Bee Overwintering Insuring Agreement 2025

Bee Overwintering Insuring Agreement

AFSC will indemnify the Insured against mortality losses for Bees overwintered in Hives in Alberta, in excess of normal losses caused by Designated Perils, pursuant to this Insuring Agreement. This Insuring Agreement incorporates by reference, and is subject to, the Terms and Conditions and Benefits. The definitions in the Terms and Conditions will apply unless the same term is otherwise defined in this Insuring Agreement.

“Insurable Crop” means Hives deemed eligible for Coverage by AFSC containing overwintering Bees.

“Apiary” means a commercial beekeeping enterprise utilizing Bees for the purpose of pollination or honey production.

“Bees” means insects designated as honey bees overwintered in Hives.

“Coverage” means the number of Hives insured by AFSC based on the number of Insurable Hives, the Individual Survival Rate, and the Coverage Level.

“Coverage Level” means 90 percent of the Individual Survival Rate of the Insurable Hives.

“Designated Perils” for purposes of this Insuring Agreement means:

a. excessive cold;

b. excessive moisture;

c. flood:

d. frost;

e. snow;

f. temperature fluctuations;

g. diseases or pests that cannot be controlled by industry accepted farm management practices; or

h. any other peril designated by AFSC from time to time where the peril results in high death loss to overwintered Bees

“Dollar Coverage per Hive” means the insured value per Hive elected by the Insured, which applies to all Insurable Hives.

“Hives” means hives arranged in single or double chambers or such other arrangements of hives that AFSC, in its discretion, accepts for Coverage under this Insuring Agreement.

“Hives Declared Adequate or Strong” means Hives with an abundant number of Bees, brood, pollen and honey stored as determined by AFSC during its spring inspection.

“Hives Declared Dead” means Hives with insufficient Bees to make the Hive salvageable, as determined by AFSC during its spring inspection.

“Hives Declared Weak” means Hives with sufficient Bees to make the Hive salvageable with replacement, as determined by AFSC during its spring inspection.

“Individual Survival Rate” means the expected survival rate of the Insurable Hives in which Coverage is offered to an Insured as calculated by AFSC, based on the Insured’s historical survival rate of Insurable Hives, and if required, the Risk Area’s survival rate.

“Insurable Hive” means a Hive that is deemed eligible for insurance by AFSC at the fall acceptance inspection.

“Surviving Hives” means the number of Hives Declared Adequate or Strong plus one third of the Hives Declared Weak, as determined by AFSC during the spring adjusting inspection.

“Uninsurable Hive” means a Hive not accepted for insurance by AFSC at the fall acceptance inspection.

Coverage is a fundamental part of any insurance Policy and is based upon a long-term average survival rate.

a. Individual Survival Rate: is based on a minimum of five years of records. Insureds with fewer than five years of records will be considered to be in the start-up phase.

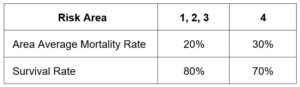

b. Start-up: Missing survival rate records are filled in with the historical average survival rate for the Risk Area in which the farm is located. If the Insured does not have any Individual Survival Rate records available, Individual Survival Rate will be based entirely on the historical average for the Risk Area(s) where the farm is located as per the table below.

Schedule of coverage

c. Survival Rate: An Insured’s average survival rate is based on the average of the survival rate records AFSC has recorded. Survival rate records are gathered by AFSC adjusters during the unwrapping inspection each spring.

d. One-year lag: Actual survival rates are not available immediately for use as it takes time to gather and verify the information. Survival rates recorded in the current year will not be available to calculate Individual Survival Rate for the following year; it will first be used to set Individual Survival Rate the second year.

