Honey Insuring Agreement 2025

Honey Insuring Agreement

AFSC will indemnify the Insured against damage caused by Designated Perils to Honey production pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

“Insurable Crop” means Honey.

“Producing Hives” means hives designated for Honey production by the Insured and agreed to by AFSC. Hives used for pollination and leaf cutter bees are excluded.

Coverage is a fundamental part of any insurance Policy and is based upon a long-term average yield.

a. Individual Coverage: is based on a minimum of five years of records. Insureds with fewer than five years of records will be considered to be in the start-up phase.

b. Start-up: Missing yield records are filled in with the historical average yield for the Risk Area in which the farm is located. If the Insured does not have any yield records available, Coverage will be based entirely on the historical average for the Risk Area(s) where the farm is located.

c. Average Yield: An Insured’s average yield is based on the average of the yield records AFSC has recorded for honey. Yield records are gathered in different ways, including:

i. Harvested Production Reports (HPR) provided by the Insured;

ii. Yield information gathered by AFSC adjusters who visit the farm, and

iii. Production reviews conducted by AFSC adjusters to confirm the accuracy of HPR information.

d. One-year lag: Actual yields are not available immediately for use as it takes time to gather and verify information. Yields produced and reported in the current year will not be available to calculate Coverage for the following year; it will first be used to set Coverage the second year.

Rules for yield records use:

i. A blend of available yield records and the historical yields for the Risk Area in which the Insured farms when there are four or fewer yield records available.

ii. The average of up to 15 of the most recent yield records for a crop when there are five or more yield records available.

a. Cushioning has the effect of stabilizing Coverage by reducing year-to-year fluctuations. Unusually low yield records are adjusted upward for the purposes of calculating the Final Individual Normal Yield for a crop. When honey yield is less than 70 percent of the Final Individual Normal Yield, the actual yield will be cushioned and replaced by 70 percent of the Final Individual Normal Yield for that year. The cushioned yield is used to set future Coverage whereas the actual yield is used to calculate an Indemnity.

a. AFSC, in its discretion may limit, restrict, exclude or deny Coverage, in whole or in part, for the following:

i. in the event AFSC determines by the application deadline that an Insured has a high risk of Production Loss;

ii. major changes are made in management practices, hives, land location, confirmed yields or experience;

iii. the Insured makes a change that increases AFSC’s risk without notifying AFSC thereof and AFSC accepting the same risk; or

iv. any other practice or action taken by the Insured that would prove detrimental to or limit production of the Insured Crop.

a. Spring Insurance Price: In the spring, AFSC forecasts expected honey prices for the coming Crop Year.

a. Minimum Premium: There is a minimum $25 of total Premium required per insurance Policy.

b. Rates: Premium rates are set annually based on historical losses and reflect AFSC’s risk of future production losses. Premium rates may vary by Risk Area and Coverage Level. The Insured’s Premium is calculated by multiplying the Dollar Coverage by the Insured’s share of the premium rate and applying any applicable premium adjustments.

c. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

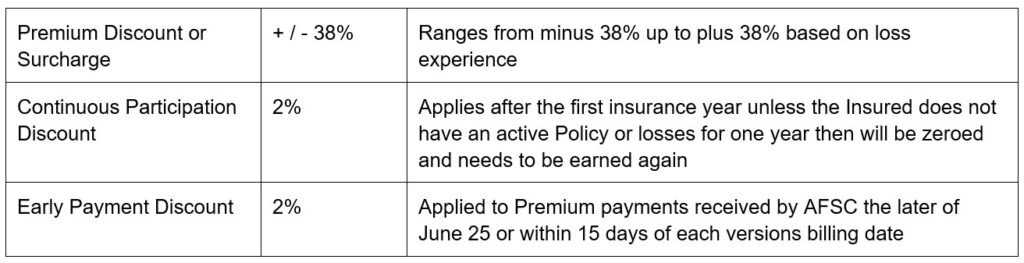

d. Adjustments & Discounts:

a. Application: New clients must apply for insurance on or before April 30 and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial and operational independence, and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect from year to year therefore an Insured who elected insurance in the previous year will be automatically renewed based upon the previous year’s information. Personalized renewal notices are available in March. The Insured is responsible to review the information and if changes are required, complete a change request form and return to an AFSC insurance representative by mail, fax, email or in person or request changes by phone, no later than April 30

c. Coverage Level: Coverage Levels of 50, 60, 70 or 80 percent can be elected.

