Hay Insuring Agreement 2025

Hay Insuring Agreement

AFSC will indemnify the Insured against damage caused by Designated Perils to Hay pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

“Insurable Crop” means Hay that will be mechanically harvested for use as livestock feed.

“Accelerated” means the additional Indemnity calculated when an Insured produces less than 30 percent of their Expected Normal Yield.

“Designated Perils” In addition to the Designated Perils in the Terms and Conditions, Article 1: Definitions, Hay is also covered for Winterkill Provision.

“Hay” means seeded perennial tame grass, legumes or grass-legume mix crops grown for mechanical harvesting for use as livestock feed on dryland acres, and if grown for harvesting on irrigated land, it means those same crops but only if they contain more than 50 percent alfalfa.

“Haying Being General in the Area” means the date set by AFSC when provincially the majority of haying has started for the current year.

“Uninsured Production” means an Insurable Crop harvested from roadsides, rejected fields, uninsured acreages or land acquired after the insurance deadline.

Coverage is a fundamental part of any insurance Policy and is based upon a long-term average yield.

a. Indexing: is based on a minimum of four years of records. Crops with fewer than four years of records will be considered to be in the start-up phase.

b. Start-up: missing yields will be filled in with the historical average yield for the Risk Area in which the farm is located. If the Insured does not have any yield records available, Coverage will be based entirely on the historical average for the Risk Area(s) where the farm is located.

c. Average Yield: An Insured’s average yield for a crop type is based on the average of the yield records AFSC has recorded for the crop. Yield records are gathered in different ways, including:

i. Harvested Production Reports (HPRs) provided by the Insured;

ii. Yield information gathered by AFSC adjusters who visit the farm; and

iii. Production reviews conducted by AFSC adjusters to confirm the accuracy of HPR information.

d. One-year lag: Actual yields are not available immediately for use as it takes time to gather and verify information. Yields produced and reported in the current year will not be available to calculate Coverage for the following year; it will first be used to set Coverage the second year.

Rules for yield records use:

i. A blend of available yield records and the historical yields for the Risk Area in which the Insured farms when there are four or fewer yield records available.

ii. The average of up to 10 of the most recent yield records for a crop when there are four or more yield records available.

iii. For Coverage that is less than 30 acres the Harvested Production for the Insured Crop will be excluded from the calculation of the Insured’s Coverage.

a. Cushioning has the effect of stabilizing Coverage by reducing year-to-year fluctuations. Unusually low yield records will be adjusted upward for the purpose of calculating the Expected Normal Yield for a crop. When a crop yield is less than 70 percent of the Expected Normal Yield, the actual yield will be cushioned and replaced by 70 percent of the Expected Normal Yield for that crop for that year. The cushioned yield will be used to set future Coverage whereas the actual yield is used to calculate an Indemnity.

a. Alfalfa (>50%) grown on irrigated land is eligible for separate Coverage if:

i. the crop is grown on fields declared as irrigated;

ii. there is an adequate source of water;

iii. the Insured has reliable irrigation equipment;

iv. adequate irrigation water is applied on a timely basis; and

v. the Insured maintains an up-to-date log showing the dates and approximate amounts of rainfall and irrigation water applied.

b. AFSC may reclassify Alfalfa (>50%) as grown on dryland, or apply Uninsured Causes of Loss if:

i. the Insured fails to fulfill all or part of the conditions in subsection (a) above; or

ii. drought is considered by AFSC to be a contributing cause of loss.

c. Irrigated acres are insured separately from dryland acres of the same crop:

i. Acres must be identified as irrigated or dryland; and

ii. Production from irrigated and dryland acres must be stored and reported separately.

