Producers can expect to see higher premiums for the 2023 crop year. The increase is mainly due to higher crop prices, more producers participating in the insurance program and impacts from the 2021 drought.

All efforts are made to ensure premiums remain affordable to clients, that coverage reflects the value of their crop, and that participation remains constant year to year.

The 60 per cent increase referenced in Alberta’s Fiscal Plan relates to the 2022 budgeted premium compared to the 2023 budgeted premium, and not actual premiums. Budgeted rates are estimates, prepared months before prices and premium rates are finalized. This year’s increase in premiums is actually an average of 22 per cent over what producers paid in 2022.

Caps and rate increases

As a government-backed entity, AFSC can take a long-term approach to its insurance programs. AFSC is not striving to recover losses in a short period and uses a 25-year time period to try and ensure that rate increases are predictable and stable.

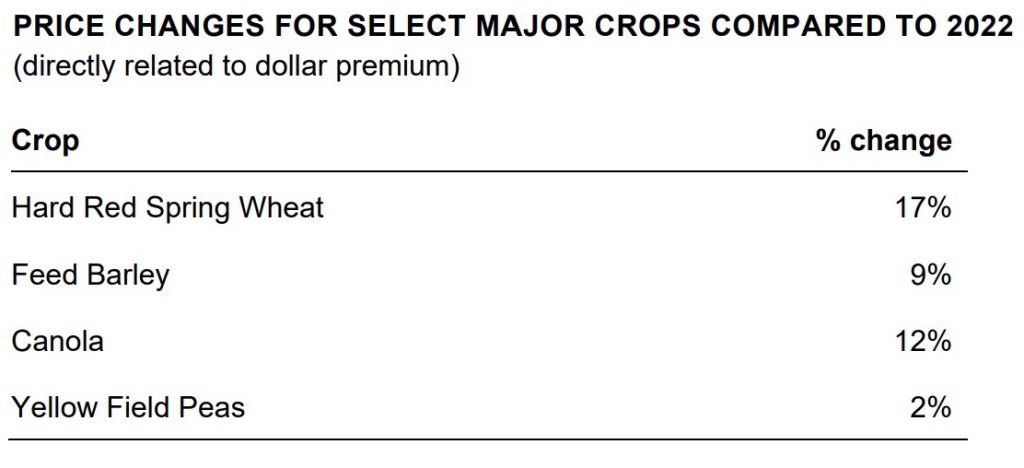

Caps exist on premium rates, which means that changes to actual premium dollars paid by AFSC clients are highly related to price changes in markets they are exposed to. The price of the commodity directly affects the cost of the premium. For example, if the price of wheat increases by 10 per cent, the cost of insurance premiums for wheat will rise by 10 per cent.

Insurance coverage that adjusts to market conditions allows farms to accurately insure their crops based on the market they are exposed to.

Once the area rate is calculated, it is individualized by adjusting for clients’ experience in the program. If the client has paid premiums for years without receiving an indemnity, they will likely have a discount. If they have had successive years of losses, they will likely pay a surcharge.

Commodity prices

Most commodities have seen increases to the spring insurance prices compared to the prior year.

Managing premium costs

Clients have options when it comes to controlling their perennial and annual crop insurance premium costs. Price options are available under the production-based insurance for hay as well as Moisture Deficiency and Corn Heat Unit insurance products.

Coverage level options, from 50 to 80 per cent, are available for most commodities insured under AFSC’s production-based insurance products. AgriStability is also an option to consider, as it provides a whole farm margin protection for producers.

AFSC also provides a two per cent discount on accounts paid within 15 days of billing. Unpaid balances start accruing interest in September.

Clients are encouraged to contact their insurance relationship manager to discuss their situation and options on how to handle any premium increases while managing their risk. Clients can reach out to their preferred branch office to book at appointment with their relationship manager or contact AFSC through Live Chat on our website or AFSC Connect, call our Client Care Centre at 1.877.899.2372

For additional information, click here to read Alberta Agriculture and Irrigation’s statement on 2023 crop insurance premiums.