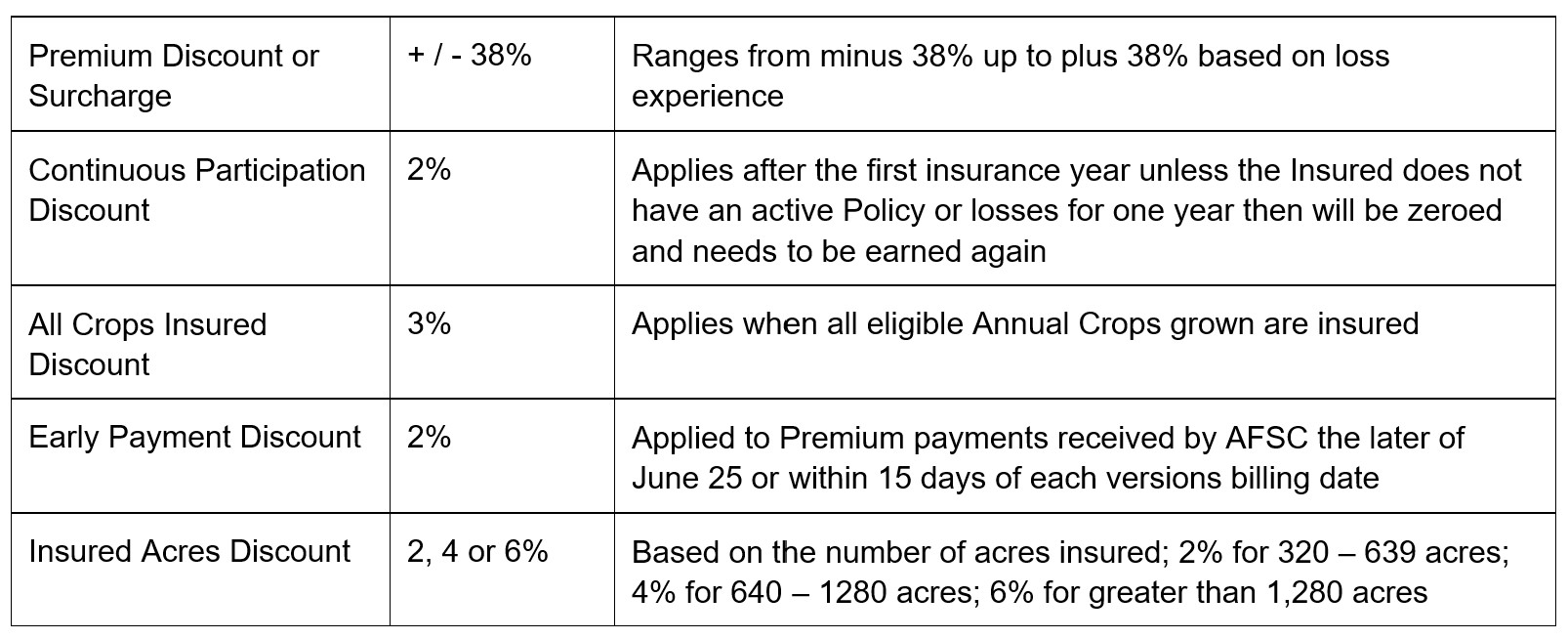

b. Rates: Premium rates are set annually based on historical losses and reflect AFSC’s risk of future production losses. Premium rates may vary by crop type, Risk Area, practice and Coverage Level. The Insured’s Premium is calculated by multiplying the Dollar Coverage by the Insured’s share of the premium rate and applying any applicable premium adjustments.

c. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

d. Adjustments & Discounts:

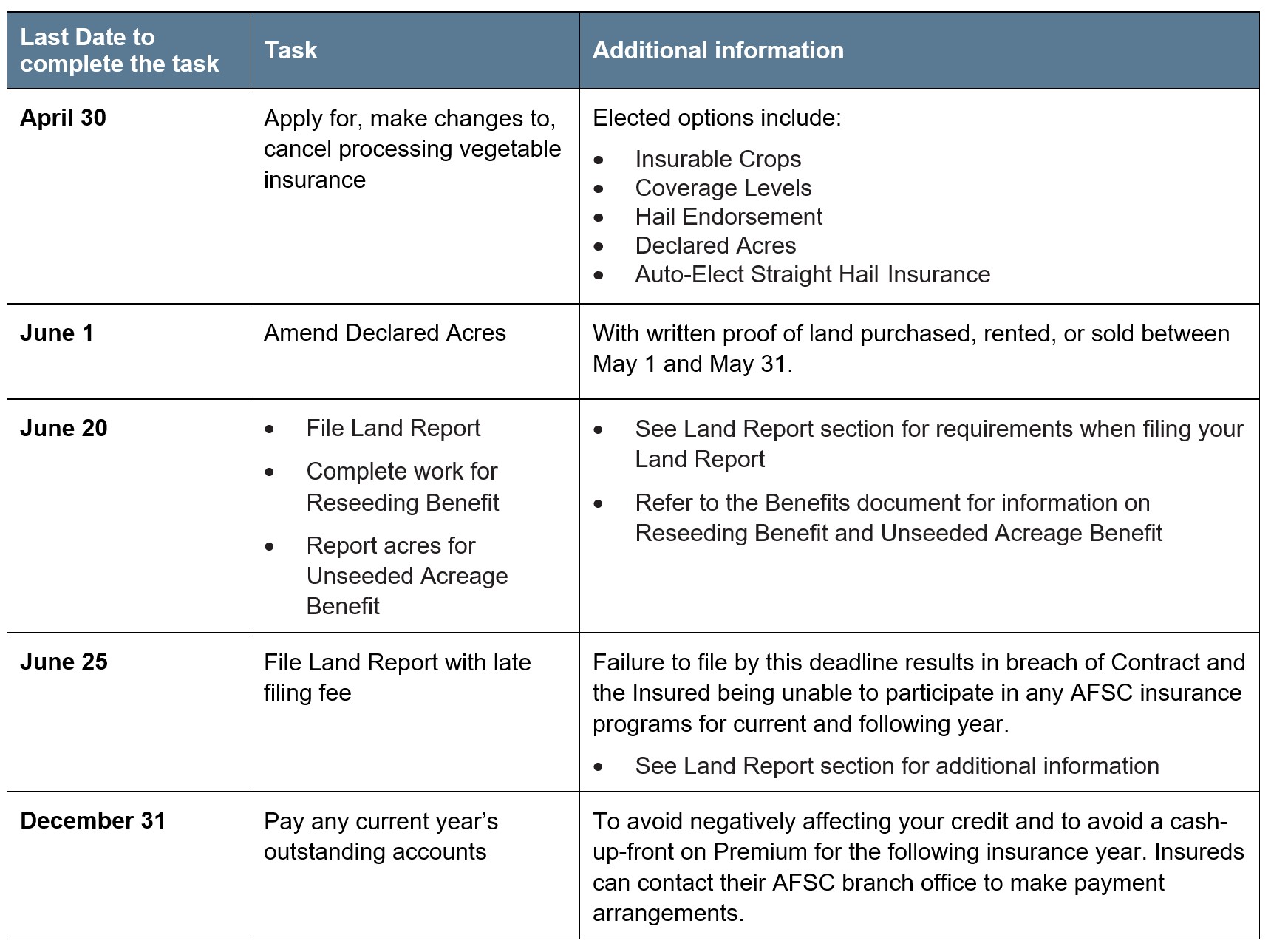

a. Application: New clients must apply for insurance on or before April 30 and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial and operational independence, and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect from year to year therefore an Insured who elected insurance in the previous year will be automatically renewed based upon the previous year’s information. Personalized renewal notices are available in March. The Insured is responsible to review the information and if changes are required, complete a change request form online or return the form to an AFSC insurance representative by mail, fax, email, in person, or request changes by phone, no later than April 30.

c. Coverage Level: Coverage Levels of 70 or 80 percent can be elected for most Insurable Crops. Coverage Levels of 60, 70, or 80 percent can be elected for carrots.

d. Declared Acres: are the total number of acres seeded and those intended to be seeded to Annual Crops, including Silage and Greenfeed crops, whether the acres are to be insured or uninsured.

e. Hail Endorsement: offers spot-loss coverage and may be elected on a crop by crop basis at 60, 70 or 80 percent Coverage Levels by April 30. Refer to the Hail Endorsement Insuring Agreement for additional information.

f. Auto-Elect Straight Hail Insurance: may be elected on a crop by crop basis by April 30. When elected, a

two percent premium discount will be applied on the Straight Hail Statement of Coverage and Premium.

| Straight Hail Insurance can be purchased on a field by field basis until July 31. Refer to the Straight Hail Contract of Insurance for additional information. |

a. The Insured must be a grower licensed by the Alberta Vegetable Growers (Processing).

a. Insurable Crops must be grown under contract between the Insured and a Licensed Processor to be eligible for Coverage.

a. A minimum of five acres, insured to one tenth of an acre, is required to be eligible for Coverage.

a. Processing Corn must be irrigated with a pivot system to be eligible for Coverage.

a. The Insurable Crop may be subject to an acceptance inspection and AFSC may, at its discretion, accept or reject insurance Coverage.

a. The Variable Price Benefit and Unharvested Acreage Benefit are not available under this Insuring Agreement.