AFSC, in its discretion may limit, restrict, exclude or deny Coverage, in whole or in part, for the following:

a. in the event AFSC determines by the application deadline that an Insured has a high risk of Production Loss;

b. where the land is subject to repeated flooding or where excess moisture is a recurring problem;

c. major changes are made in management practices, acreage, land location, confirmed yields or experience;

d. the Insured makes a change that increases AFSC’s risk without notifying AFSC thereof and AFSC accepting the same risk; or

e. any other practice or action taken by the Insured that would prove detrimental or limit production to the Insured Crop.

a. Spring Insurance Price: this Insuring Agreement has the option of two Spring Insurance Prices, a low and a high price, based on forecasted market prices and transportation costs for the year.

b. Fall Market Price: is based on Alberta Government ministry responsible for Agriculture hay price from the Farm Input Survey for the month of October.

c. Variable Price Benefit: is offered to protect against price fluctuations between the Spring Insurance Price and the Fall Price. See Benefits document for information.

The Variable Price Benefit triggers when the Fall Price increases by a minimum of 10% above the Spring Insurance Price and compensates when the eligible crop is in a Production Loss.

a. Rates: Premium rates are set annually based on historical losses and reflect AFSC’s risk of future production losses. Premium rates may vary by crop type, Risk Area, and Coverage Level. The Insured’s Premium is calculated by multiplying the Dollar Coverage by the Insured’s share of the premium rate and applying any applicable premium adjustments.

b. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

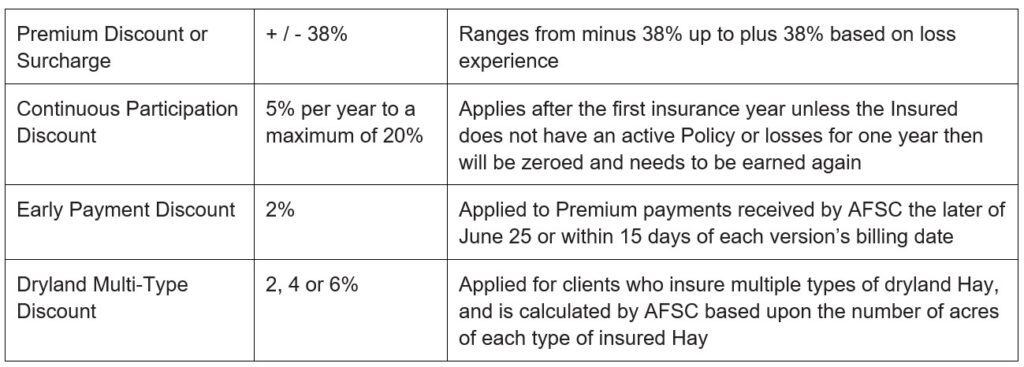

c. Adjustments & Discounts:

a. Application: New clients must apply for insurance on or before the last day of February and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial and operational independence and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect from year to year therefore an Insured who elected Hay Insurance in the previous year will be automatically renewed based upon the previous year’s information. Personalized renewal notices are available in January. The Insured is responsible to review the information and if changes are required, complete a Change Request form and return the form to an AFSC insurance representative by mail, fax, email, in person, online or request changes by phone by the last day of February.

c. Coverage Level: Coverage Levels of 50, 60, 70 or 80 percent can be elected;

i. Different Coverage Levels may be selected for dryland and irrigated Hay.

d. Price Options: An Insured has the option of electing a high price or a low price option.

i. The same insurance price option must be selected for dryland and irrigated Hay.

e. Crop Information: Land locations and crop type(s) by field, the date the field was seeded and the number of acres in the field.

f. Moisture Deficiency Endorsement: may be elected by the last day of February. Refer to the Moisture Deficiency Endorsement Insuring Agreement for required information.

a. Insurable Crops that will be mechanically harvested for use as livestock feed are eligible for Hay Insurance. This includes perennial tame grasses, legumes and grass-legume mixes which are insurable under the following crop types:

i. Dryland – Alfalfa (>50 percent alfalfa) intended for two cuts, in Designated Areas only;

ii. Legume (>50 percent), including alfalfa, red clover, alsike clover, sainfoin, sweet clover and milkvetch, intended for one cut;

iii. Grass (<=50 percent Legume), including brome grass, wild rye grass, wheat grass, fescue, timothy, orchard grass, rye grass, etc.;

iv. Irrigated – Alfalfa (>50 percent alfalfa) intended for multi-cuts, insurable in all forage Risk Areas.

