Hail Endorsement Insuring Agreement 2025

Hail Endorsement Insuring Agreement

AFSC will indemnify the Insured against Spot Loss damage caused by hail, fire by lightning or accidental fire to an Insured Crop pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

The Hail Endorsement can be purchased on a crop by crop basis along with annual crop insurance Policies. This endorsement provides Spot-Loss coverage for crop losses due to hail and fire damage.

“Insurable Crop” means crops insured under the following Insuring Agreements:

a. Cereal and Oilseed Crops;

b. Pulse Crops;

c. Organic Crops;

d. Pedigreed Crops;

e. Pedigreed Hybrid Canola;

f. Pedigreed Alfalfa Seed;

g. Commercial & Pedigreed Creeping Red Fescue;

h. Pedigreed Timothy Seed;

i. Grain Corn;

j. Fresh Vegetable;

k. Potato;

l. Safflower and Sunflower;

m. Sugar Beet;

n. Corn Heat Unit;

o. New Crop Insurance Initiative;

p. Processing Vegetable;

q. Silage Greenfeed Insurance – Barley Proxy; and

r. Silage Greenfeed Insurance – Lack of Moisture.

“Designated Peril” means hail, fire by lightning, or accidental fire. For greater clarity, these are the only Designated Perils under this Insuring Agreement, and the additional Designated Perils listed under Article 1 of the Terms and Conditions do not apply to this Insuring Agreement.

“Dollar Coverage per Acre” means the value in dollars of the Insured Crop at the Coverage Level elected under the annual crop Policy where the Hail Endorsement has been elected.

“Spot Loss” means losses eligible for Indemnity on the actual area of a crop damaged by an incidence of hail, fire by lightning or accidental fire.

a. Hail Endorsement applies to the entire acreage of the Insured Crop and at the same Dollar Coverage per Acre as provided under the annual crop insurance Policy. When the Insured Crop suffers a loss of 10 percent or more, the Insured is eligible for a payment based on the percentage of loss on the damaged acres.

a. Hail Endorsement does not cover and will not pay any Indemnity for:

i. loss from an Uninsured Cause of Loss, even though the loss may have occurred in conjunction with a Designated Peril;

ii. loss of any portion of a crop recoverable by harvesting equipment;

iii. loss due to failure of the crop to mature;

iv. loss due to neglect or failure to harvest mature crops;

v. consequential, special or indirect damages including, but not limited to, diseases, insect infestation, lodging and loss of markets; or

vi. loss to crops which AFSC considers not viable.

a. Rates: Premium rates are set annually based on historical losses and reflect AFSC’s risk of future hail losses. Hail Endorsement rates may vary by crop type, township, and whether the crop is eligible for the Variable Price Benefit (VPB) or not. The Insured’s Premium is calculated by multiplying the Dollar Coverage per Acre by the Hail Endorsement premium rate.

b. Loss Experience: Hail Endorsement Indemnities do not affect the Insured’s premium adjustment under the annual crop Policy(s).

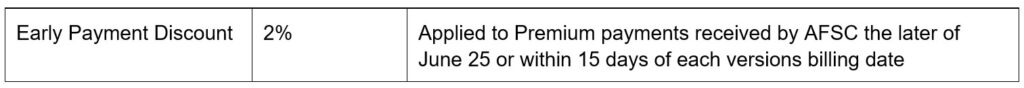

c. Adjustments & Discounts:

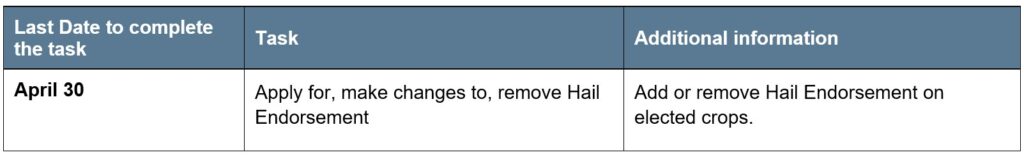

a. Application: New clients can apply for Hail Endorsement along with their annual crop insurance Policy by April 30. Hail Endorsement may be elected on a crop by crop basis at 60, 70, or 80 percent Coverage Levels. All acres of each Insured Crop will then have Hail Endorsement.

b. Renewal Process: Hail Endorsement remains in effect from year to year therefore an Insured who elected Hail Endorsement in the previous year will be automatically renewed based upon the previous year’s information. Personalized renewal notices are available in March. The Insured is responsible to review the information and if changes are required, complete a change request form online or return the form to an AFSC insurance representative by mail, fax, email, in person, or request changes by phone, no later than April 30.

a. The Hail Endorsement Insuring Agreement shall commence on May 1 and comes into effect on the date the Insured Crop emerges and is viable.

a. Hail Endorsement cannot be cancelled on any parcel of land on which an Indemnity has been paid.

