WLPIP helping livestock producers navigate market challenges

Livestock producers struggling with little or no feed, or low quality feed for their cattle this year are not alone. Backgrounding their calves or buying feeders this fall may be an option for some, but it may not be the right option for others.

World events and their impact can be immediate at times and reaction from futures markets can be just as swift. Changing market opportunities that may take

But there are a few road markers that can help producers manage some of their risks. One of these price risk management tools relate to the Western Livestock Price Insurance Program (WLPIP at wlpip.ca), where coverage opportunities are available for this fall that would expire into the winter and spring of 2019. Currently a range of options from 16-week policies expiring in January, 2019 to 36-week policies expiring in June, 2019 offer pricing choices through WLPIP.

A good place for producers to evaluate options is to begin with their own numbers. Taking stock of one’s resources, including assessing financial strength and the ability to access capital are the obvious factors to look at. Appraising purchase or feeding decisions will require break-even and cost-of-gain calculations specific to the producer’s operation. These calculators are available online through Canfax or Alberta Agriculture and Forestry or by using one’s own accounting and spreadsheet packages.

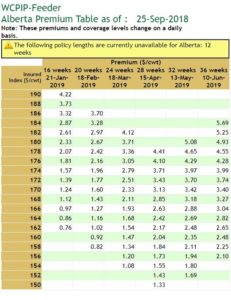

On the following page is the premium table for Feeder policy purchase in Alberta on September 25, 2018. Producers should keep in mind these premium tables, including Feeder policies for the Saskatchewan/Manitoba region, are only available for purchase for the posted day from 2 p.m. to 5:30 p.m. MT Tuesday, Wednesday and Thursday each week. Access to these tables are open to anyone and any producer can sign up for a daily premium and weekly settlement email reminder to be delivered to any digital device. Having an estimate of average daily gain and cost-per-pound of gain will provide the producer with a couple of tips relative to this table.

When is the expected time the feeders will be marketed? While there is no requirement to sell the insured animals, producers need to keep in mind that price protection for the animals is no longer available once the policy expires.

Also the Feeder program works with a 750- to 950-lb animal with a slide adjustment to an 850-lb settlement price for it. Currently Feeder policy in Alberta is using an 11.6-cent-per-pound slide. This means weights below 850 lbs have their prices adjusted down 11.6 cent per pound, while weights above 850 lbs have their prices adjusted up by 11.6 cent per pound. The policy also provides a four-week claim window up to the point of expiry to provide flexibility as to when the weight is claimed. For example, if a producer is interested in a February 18, 2019 or 20-week policy length, putting on 250 pounds over 145 days on a 600-lb feeder would need a gain of 1.70 lb/day to hit this policy expiry.

The left hand side of the above premium table is the coverage available for purchase at the time of expiry. The table lists the insurance premiums to be paid per cwt (per 100 lb) for the corresponding coverage period of the insurance policy. Top coverage available on September 25 for a 20-week policy was $186 per 100 pounds (per cwt) at a premium cost of $3.70 per cwt. Selection of coverage on the left column and determination of the time when the animals will be put on the market will depend, in part, where the producer’s break-even and cost-of-gain numbers come in. On a per head basis, this policy example for an 8.5cwt (850-lb) animal would cost $31.45.

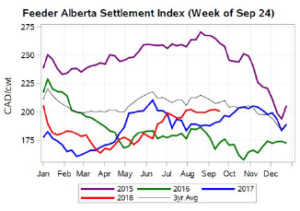

Below is the Feeder Alberta Settlement Index for the week of September 24, 2018 with the 2018 year in red. The chart, updated weekly on wlpip.ca, shows the price variation in settlements for 2018 and a comparison against previous years and the three-year average. Feeder Settlement Index for Saskatchewan/Manitoba is also available to claim against, with a policy purchased under this specific feeder index, should this be more appropriate for the producer’s market.

Settlements are currently about 4-6 dollars stronger than this time for 2017 (in brackets). Feeder settlement for September 24, 2018 was $200.65 ($196.43) in Alberta and $201.50 ($195.00) in Saskatchewan/Manitoba.

However, we are seeing a slightly weaker cash-to-futures basis at this time, in part due to more expensive feed, impacting the cost of gain.

WLPIP website offers lots of useful market information from feeder slide adjustments to spread values and currency charts updated regularly to help livestock producers with their decisions.

Branch staff at each one of the AFSC offices throughout Alberta and at AFSC’s client contact centre are ready to help with any assistance for policy purchasing or settlement claim decisions regarding price insurance for cattle and hog.

A complete list of AFSC branch offices can be found on the AFSC website (afsc.ca) under the “Contact us” button. Producers can reach Client Contact Centre by phone (1.877.899.2372), by email (info@afsc.ca) or by fax (1.855.700.2372).