Maps for Perennial Crops are available on afsc.ca.

a. This Insuring Agreement does not provide Coverage for the following:

i. Hay in the year it is seeded;

ii. Hay pastured consecutively in the previous two years;

iii. native hay;

iv. pasture;

v. straw from either grass or legumes grown for seed.

a. This Insuring Agreement has coverage for Winterkill Provision when the following conditions are met:

i. The acres are insured in the current year; and

ii. The acres were insured in the previous Crop Year; and

iii. Alfalfa and legume acres have not had more than five years of production; or

iv. Grass acres have not had more than eight years of production.

a. The Insurable Crop may be subject to an acceptance inspection and AFSC may, at its discretion, change Coverage or reject insurance.

b. If alfalfa acres are rejected:

i. these acres can be insured as legume or grass; or

ii. if the acres will be pastured, they can be insured under Moisture Deficiency Insurance as improved pasture when the Insured has an active Moisture Deficiency Insurance Policy.

Reasons acceptance inspections are completed for Hay include:

• Hay fields in the first year of production

• Newly insured Hay fields

• Hay stands that are older than the age criteria established for the crop type as calculated from the first year of production

• Hay fields that were grazed past April 30

• Hay fields that have not been hayed for two years

• Other risk criteria as determined by AFSC

a. Quality Loss is not available under this Insuring Agreement.

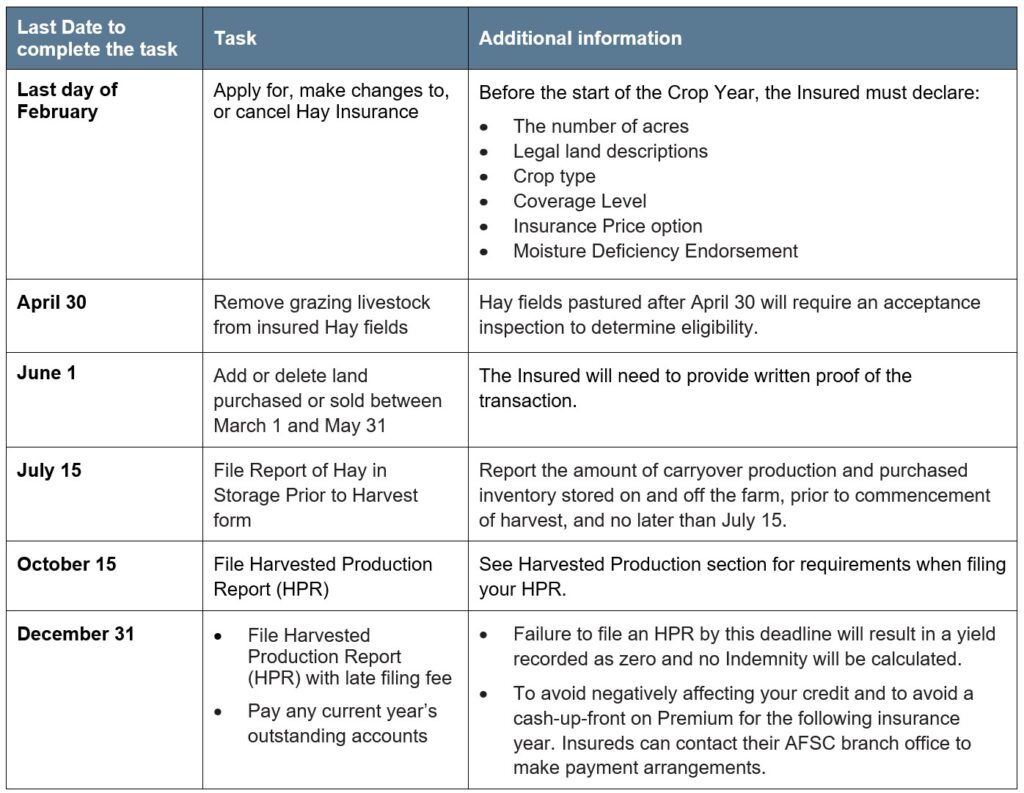

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

a. All acreage managed as Hay (dryland and irrigated), whether owned, rented or crop-shared, must be insured and there is a minimum of 20 acres for this Insuring Agreement. Acres insured under this Insuring Agreement are not insurable under any other crop insurance program, except for applicable Endorsement, or when AFSC has consented in writing.