d. Number of Producing Hives: The Insured needs to declare the number of Producing Hives intended to be insured.

a. The Insured must be registered, operate under and meet the requirements of the Bee Act of Alberta, or under any enactment that governs beekeepers in effect from time to time.

a. The Insured must operate and insure a minimum of 100 Producing Hives to be eligible for Coverage.

a. The Insured must follow best management practices as stated in the Beekeeping in Western Canada Manual published by the Alberta Government ministry responsible for Agriculture and provide a treatment log to AFSC upon request.

b. AFSC reserves the right to inspect hive locations for overcrowding and placement.

a. Coverage under Honey Insurance is based on the location of the Producing Hives in Honey Risk Areas 1, 2, 3, or 4. See Honey and Bee Overwintering Insurance map on afsc.ca.

a. Producing Hives that are transported away from their primary location, whether in province or out of province, must be returned on or before June 30.

a. Producing Hives will be subject to an acceptance inspection in the spring to determine if Producing Hives are viable and eligible for Coverage.

a. The Variable Price Benefit is not available under this Insuring Agreement.

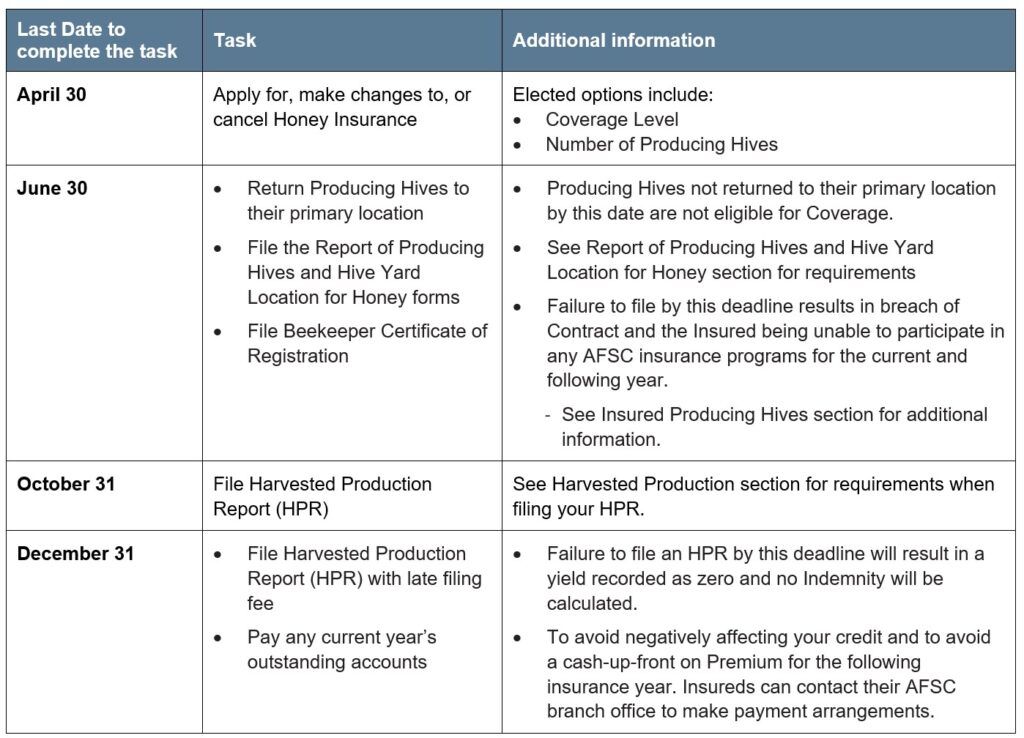

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

a. All eligible hives for the sole purpose of producing honey are required to be insured.

b. Producing Hives that are overwintered outside of Alberta, and Producing Hives that are overwintered in Alberta, must be transported to their primary location on or before June 30.

c. All Producing Hives are to be included on the Hive Yard Locations for Honey form and filed to AFSC by June 30.

a. The Insured must file a Report of Producing Hives and the Hive Yard Locations for Honey forms no later than June 30. AFSC requires that the Insured also file a signed Beekeeper Certificate of Registration from the Provincial Apiculturist as proof of registration under the Bee Act of Alberta.