Rules for yield records use:

i. A blend of available survival rate records and the historical survival rates for the Risk Areas in which the Insured farms when there are four or fewer yield records available.

ii. The average of up to 15 of the most recent survival rate records when there are five or more survival rate records available.

a. AFSC, in its discretion may limit, restrict, exclude or deny Coverage, in whole or in part, for the following:

i. in the event AFSC determines by the application deadline that an Insured has a high risk of mortality losses;

ii. major changes are made in management practices, Hives, land location, or experience;

iii. the Insured makes a change that increases AFSC’s risk without notifying AFSC thereof and AFSC accepting the same risk; or

iv. any other practice or action taken by the Insured that would prove detrimental to the Insured Crop.

a. Spring Insurance Price: Bee Overwintering Insurance offers two price options, a low and a high price option, based on forecasted market prices for Hives.

a. Minimum Premium: There is a minimum $25 of total Premium required per insurance Policy.

b. Rates: Premium rates are set annually based on historical losses and reflect AFSC’s risk of future losses. Premium rates may vary by Risk Area and price option. The Insured’s Premium is calculated by multiplying the Dollar Coverage per Hive by the Insured’s share of the premium rate and applying any applicable premium adjustments.

c. Cost Share: Federal and provincial governments support AgriInsurance programs by paying all administration expenses and sharing premium costs with the Insured.

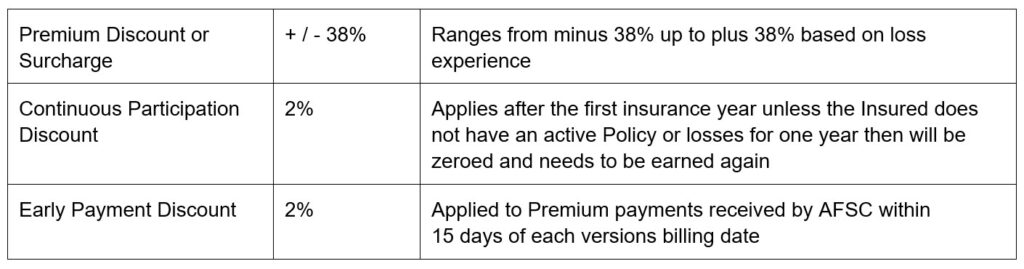

d. Adjustments & Discounts:

a. Application: New clients must apply for Bee Overwintering Insurance on or before June 30 and AFSC will evaluate eligibility for insurance. Producers are required to demonstrate their legal, financial, and operational independence and can contact AFSC for application documents.

b. Renewal Process: Insurance remains in effect from year to year therefore an Insured who elected Bee Overwintering Insurance in the previous year will be automatically renewed based upon the previous year’s information, excluding the number of Hives intended for overwintering. Personalized renewal notices are available in May. The Insured is responsible to review the information and if changes are required, complete a change request form and return the form to an AFSC insurance representative by mail, fax, email or in-person, or request changes by phone, no later than June 30.

c. Coverage Level: Bee Overwintering Insurance applies a 90 percent Coverage Level to the Insured’s Individual Survival Rate.

d. Price Options: the Insured can select either the high or low option for Dollar Coverage per Hive.

e. Number of Hives Intended to Overwinter in Alberta: The Insured needs to declare the number of Hives they intend to overwinter in Alberta.

a. The Insured must be registered, operate under and meet the requirements of the Bee Act of Alberta, or under any enactment that governs beekeepers in effect from time to time.

a. The Insured must operate and insure a minimum of 100 Hives to be eligible for Coverage.

a. The Insured must follow best management practices as stated in the Beekeeping in Western Canada Manual published by Alberta Government ministry responsible for Agriculture and provide a treatment log to AFSC upon request.

a. Coverage for Hives insured under Bee Overwintering Insurance is based on the location of the Hives in Bee Overwintering Risk Areas 1, 2, 3, or 4. See Honey and Bee Overwintering Insurance map on afsc.ca

a. Hives will be subject to an acceptance inspection in the fall to determine if Hives are viable and eligible for Coverage.

a. The Variable Price Benefit is not available under this Insuring Agreement.