Cash rent and crop share landlords are not eligible for insurance as they are not responsible for pasture management decisions.

b. If AFSC determines acres of an Insured Crop and the crop and/or acres differ from those reported by the Insured, the following will apply:

i. When completing acceptance inspections or acreage verification, AFSC will issue a revised Statement of Coverage and Premium based on the crop type and actual number of seeded acres calculated by AFSC and any Indemnity calculation will also be based on the crop type and actual acres.

ii. When completing all other inspections:

1) If the measured or established acreage is within Acreage Tolerance, there is no revision to the Statement of Coverage and Premium and the reported insured acres are used in the calculation of the Indemnity.

2) If the measured acres are outside the Acreage Tolerance compared to acreage reported, AFSC may issue a revised Statement of Coverage and Premium and the Indemnity calculation shall be based on the actual number of seeded acres.

3) AFSC is not obligated to pay an Indemnity on the additional acres if a loss has previously occurred.

c. AFSC is not required or in any way obligated to revise or adjust its calculation of insured acres for any preceding year.

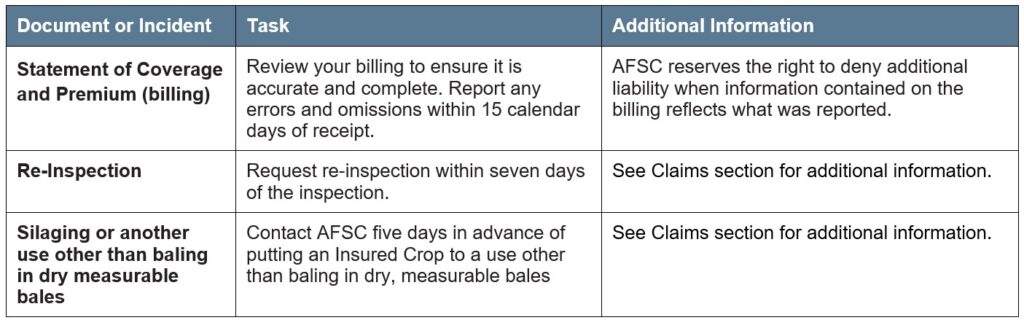

a. Information provided by the Insured is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is reported by the last day of February.

a. The Insured is required to submit a Notice of Loss to initiate a claim. The required timeframes for the Notice of Loss and the deadline to initiate a claim are as follows:

i. Harvested Production Report (HPR): on a form acceptable to AFSC once harvest is complete and not later than October 15.

ii. Post Harvest claim: via the HPR; losses must be reported before December 31 in the calendar year in which the loss is claimed to have occurred.

b. If the Insured is late in filing a Notice of Loss AFSC may reject the claim.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

ii. where AFSC’s process is to conduct an inspection, following the inspection, AFSC will serve the Insured with a copy of the Inspection Report.

b. If the Inspection Report results in no payment, or if as a result of the Inspection Report the claim for loss is withdrawn by the Insured, the Inspection Report will be considered to be the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

c. If the Insured does not, within seven days of service of the Inspection Report, advise AFSC of the Insured’s disagreement with the report or does not request a re-inspection, AFSC will issue the Statement of Loss according to the Inspection Report.

d. When AFSC has conducted an inspection and issued an Inspection Report and a Statement of Loss, and the Insured has a dispute relating to the Statement of Loss and requests a re-inspection, AFSC will only review the Statement of Loss if the Insured notifies AFSC of the request for a re-inspection within seven days from the day that the Insured is served with the Inspection Report.

a. After an inspection, pursuant to Section 7.02 c, if the Insured, within seven days of service of the Inspection Report:

i. advises AFSC of the Insured’s disagreement with the report, and

ii. requests a re-inspection,

AFSC will conduct a re-inspection, and no Statement of Loss will be issued until after the re-inspection has been conducted. AFSC reserves the right to charge a fee for Insured requested re-inspection of crops.

a. Acreage of Insured Crop Put to Another Use must first be released by AFSC.