b. If the Insured is late filing or fails to file a Report of Producing Hives and Hive Yard Locations for Honey, including the Beekeeper Certificate of Registration, by the June 30 deadline, AFSC may, in its discretion:

i. accept the Report of Producing Hives and Hive Yard Locations for Honey and assess a late filing fee to be paid by the Insured;

ii. if due to extenuating circumstances, AFSC has the discretion to determine the required information and file a Report of Producing Hives which shall be binding on the Insured; or

iii. cancel this Contract or any part thereof for the current Crop Year, in which case the Insured will be unable to participate in any AFSC insurance programs for the current and following year with the following exceptions:

1) Livestock Price Insurance can be purchased in the current year; and

2) Straight Hail Insurance can be purchased in the following year.

a. An acceptance inspection is completed to determine insurance eligibility by:

i. determining the viability and number of Producing Hives;

ii. determining whether Producing Hives are strong and able to produce honey at a normal level;

iii. verifying when splitting of the colony was done; and

iv. determining and recording insurable or uninsurable problems that may cause a loss.

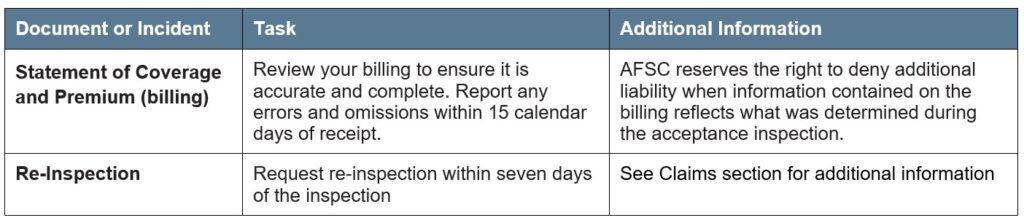

a. Information provided by the Insured is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is determined during the acceptance inspection.

a. The Insured is required to submit a Notice of Loss to initiate a claim. The required timeframes for the Notice of Loss and the deadline to initiate a claim are as follows:

i. Harvested Production Report (HPR): on a form acceptable to AFSC once harvest is complete and not later than October 31.

ii. Post harvest claim: via the HPR, losses must be reported before December 31 in the calendar year in which the loss is claimed to have occurred.

b. If the Insured is late in filing a Notice of Loss AFSC may reject the claim.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

ii. where AFSC’s process is to conduct an inspection, following the inspection, AFSC will serve the Insured with a copy of the Inspection Report.

b. If the Inspection Report results in no payment, or if as a result of the Inspection Report the claim for loss is withdrawn by the Insured, the Inspection Report will be considered to be the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

c. If the Insured does not, within seven days of service of the Inspection Report, advise AFSC of the Insured’s disagreement with the report or does not request a re-inspection, AFSC will issue the Statement of Loss according to the Inspection Report.

d. When AFSC has conducted an inspection and issued an Inspection Report and a Statement of Loss, and the Insured has a dispute relating to the Statement of Loss and requests a re-inspection, AFSC will only review the Statement of Loss if the Insured notifies AFSC of the request for a re-inspection within seven days from the day that the Insured is served with the Inspection Report.

a. After an inspection, pursuant to Section 7.02 (c), if the Insured, within seven days of service of the Inspection Report:

i. advises AFSC of the Insured’s disagreement with the report; and

ii. requests a re-inspection:

AFSC will conduct a re-inspection, and no Statement of Loss will be issued until after the re-inspection has been conducted. AFSC reserves the right to charge a fee for Insured requested re-inspection.

a. The procedures set out in AFSC’s adjusting procedure manuals shall be used in the assessment of production and insurable loss of an Insured Crop.