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

a. All eligible acreage and seeded acreage of an elected Insurable Crop, whether owned, rented or crop-shared, must be insured. Acres insured under this Insuring Agreement are not insurable under any other crop insurance program, except for applicable Endorsements or where AFSC has consented in writing.

| Cash rent and crop share landlords are not eligible for insurance as they are not responsible for the agronomic decisions and do not receive the majority of the proceeds from the sale of the crop. |

b. If AFSC determines acres of an Insured Crop and the crop type and/or acres differ from those reported by the Insured, the following will apply:

i. When completing reseed inspections and unseeded inspections AFSC will issue a revised Statement of Coverage and Premium based on the crop type and actual number of seeded acres calculated by AFSC and any Indemnity calculation shall be based on the crop type and actual acres determined.

ii. When completing all other inspections:

1) If the measured or established acreage is within Acreage Tolerance, there is no revision to the Statement of Coverage and Premium and the reported insured acres are used in the calculation of the Indemnity.

2) If the measured acres are outside the Acreage Tolerance compared to acreage shown on the Land Report, AFSC may issue a revised Statement of Coverage and Premium and the Indemnity calculation shall be based on the actual number of seeded acres.

3) AFSC is not obligated to pay an Indemnity on the additional acres if a loss has previously occurred.

4) AFSC may remove the All Crops Insured Discount if additional acres outside of Acreage Tolerance.

c. AFSC is not required or in any way obligated to revise or adjust its calculation of insured acres for any preceding year.

a. A Land Report must be filed once seeding is finished and no later than June 20.

b. The Insured must report all annual spring and fall crops on land that is owned, rented, or crop-shared and include the following information for each field:

i. legal land description for the location including the part;

ii. number of seeded acres, or the number of acres intended for Summerfallow in the current year;

iii. whether the field is to be insured or uninsured;

iv. crop type seeded;

v. insured end use (e.g. Processing, Organic)

vi. whether the acres are seeded on dryland or irrigated land;

vii. seeding date;

viii. cropping and tillage practice;

ix. report acres too wet to seed by quarter section, including whether fertilizer had been incorporated or not, and if the land is irrigated or not; and

x. summary of insured acres for each crop.

| AFSC requires both insured and uninsured land information. Coverage is based on the land base farmed, not just the land insured, therefore the information is required to ensure Coverage and discounts are correct. |

c. Failure to file a Land Report will result in all insurance Policies being cancelled and restrictions on future year’s program participation. Where the Insured fails to file a Land Report by the June 20 deadline AFSC may, in its discretion:

i. accept the Land Report, if received by June 25, and assess a late filing fee to be paid by the Insured in full before the start of the next Crop Year;

ii. if due to extenuating circumstances, AFSC has the discretion to determine the acreage seeded by the Insured and file a Land Report for the Insured which shall be binding on the Insured; or

iii. cancel this Contract or any part thereof for the current Crop Year, in which case the Insured will be unable to participate in any AFSC insurance programs for the current and following year with the following exceptions:

1) Livestock Price Insurance can be purchased in the current year; and

2) Straight Hail Insurance can be purchased in the following year.

d. AFSC reserves the right to reject requests for changes to the Land Report after the June 20 filing deadline.