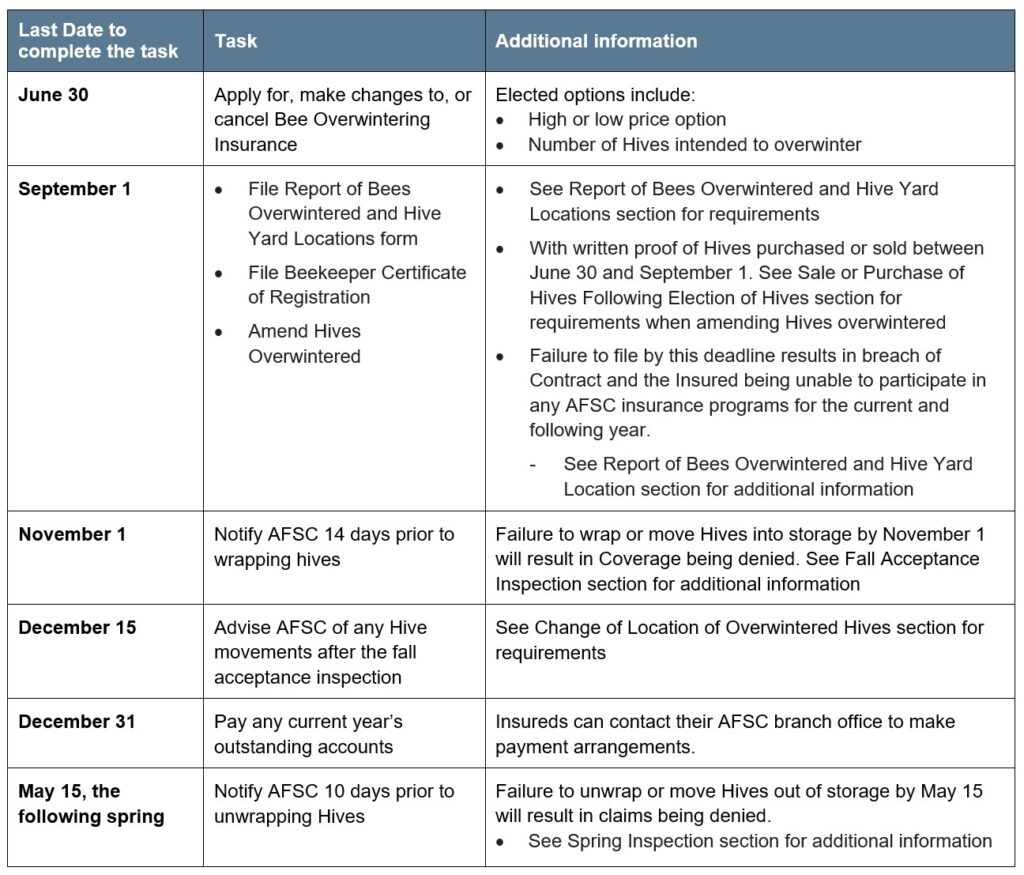

If a reporting deadline date falls on a weekend, the deadline will be extended to the next Business Day.

Other Important Information

a. All eligible Hives within an Apiary are required to be insured when overwintered in Alberta.

i. Insurable Hives include:

1) hives for honey production; and

2) pollinator hives.

ii. Excluded hives are:

1) leafcutter bee and nucs; and

2) hives overwintered outside of Alberta.

a. If the Insured completes a sale of Hives after completing the Confirmation of Insurance and Election of Hives form but prior to September 1 in the same calendar year, the following applies:

i. if the Insured notifies AFSC in writing of the finalized sale before September 1 in the same calendar year, and provides evidence of sale satisfactory to AFSC, then the Hive count reported for Coverage will be adjusted accordingly; or

ii. if the purchaser provides evidence of the purchase satisfactory to AFSC, and the purchased Hives are the only Hives the purchaser operates and meets the 100 Hive minimum, then the purchaser may obtain the same insurance Coverage as the Insured’s Policy on the purchased Hives.

b. If the Insured purchased Hives following the completion of the Confirmation of Insurance and Election of Hives but prior to September 1 in the same calendar year, the following applies:

i. the Insured must advise AFSC in writing of the finalized purchase before September 1 in the same calendar year and provide evidence of the purchase satisfactory to AFSC; and

ii. the newly acquired Hives must be insured subject to the existing Coverage under the Insured’s Policy. The Hive count reported for Coverage will be adjusted accordingly.

a. The Insured must file a Report of Bees Overwintered and Hive Yard Locations form no later than September 1. AFSC requires that the Insured also file a signed copy of the Beekeeper Certificate of Registration from the Provincial Apiculturist as proof of registration under the Bee Act of Alberta.