b. The Insured is required to contact AFSC five days in advance of putting an Insured Crop to a use other than baling dry, measurable bales to request an appraisal and release of acres, and provide the following information:

i. the number of acres intended to be put to an alternate use;

ii. the reason for the alternate use; and

iii. an estimate of the yield.

c. Depending on the estimate of yield, the acres may be released from an AFSC branch office, or an adjuster may complete a field inspection to determine the yield appraisal before acres are released.

d. AFSC may defer the appraisal on a damaged Insured Crop which the Insured intends to Put to Another Use.

e. When the Insured has accepted the Appraised Potential Production on any portion of an Insured Crop, no further appraisal will be made on that portion unless, and at the sole discretion of AFSC, substantial damage occurs before the Insured Crop can be Put to Another Use within a reasonable period of time.

i. An additional inspection may be subject to a re-inspection administrative fee.

f. Where an Insured Crop is Put to Another Use without first being assessed and/or released by AFSC, AFSC will deem the Appraised Potential Production to be zero, and the Uninsured Causes of Loss up to Coverage on acres Put to Another Use.

g. If an Insured Crop is eligible for the Winterkill Provision and is Put to Another Use due to winterkill:

i. the Appraised Potential Production will be an amount no less than one-half of Coverage on the acres Put to Another Use provided the acreage was first assessed by AFSC.

ii. Alternatively, Premiums may be refunded and these acres become eligible for annual crop insurance, subject to the Terms and Conditions and the Insuring Agreement for the annual Insurable Crop.

h. If an Insured Crop is intended to be ploughed under or sprayed out prior to first cut Haying Being General in the Area, the Insured must provide AFSC with prior notification to obtain release.

i. If the released Hay acres are subsequently seeded to an elected annual crop, these acres can be transferred to an annual crop Policy, subject to the Terms and Conditions, and the Insuring Agreement for the annual Insurable Crop.

ii. If the released acres are not seeded to an elected annual crop, the acres will remain insured under the Hay Policy; AFSC will deem the Appraised Potential Production to be zero, and the uninsured loss to be equal to Coverage.

i. If a one-cut Insured Crop is Put to Another Use on or after first cut Haying Being General in the Area and with prior authorization from AFSC, Coverage and Premium on this acreage will remain in effect and AFSC will apply the Appraised Potential Production.

j. If a two-cut Insured Crop (Alfalfa >50%) is ploughed under, sprayed out, or pastured after first cut Haying Being General in the Area but prior to second cut Haying Being General in the Area and with prior authorization from AFSC, Coverage and Premium will be reverted to one-cut Hay (Legume).

k. Insured must not dispose of an Insured Crop or Put to Another Use without AFSC releasing acres, as it may negatively impact their insurance. Once authorized by AFSC, the Insured may leave standing Inspection Strips or Exclosures.

l. Where standing Inspection Strips or Exclosures are authorized by AFSC, the Insured is required to leave standing Inspection Strips or set up appropriate Exclosures, or AFSC will deem the Appraised Potential Production to be zero, and the Uninsured Causes of Loss up to Coverage on the acres Put to Another Use.

a. Inspection Strips are representative standing strips of the Insured Crop in such measurements as required by AFSC to determine the crop’s production potential. Inspection Strips are to be left in from the edges of the field, a distance of about one-third of the width of the field, for the length of the field and a minimum of ten feet in width, for inspection by AFSC.

i. On fields less than 100 acres, two strips are required.

ii. On fields of 100 acres or more, an additional strip must be left in the middle of the field.

iii. On fields of 100 acres or more that span multiple quarter sections, treat each quarter section as a separate field; for fields less than 100 acres, two strips are required; for fields greater than 100 acres, three strips are required.

b. Exclosures are representative sites of the crop that are fenced off and are used when the crop is being pastured as the Insured is unable to leave representative Inspection Strips.

i. A minimum of two sites are required for fields up to 40 acres,

ii. A minimum of one additional site is required for every additional 40 acres in that item.

Information on Inspection Strips is available on afsc.ca Contact AFSC directly for information regarding Exclosures.

a. The procedures set out in AFSC’s adjusting procedure manuals shall be used in the assessment of production and insurable loss of an Insured Crop.