b. The Insured may cancel the Hail Endorsement by giving AFSC appropriate notice. The cancellation shall be effective immediately on the date of receipt of that notice by AFSC. When notice is received:

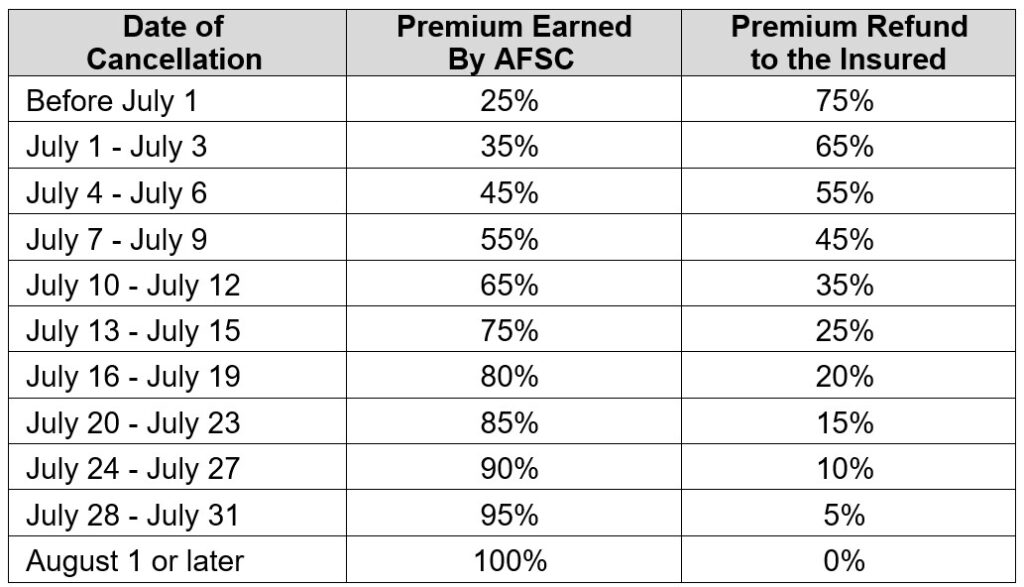

i. After April 30, provided no Indemnity has been paid under this Insuring Agreement, Hail Endorsement may be cancelled and the Premium refunded on spring seeded crops in accordance with the date of cancellation as shown in the following Cancellation and Premium Refund Schedule:

ii. For fall seeded crops and perennial crops grown for seed, the cancellation dates are 14 days in advance of the dates set forth in subsection (i) above.

c. Where there has been no hail damage assessed, the Insured can cancel Hail Endorsement on partial acres of an Insured Crop when confirmation that the acres have been Put to Another Use has been completed.

i. Cancellation is effective as of the date the Insured notifies AFSC that the acres have been Put to Another Use, and the Premium refund is based on the Cancellation and Premium Refund Schedule.

ii. The Insured cannot cancel partial acres of an Insured Crop unless confirmation that the acres have been Put to Another Use has been completed.

a. Hail Endorsement is available at 60, 70, and 80 percent Coverage Level for most Insurable Crops, and 90 percent Coverage Level for Sugar Beets.

b. Hail Endorsement is not available at the 50 percent Coverage Level.

a. When acres of an Insured Crop are reseeded, the Hail Endorsement Coverage and Premium on the original crop will be reversed.

b. When acres of an Insured Crop are reseeded to an Insured Crop with Hail Endorsement elected, Coverage and Premium is determined for the reseeded crop.

a. Hail Endorsement is offered on the majority of crops that are insurable under NCII. AFSC reserves the right not to provide Hail Endorsement Coverage on crops where, in the opinion of AFSC, hail damage cannot be accurately assessed.

b. Intercrop Cereal, Intercrop Oilseed, Intercrop Pulse: Hail damage will be assessed on the primary crop only. Hail damage will not be assessed on the non-primary crops in the mixture.

a. Cereal Mixture, Oilseed Mixture, Pulse Mixture: Hail damage will be assessed on the primary crop only. Hail damage will not be assessed on the non-primary crops in the mixture.

b. Cocktail Crops: Hail damage will be assessed on the primary crop only. If there is no approved primary crop comprising of 35 percent or more by established field stand during a hail inspection, Hail Endorsement will be revoked and the Premium refunded for the ineligible acres.