AFSC recommends the Insured or Authorized Representative accompany adjusters during on-farm inspections.

a. When Uninsured Causes of Loss are determined, claims may be reduced or denied, reflecting the amount of production due to the uninsured causes. The Producing Hives remain insured and full Premium remains payable. Common examples where Uninsured Causes of Loss may be applied include, but are not limited to:

i. unapproved, untimely or improperly applied products or methods for the:

1) control of pests,

2) control of diseases;

ii. inadequate machinery, labour or failure to complete repairs to equipment on a timely basis;

iii. machinery and equipment failure due to mechanical defects or improper operations;

iv. damage to an Insured Crop from exposure to insecticides, herbicides, pesticides, fungicides, or any other product where the damage was caused

v. improper application, use, or timing in the treatment for diseases;

vi. untimely harvest practices for the area and the Insurable Crop;

vii. improper harvest management;

viii. damage by domestic animals or poultry;

ix. neglect or theft of the Insured Crop;

x. negligent or wrongful acts of a third party;

xi. damage after an inspection by AFSC or while in storage;

xii. the presence of residue in the honey from the drug sodium sulfathiazole; or

xiii. any Designated Peril deemed avoidable by AFSC.

b. AFSC pays no Indemnity because of an Uninsured Cause of Loss, AFSC will not refund any portion of the Premium and the Insured is not relieved from paying any outstanding Premium.

a. Service of the Inspection Report or a Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop loss for which an inspection has been made, service of the Inspection Report or Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. Carryover honey, including purchased inventory and uninsured crop production, stored on or off the farm must be declared to AFSC in the spring on the Report of Producing Hives form, and in the fall on the Harvested Production Report for Honey form.

b. The Insured may be required to provide sales receipts to identify carryover, purchased inventory and uninsured production. It is important to report Carryover Inventory as it may affect eligibility for a claim if in a loss situation.

c. AFSC may count Carryover Inventory and uninsured production as part of the Harvested Production if the Insured fails to report, store separately and/or identify previous year’s production, or honey purchases.

a. An HPR must be submitted to an AFSC branch office when extraction is complete, and no later than October 31.

b. A late filing fee will be applied for HPRs submitted after the October 31 deadline.

c. The Insured is required to provide:

i. Changes to Carryover Inventory from what was reported on the Report of Producing Hives form;

ii. Hive Documentation: number of Producing Hives not extracted, abandoned or destroyed;

iii. Uninsured production;

iv. Current Year Harvested Production:

1) Stored;

2) Delivered, sold, given away;

v. Date extracting was completed.

d. Notification of an insurance claim and any required loss adjustment procedures are based on the information provided by the Insured on the HPR.

e. If the HPR is not submitted by the Insured before December 31, the yield will be recorded as zero and no Indemnity will be calculated.

f. The Insured may request corrections or revisions to the existing HPR record for a Crop Year, prior to the next Crop Year, by providing supporting documentation that is satisfactory to AFSC.

a. Where, after the HPR is filed, Harvested Production is less than total Coverage, AFSC will determine Adjusted Production.

b. The Adjusted Production of delivered, sold, or given away production will be assessed based on the cash purchase tickets.

a. Post harvest claims are triggered based on the information provided by the Insured on the HPR.

b. An AFSC adjuster will be assigned to the claim and will make an appointment for an on-farm inspection. The adjuster will:

i. Verify and/or measure the number of Producing Hives insured;

ii. Identify honey harvested; and

iii. Determine the quantity of honey harvested by measuring storage facilities and reviewing production sales receipts.

a. AFSC may combine production or calculate production from the Insured’s crop in a manner determined by AFSC including but not limited to combining, combining and prorating, and prorating of production.

b. In the event that Harvested Production is stored in such a manner that it is not possible to obtain an accurate production count (e.g. stored with uninsured production) AFSC may assign Uninsured Causes of Loss up to Coverage or prorate production.

c. AFSC may prorate or combine the production if the Insured fails to retain:

i. insured production separate from uninsured production;

ii. insured production separate from production of another producer;

iii. Harvested Production separate from Carryover Inventory; or

iv. stored production separately for each Policy where there are two or more of the same Policy type for one business.

a. An Indemnity shall be calculated for the period commencing with the time the Producing Hives are at their primary location and shall end at the earlier of:

i. when the Producing Hives are put to a use other than that for which it was originally intended;

ii. when the Producing Hives are transported away from their primary location;

iii. when the honey extraction is completed; or

iv. October 31 of the year in which the Insured Crop would normally have been extracted.

b. If the Insured extracts production from Producing Hives after October 31, that production is to be reported and is included in the Insured’s Harvested Production for the year in which the crop would normally be harvested.

a. If Adjusted Production is less than Coverage, Indemnities shall be calculated as follows:

{(Coverage – Adjusted Production) x Insurance Price} – Wildlife Damage Compensation Program payments.