AFSC recommends the Insured or Authorized Representative accompany adjusters during on-farm inspections.

When Uninsured Causes of Loss are determined, claims may be reduced or denied, reflecting the amount of production due to the uninsured causes. The acres remain insured and full Premium remains payable. Common examples where Uninsured Causes of Loss may be applied include, but are not limited to:

a. inadequate machinery, labour or failure to complete repairs to equipment on a timely basis;

b. machinery and equipment failure due to mechanical defects or improper operations;

c. damage to an Insured Crop from fertilizers, herbicides, pesticides, fungicides, soil or crop additives or any other product where the damage was caused by drift, residue, improper direct application or improper use of product;

d. untimely harvest practices for the area and the crop;

e. improper harvest management;

f. damage by domestic animals or poultry;

g. neglect or theft of the Insured Crop;

h. negligent or wrongful acts of a third party (e.g. spray drift or stray animals);

i. damage after an inspection by AFSC or while in storage, including heating;

j. damage resulted from winter grazing;

k. any Designated Peril deemed avoidable by AFSC.

If AFSC pays no Indemnity because of an Uninsured Cause of Loss, AFSC will not refund any portion of the Premium and the Insured is not relieved from paying any outstanding Premium.

a. Service of the Inspection Report or a Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop loss for which an inspection has been made, service of the Inspection Report or Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. Carryover Hay, including purchased inventory and Uninsured Production, stored on or off the farm, must be declared to AFSC via the Report of Hay in Storage Prior to Harvest form prior to commencing harvest and not later than July 15, even though the intent may be to sell or feed it before harvest.

b. The Insured may be required to provide sales receipts to identify carryover, purchased inventory and Uninsured Production.

c. AFSC may count Carryover Inventory and Uninsured Production as part of the Harvested Production if the Insured fails to report, store separately and/or identify previous year’s production, or hay purchases.

It is important to report Carryover Inventory as it may affect eligibility for an advance or claim if in a loss situation.

a. An HPR must be submitted online or to an AFSC branch office when harvest is complete, and no later than October 15.

b. A late filing fee will be applied for HPRs submitted after the October 15 deadline.

c. The Insured is required to provide:

i. Changes to Carryover Inventory from what was reported on the Report of Hay in Storage Prior to Harvest form;

ii. Field Documentation information including preharvest, pastured, plowed down, or abandoned acres:

1) Abandoned acres require a reason, land location, number of acres and yield estimate;

iii. Uninsured Production;

iv. Insured production by field and cut;

v. Bale weight and percent of moisture;

vi. Date harvest of each cut was completed; and

vii. Number and type of bales stored, fed, or sold.

d. Harvested Production from all insured crop types are combined and moisture is standardized to 15 percent by weight.

e. Notification of an insurance claim and any required loss adjustment procedures are based on the information provided by the Insured on the HPR.

f. When there is a Production Loss, the Insured is required to contact AFSC prior to feeding any Hay from insured acres.

g. If the HPR is not submitted by the Insured before December 31, the yield will be recorded as zero and no Indemnity will be calculated.

h. The Insured may request corrections or revisions to the existing HPR record for a Crop Year, up to March 1 of the following year by providing supporting documentation that is satisfactory to AFSC.

a. Where, after the HPR is filed, total production of an Insured Crop is less than total Coverage after consideration of percent of moisture, AFSC will determine Adjusted Production.

b. The Adjusted Production of delivered or sold production of an Insured Crop will be assessed based on the cash purchase tickets or the agreed upon weight and moisture content that the final cash purchase tickets will be issued on.

c. When irrigated acres are in a Production Loss, the Insured will be asked to provide an irrigation log showing dates of precipitation and approximate amounts of water applied.

a. If, based on the production reported on the HPR, the Insured Crop is in a Production Loss and meets a set of criteria determined by AFSC, the Insured may be eligible to be paid for the loss. AFSC will calculate the potential payment, contact the Insured to verify the information reported on the HPR, and when eligible, process the Indemnity without an on-farm inspection.

a. If, based on the production reported on the HPR, the Insured Crop is in a Production Loss, the Insured has the option of accepting an advance payment prior to AFSC completing an on-farm inspection.

i. The advance is a minimum 50 percent of the estimated shortfall and will be the higher of the following;

1) 50 percent advance if the Insureds production is above 30 percent of their Coverage.