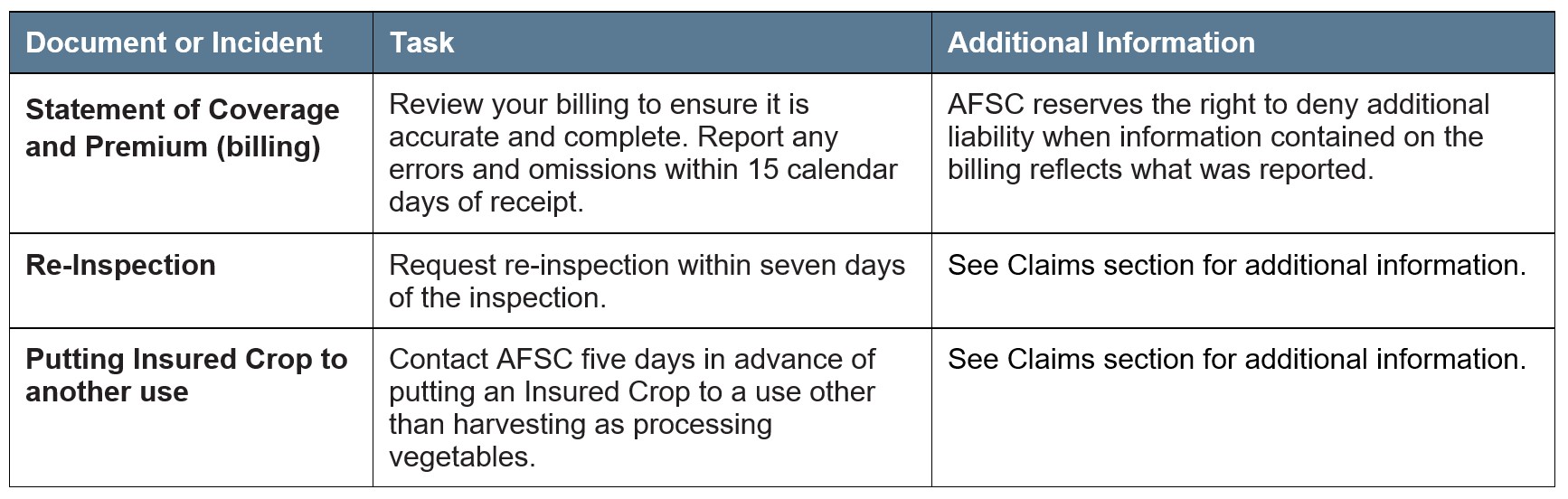

a. Information provided by the Insured is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is reported on the Land Report.

a. The Insured is required to submit a Notice of Loss to initiate a claim. The required timeframes for the Notice of Loss and the deadline to initiate a claim are as follows:

i. Reseeding Benefit: contact AFSC prior to taking acres intended for reseeding out of production. Refer to Benefits document for information.

ii. Unseeded Acreage Benefit: via the Land Report on or before June 20.

iii. Post Harvest claim: based on the Production Value reported to AFSC by the Licensed Processor after harvesting has been completed.

b. If the Insured is late in filing a Notice of Loss AFSC may reject the claim.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

ii. where AFSC’s process is to conduct an inspection, following the inspection, AFSC will serve the Insured with a copy of the Inspection Report.

b. If the Inspection Report results in no payment, or if as a result of the Inspection Report the claim for loss is withdrawn by the Insured, the Inspection Report will be considered to be the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

c. If the Insured does not, within seven days of service of the Inspection Report, advise AFSC of the Insured’s disagreement with the report or does not request a re-inspection, AFSC will issue the Statement of Loss according to the Inspection Report.

d. When AFSC has conducted an inspection and issued an Inspection Report and a Statement of Loss, and the Insured has a dispute relating to the Statement of Loss and requests a re-inspection, AFSC will only review the Statement of Loss if the Insured notifies AFSC of the request for a re-inspection within seven days from the day that the Insured is served with the Inspection Report.

a. After an inspection, pursuant to Section 8.02 (c), if the Insured, within seven days of service of the Inspection Report:

i. advises AFSC of the Insured’s disagreement with the report; and

ii. requests a re-inspection:

AFSC will conduct a re-inspection, and no Statement of Loss will be issued until after the re-inspection has been conducted. AFSC reserves the right to charge a fee for Insured requested re-inspection of crops, or re-grading of samples.

a. Acreage of Insured Crop(s) Put to Another Use must first be released by AFSC.

b. The Insured is required to contact AFSC five days in advance of putting an Insured Crop to a use other than harvesting as processing vegetables to request an appraisal and release of acres. The Insured will provide the following information:

i. The number of acres intended to be put to an alternate use;

ii. The reason for the alternate use.

c. An AFSC adjuster will complete a field inspection to verify the yield appraisal before acres are released.

d. AFSC may defer the appraisal on a damaged Insured Crop which the Insured intends to Put to Another Use.

e. When the Insured has accepted Appraised Potential Production on any portion of an Insured Crop, no further appraisal will be made on that portion unless, and at the sole discretion of AFSC, substantial damage occurs before the Insured Crop can be Put to Another Use within a reasonable period of time.

i. An additional Inspection may be subject to a re-inspection administrative fee.

f. Where an Insured Crop is Put to Another Use without first being assessed and/or released by AFSC, AFSC will deem the Appraised Potential Production to be zero, and the Uninsured Causes of Loss to be equal to Coverage on acres Put to Another Use.