b. If the Insured is late filing or fails to file a Report of Bees Overwintered and Hive Yard Locations, including the Beekeeper Certificate of Registration, by the September 1 deadline, AFSC may, in its discretion:

i. accept the Report of Bees Overwintered and assess a late filing fee to be paid by the Insured;

ii. if due to extenuating circumstances, AFSC has the discretion to determine the required information and file a Report of Bees Overwintered which shall be binding on the Insured; or

iii. cancel this Contract or any part thereof for the current Crop Year, in which case the Insured will be unable to participate in any AFSC insurance programs for the current and following year with the following exceptions:

1) Livestock Price Insurance can be purchased in the current year; and

2) Straight Hail Insurance can be purchased in the following year.

a. The Insured must contact AFSC a minimum of 14 days prior to wrapping or moving Hives indoors, to allow AFSC time to complete an acceptance inspection. Acceptance inspections are required to be completed by November 1.

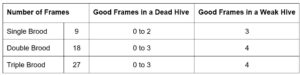

b. Insurable Hives are determined during the fall acceptance inspection, and eligibility is based on the following criteria:

i. adequate feed;

ii. medication;

iii. the extent of mite infestation; and

iv. the number of good frames and brood condition.

c. Coverage will be excluded for:

i. hives overwintered outside of Alberta;

ii. hives that AFSC inspects and deems too weak to survive the winter; and

iii. leafcutter bees.

a. AFSC will insure all Insurable Hives, subject to the following limits:

i. When the number of Hives determined during fall acceptance inspection is greater than 120 percent of that declared on the Election of Hives, the Insured’s Coverage and Premium will be capped at 120 percent of the number of Hives declared on the Election of Hives.

ii. When the number of Hives determined during fall acceptance inspection is less than 80 percent of that declared on the Election of Hives, the Insured’s Coverage and Premium will be based on the actual number of Insurable Hives, subject to a penalty on over-declared Hives.

1) If the Hives accepted for Coverage are less than 80 percent of the declared Hives in Article 2, subsection 2.05 (e), the Insured will be subject to a penalty based on the following formula:

(80% of declared Hives – accepted Insurable Hives) x (average Premium per Hive for the Insurable Hives)

a. AFSC must be advised of all Hive movements after the fall acceptance inspection has been completed.

b. Movement of Hives outside of Alberta prior to December 15 will result in denied Coverage and Premium refund for the Hives moved. The Insured must notify AFSC of such movement on or before December 15, or the Hives will be deemed by AFSC to have been moved outside of the province on or after December 15.

c. Movement of Hives outside of Alberta on or after December 15 will result in those Hives being assessed with Uninsured Causes of Loss, and full Premium will remain payable.

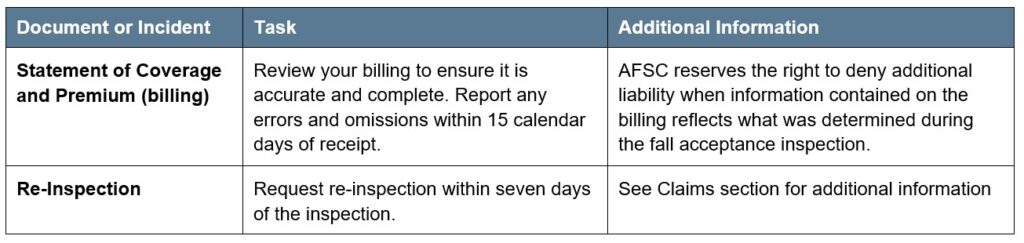

a. Insurable Hive information determined by AFSC during the fall acceptance inspection is used to generate a Statement of Coverage and Premium, which explains Coverage and Premium and states AFSC’s Coverage limit.

b. The Insured should review their Statement of Coverage and Premium carefully to ensure it is complete and accurate. Errors and omissions must be reported to AFSC within 15 calendar days of receipt.

c. AFSC reserves the right to deny additional Coverage when information contained on the Statement of Coverage and Premium reflects what is determined during the fall acceptance inspection.

a. The Insured is required to submit a Notice of Loss to initiate a claim. The required timeframes for the Notice of Loss and the deadline to initiate a claim are as follows:

i. Spring inspection: the Insured must contact AFSC and request an inspection a minimum of 10 days prior to unwrapping Hives or moving Hives out of storage. Hives must be unwrapped or moved out of storage no later than May 15.

b. If the Insured is late in filing a Notice of Loss AFSC may reject the claim.