2) 75 percent advance if the Insureds production is less than 30 percent of their Coverage.

ii. The Accelerated Indemnity allowance for lower production is not available on the advance and will be applied to the final post harvest assessment.

b. If there is an overpayment due to differences between the Insured’s information reported on the HPR, and the Harvested Production determined during the post harvest inspection, repayment will be required within 30 days of notification. The advance Indemnity must exceed a minimum amount and will be applied to amounts owing to AFSC and assignments. Advances on Hay Insurance cannot be deferred.

a. Post harvest claims are triggered based on the information provided by the Insured on the HPR.

b. An AFSC adjuster is assigned to the claim and will make an appointment for an on-farm inspection. The adjuster will:

i. Verify and/or measure the number of acres insured;

ii. Identify acres harvested; and

iii. Determine the quantity of the crop harvested and review production sales receipts.

a. To ensure program integrity, AFSC retains the right to complete production reviews. Some production reviews are selected on the basis of an identified risk, while others are randomly generated.

a. AFSC may combine production or calculate production from the Insured’s crop in a manner determined by AFSC, including but not limited to, combining, combining and pro-rating, and pro-rating of production.

b. In the event that the Harvested Production is stored in such a manner that it is not possible to obtain an accurate production count (e.g. stored with Uninsured Production), AFSC may assign Uninsured Causes of Loss up to Coverage or prorate production.

c. AFSC may pro-rate or combine the production if the Insured fails to retain:

i. insured production separate from Uninsured Production;

ii. insured production separate from production of another producer;

iii. Harvested Production separate from Carryover Inventory;

iv. irrigated production separate from dryland production; or

v. stored production separately for each Policy where there are two or more of the same Policy type for one business.

The Insurable Period begins at the start of the Crop Year and shall end at the earlier of:

a. the date the Insured Crop is Put to Another Use;

b. the date the Insured Crop is harvested; or

c. October 15 of the year in which the Insured Crop would normally have been harvested.

a. Prior to first cut Haying Being General in the Area, as determined by AFSC, an Indemnity will be calculated as follows:

i. if selected by the Insured, a Premium refund on damaged acres; or

ii. an Indemnity not to exceed 50 percent of the Dollar Coverage; or

iii. Appraised Potential Production shall not be less than 50 percent of Coverage

b. If only a portion of the total acreage is released because of damage, the appraisal will be added to the Adjusted Production from the remaining acreage.

c. Once all the Harvested Production and Appraised Potential Production for the Insured is reported for the year:

i. If the Insured incurs a loss from Designated Perils on or before October 15 in each year, the Indemnity for the Hay will be calculated based on full Coverage as follows:

1) If the Adjusted Production is less than Coverage but equal to or greater than 30 percent of the Expected Normal Yield for all Insured Acres (Expected Normal Yield x Insured Acres), Indemnities will be an amount equal to:

[(Coverage – Adjusted Production) x Insurance Price] – Wildlife Damage Compensation Program payments

2) If the Adjusted Production is less than 30 percent but greater than 20 percent of the Expected Normal Yield for all Insured Acres, Indemnities will be Accelerated by compensating for twice the loss between 20 and 30 percent, and shall be an amount equal to:

[{Coverage – (Adjusted Production – {((Expected Normal Yield x Insured Acres x 30%) – Adjusted Production) x 2))} x Insurance Price] – Wildlife Damage Compensation Program payments

3) If the Adjusted Production is less than or equal to 20 percent of the Expected Normal Yield for all Insured Acres (Expected Normal Yield x Insured Acres), Indemnities will be an amount equal to, but not exceeding;

[Coverage x Insurance Price] – Wildlife Damage Compensation Program payments

ii. AFSC, in its discretion, may apply the Appraised Potential Production if the Insured has not completed harvest on or before October 15.