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Deadlines

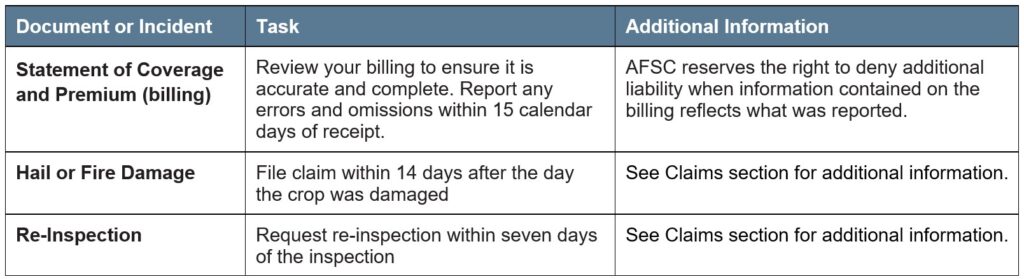

a. The Insured is required to submit a Notice of Loss to initiate a claim. The required timeframes for the Notice of Loss and the deadline to initiate a claim are as follows:

i. Hail or Fire Damage: online, by phone, by email, or in person on a form acceptable to AFSC within 14 days after the crop was damaged.

b. If the Insured is late in filing a Notice of Loss AFSC may reject the claim.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

ii. where AFSC’s process is to conduct an inspection, following the inspection, AFSC will serve the Insured with a copy of the Inspection Report.

b. If the Inspection Report results in no payment, or if as a result of the Inspection Report the claim for loss is withdrawn by the Insured, the Inspection Report will be considered to be the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

c. If the Insured does not, within seven days of service of the Inspection Report, advise AFSC of the Insured’s disagreement with the report or does not request a re-inspection, AFSC will issue the Statement of Loss according to the Inspection Report.

d. When AFSC has conducted an inspection and issued an Inspection Report and a Statement of Loss, and the Insured has a dispute relating to the Statement of Loss and requests a re-inspection, AFSC will only review the Statement of Loss if the Insured notifies AFSC of the request for a re-inspection within seven days from the day that the Insured is served with the Inspection Report.

a. After an inspection, pursuant to Section 5.02 (c), if the Insured, within seven days of service of the Inspection Report:

i. advises AFSC of the Insured’s disagreement with the report; and

ii. requests a re-inspection:

AFSC will conduct a re-inspection, and no Statement of Loss will be issued until after the re-inspection has been conducted. AFSC reserves the right to charge a fee for Insured requested re-inspection of crops.

a. Where hail damage occurs to a standing crop or a crop that is already swathed, if the hail inspection has not yet been completed, the Insured must receive permission from AFSC to leave representative Inspection Strips for an AFSC adjuster to determine the percentage of loss.

a. Inspection Strips are representative standing strips or swaths of the Insured Crop in such measurements as required by AFSC. Inspection Strips are to be left in from the edges of the field a distance of about one-third of the width of the field, for the length of the field and a minimum of ten feet in width, for inspection by AFSC.

i. On fields less than 100 acres, two strips are required.

ii. On fields of 100 acres or more, an additional strip must be left in the middle of the field.

iii. On fields of 100 acres or more that span multiple quarter sections, treat each quarter section as a separate field; for fields less than 100 acres, two strips are required; for fields greater than 100 acres, three strips are required.

Information on Inspection Strips is available on afsc.ca

a. The procedures set out in AFSC’s adjusting procedure manuals shall be used in the assessment of production and insurable loss of an Insured Crop.

AFSC recommends the Insured or Authorized Representative accompany adjusters during on-farm inspections.

a. If no part of the Insured Crop has sustained a loss of at least ten percent, the cost of the inspection may, at the discretion of AFSC, be charged to the Insured, and in that case:

i. the cost shall be added to any unpaid Premium owing by the Insured and become part of it; and

ii. AFSC has such a lien for the costs of inspection as it has for unpaid Premium, if the Insured is not indebted to AFSC for any unpaid Premium.

a. Service of the Inspection Report or a Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the crop loss for which an inspection has been made, service of the Inspection Report or Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. The Insured shall be entitled to an Indemnity pursuant to this Insuring Agreement if the loss occurs the earlier of:

i. when the Insured Crop is put to a use other than that for which it was originally intended;

ii. when the acres have been harvested;

iii. when the acres have been abandoned by the Insured because of no harvest value, or

iv. midnight on October 31 of the Crop Year.

a. Hail Endorsement Indemnity is determined by the percentage of damage to the Insured Crop multiplied by the Dollar Coverage per Acre and the number of damaged acres.

b. When the hail loss is determined to be less than ten percent on the damaged acres, no Hail Endorsement Indemnity shall be payable to the Insured.

c. For hail loss greater than 70 percent:

i. Where the actual percentage of damage from hail is determined by AFSC to be in excess of 70 percent but less than 90 percent, an additional allowance shall be made. This allowance will be equal to the difference between the actual percentage of damage and 70 percent to a maximum of ten percent.

ii. Where the actual percentage of damage from hail is determined by AFSC to be equal to or in excess of 90 percent, the damage shall be deemed and calculated by AFSC to be 100 percent.

d. In no case shall any Indemnity be paid under this Insuring Agreement in respect of any crop or part of it that has been so damaged by causes other than hail that, in the opinion of the adjuster, the value likely to be obtained for the Harvested Production would not exceed the actual cost of cutting, threshing and marketing the Harvested Production.