a. Upon receipt of a claim for loss:

i. where AFSC processes a claim, AFSC will serve the Insured with a Statement of Loss.

ii. where AFSC’s process is to conduct an inspection, following the inspection, AFSC will serve the Insured with a copy of the Inspection Report.

b. If the Inspection Report results in no payment, or if as a result of the Inspection Report the claim for loss is withdrawn by the Insured, the Inspection Report will be considered to be the final Statement of Loss for the claim by the Insured and no further Statement of Loss will be issued by AFSC.

c. If the Insured does not, within seven days of service of the Inspection Report, advise AFSC of the Insured’s disagreement with the report or does not request a re-inspection, AFSC will issue the Statement of Loss according to the Inspection Report.

d. When AFSC has conducted an inspection and issued an Inspection Report and a Statement of Loss, and the Insured has a dispute relating to the Statement of Loss and requests a re-inspection, AFSC will only review the Statement of Loss if the Insured notifies AFSC of the request for a re-inspection within seven days from the day that the Insured is served with the Inspection Report.

a. After an inspection, pursuant to Section 7.02 (c), if the Insured, within seven days of service of the Inspection Report:

i. advises AFSC of the Insured’s disagreement with the report; and

ii. requests a re-inspection:

AFSC will conduct a re-inspection, and no Statement of Loss will be issued until after the re-inspection has been conducted. AFSC reserves the right to charge a fee for Insured requested re-inspection.

a. The procedures set out in AFSC’s adjusting procedure manuals shall be used in the assessment and determination of Insurable Hives and Surviving Hives.

AFSC recommends the Insured or Authorized Representative accompany adjusters during on-farm inspections.

a. When Uninsured Causes of Loss are determined, claims may be reduced or denied, reflecting the amount of loss due to the uninsured causes. The Hives remain insured and the full Premium remains payable. Common examples where Uninsured Causes of Loss may be applied include, but are not limited to:

i. losses attributable to management practices;

ii. wildlife damage;

iii. theft or vandalism; or

iv. untreated diseases or infestations.

b. If the Insured moves Hives outside of Alberta on or after December 15, AFSC will apply Uninsured Causes of Loss equal to Coverage on the affected Hives.

c. If AFSC pays no Indemnity because of an Uninsured Cause of Loss, AFSC will not refund any portion of the Premium and the Insured is not relieved from paying any outstanding Premium.

a. Service of the Inspection Report or a Statement of Loss may be effected on the Insured by:

i. personal service;

ii. ordinary mail or registered mail, in which case service is deemed to have been effected;

1) seven days from the date of mailing if the document is mailed in Alberta to an address in Alberta, or

2) 14 days from the date of mailing if the document is mailed to an address located outside of Alberta; or

iii. by facsimile, email or other electronic means in accordance with AFSC’s most recent records for the Insured.

b. Where there is more than one Insured in respect of the overwintering loss for which an inspection has been made, service of the Inspection Report or Statement of Loss on one of the Insured is deemed to be service on all the Insureds.

a. To facilitate tax planning, Insureds can choose in advance to defer Indemnities to the following tax year. There will be no recourse to defer payment once a payment has been issued. Deferred Indemnities will not be applied to outstanding Premiums/balances until the deferred date and interest will continue to accrue.

a. In the spring, the Insured is required to contact AFSC to request an inspection a minimum of 10 days prior to unwrapping Hives or moving out of indoor storage. Hives must be unwrapped or moved out of storage no later than May 15.

b. Claims will be denied when AFSC is notified that Hives are being unwrapped after May 15.

c. The Insured will be eligible for a claim if Surviving Hives are determined to be less than Coverage. The table below demonstrates loss calculations for a dead Hive and a weak Hive.

d. Results of the spring inspection are used to calculate Indemnities, as well as the Individual Survival Rate for future Coverage.

a. An Indemnity shall be calculated for the period commencing with the time of completion of AFSC’s fall acceptance inspection to the time of completion of AFSC’s spring inspection.

a. For the purpose of this Insuring Agreement, an Indemnity shall be calculated as follows:

i. [(Insurable Hives x Individual Survival Rate x Coverage Level) – (Surviving Hives) – (Hives lost due to Uninsured Causes of Loss)] x Dollar Coverage per Hive.

1) If negative, no Indemnity is paid.