g. The Insured must not dispose of an Insured Crop or Put to Another Use without AFSC releasing acres, as it may negatively impact their insurance.

a. The procedures set out in AFSC’s adjusting procedure manuals shall be used in the assessment of production and insurable loss of an Insured Crop.

| AFSC recommends the Insured or Authorized Representative accompany adjusters during on-farm inspections. |

a. When Uninsured Causes of Loss are determined, claims may be reduced or denied, reflecting the amount of production and/or Quality Loss due to the uninsured causes. The acres remain insured and full Premium remains payable. Common examples where Uninsured Causes of Loss may be applied include, but are not limited to:

i. unapproved, untimely or improperly applied products or methods for the:

1) control of weeds,

2) control of insects,

3) control of plant diseases,

4) enhancement of plant development;

ii. inadequate machinery, labour or failure to complete repairs to equipment on a timely basis;

iii. machinery and equipment failure due to mechanical defects or improper operations;

iv. damage to an Insured Crop from fertilizers, herbicides, pesticides, fungicides, soil or crop additives or any other product where the damage was caused by drift, residue, improper direct application or improper use of product;

v. untimely harvest practices for the area and the crop;

vi. improper harvest management;

vii. damage by domestic animals or poultry;

viii. neglect or theft of the Insured Crop;

ix. negligent or wrongful acts of a third party (e.g. spray drift or stray animals);

x. damage after an inspection by AFSC or while in storage, including heating;

xi. grade reduction before an inspection by AFSC if stored production is not weather protected; or

xii. any Designated Peril deemed avoidable by AFSC.

b. If AFSC pays no Indemnity because of an Uninsured Cause of Loss, AFSC will not refund any portion of the Premium and the Insured is not relieved from paying any outstanding Premium.

a. Service of the Inspection Report or a Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop loss for which an inspection has been made, service of the Inspection Report or Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. The Licensed Processor shall notify AFSC of any By-passed Crop, and the Insured’s acreage of the By-passed Crop. The by-pass committee consisting of AFSC, the Licensed Processor, Alberta Vegetable Growers (Processing), and the Insured will conduct a joint field inspection to verify the by-passed acres. Once all acres of each Insured Crop have been harvested, AFSC will calculate the Percentage of Acreage By-passed.

a. Where, the reported Production Value of an Insured Crop is less than Dollar Coverage after consideration of

By-passed Crop, AFSC will utilize Production Value for calculation of Indemnities.

b. When the Insured Crop is in a Production Loss, the Licensed Processor will provide AFSC with the irrigation logs showing dates of precipitation and approximate amounts of water applied.

a. Post harvest claims are triggered based on the information received by AFSC from the Licensed Processor after harvest is completed.

a. An Indemnity shall be calculated for the period commencing with the time the Insurable Crop is seeded and shall end at the earlier of:

i. when the Insured Crop is Put to Another Use; or

ii. when the Insured Crop is harvested.

a. Stage 1 on or Before June 20 (Refer to the Benefits document)

b. Stage 2 on or After June 21

i. If the Licensed Processor notifies AFSC of a loss from Designated Perils on or after June 21 and before November 30 in each year, an Indemnity for each Insured Crop shall be calculated as follows:

{[(Dollar Coverage per Acre x harvested acres) + Harvesting Allowance –Production Value] + By-passed Crop Indemnity} – Hail Endorsement payments – Wildlife Damage Compensation Program payments) – (bypass fee – growers fee – GST) = award

c. By-passed Crop Indemnities

i. When acreage of an Insured Crop is by-passed, the Indemnity for that By-passed Crop will be calculated as follows:

1) if the Percentage of Acreage By-passed is less than 10%, no Indemnity is calculated for the By-passed Crop.

2) if the Percentage of Acreage By-passed is 10% or greater but less than 20%, then the Indemnity will be an amount equal to:

(Dollar Coverage per Acre – 10%) x number of acres By-passed

3) if the Percentage of Acreage By-passed is 20% or greater but less than 30%, then the Indemnity will be an amount equal to:

(Dollar Coverage per Acre – 20%) x number of acres By-passed

4) if the Percentage of Acreage By-passed is 30% or greater, then the Indemnity will be an amount equal to:

(Dollar Coverage per Acre – 30%) x number of acres By-passed

ii. In no case, for an Insured Crop, shall the combined Indemnities under any Insuring Agreement (including Hail Endorsement) and Wildlife Damage Compensation exceed total Dollar Coverage plus Harvesting Allowance for that crop under this Contract.