Cushions and trended yields help protect producers from severe coverage fluctuations

Annual Insurance Crop InsuranceProducers who have experienced recurring years of loss may be uncertain as to how that will affect their insurance coverage in the future. The use of cushioned and trended yields in individual coverage calculations helps protect producers from severe coverage fluctuations.

Coverage is a fundamental part of the annual crop insurance policy, so it is important to understand how it is determined. In annual crop insurance, coverage is based upon a yield expectation or ‘normal yield’.

A client’s normal yield for a crop is based on the average of the yield records AFSC has recorded for that crop. Yield records are gathered in different ways, including:

- from Harvested Production Reports (HPRs)

- yield information gathered by AFSC adjusters who visit the farm in claim situations

- production verifications completed by adjusters visiting the farms of clients not in a claim

Yield coverage is based entirely on an individual’s yield history, and individual coverage will use:

- A blend of available yield records and the historical yields for the townships in which the client farms when there are four or fewer yield records available.

- The average of up to 15 of the most recent yield records for a crop when there are five or more yield records available. (Yield records older than 25 years are not used.)

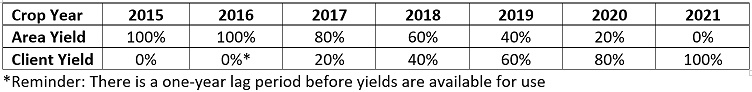

There is a one-year lag between when the yield is produced and when it is used to set coverage. For example, yields produced in 2019 will be used to set coverage for the first time in 2021.

Start up

Coverage is based on five years of records. The transition to having coverage based entirely on an individual’s yield records occurs in 20 percent increments.

- Crops with fewer than five years of yields available are considered to be in start-up phase.

- Missing yields will be filled in with the historical average yield for the township(s) in which the farm is located.

- If clients do not have any yield records available, coverage will be based entirely on the historical average for the township(s) where the farm is located.

- As client yield records become available they are included in the calculation, dropping off a year of the area average yield to be replaced with the client’s own yield.

Example:

Client applies for insurance in 2015 so the yields used for coverage are based on the following

Actual client yields are adjusted for two reasons: to cushion an abnormally low yield and to reflect a positive trend in yields.

Cushioning

One feature of individual coverage is cushioning of low yield records.

- Cushioning has the effect of stabilizing coverage by reducing year-to-year fluctuations.

- Cushioning is a formula applied to a yield when a client’s production for the year is low.

- The purpose of cushioning is to minimize the impact of abnormally low yields on the client’s individual normal yield.

- For the purposes of calculating future coverage, the low yield will be replaced with 70 per cent of the individual normal yield for that crop in the year in question.

Example:

- Client actual yield is 20 bushels per acre

- Individual normal is 40 bushels per acre

- Cushioned yield is (40 x 70%) 28 bushels per acre

- Client’s actual yield of 20 bushels is replaced with 28 bushels when determining individual coverage.

Trending

For most crops, due to improvements in varieties and management practices, yields generally increase over time. In order to ensure that individual coverage reflects this trend, individual yield records are adjusted by a trend factor.

- Older yield records will be increased more than recent yield records.

- Adjustments will be made by multiplying individual actual or cushioned yields by a trend factor.

- The trend factor is a number which reflects the average annual increase in yield for a specific crop in a specific risk area.

Example:

- Trend factor for canola in Risk Area 7 is 1.012

- One-year-old yield record at 30 bushels will be increased by 1.012 (to 30.36 bushels) to reflect improvements to technology and management

If a yield at 30 bushels was four years old, it would be increased by 1.012 four times (31.47 bushels) to reflect four years of improvement.

Remember that the actual yield is used to calculate a claim while the cushioned and trended yield will be used to set future coverage, thus supporting clients from severe fluctuations in their coverage when insurable perils impact their crop yields.

For more information about trended yields and cushioning, please use Live Chat on our website or AFSC Connect, call our Client Service Centre at 1.877.899.2372 or contact your branch office.