AgriStability: Separating fact and fiction

AgriStabilityIt’s time to dispel some common myths about AgriStability.

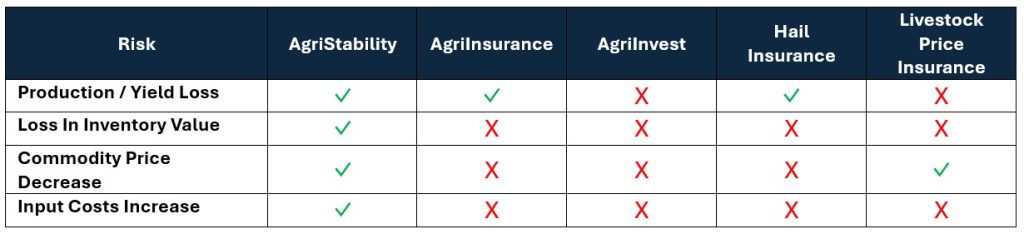

Fiction: Crop insurance is the only risk management tool that’s needed.

Fact: While crop insurance provides protection against specific perils, AgriStability provides comprehensive protection when events have a direct and significant impact to the farm’s margin.

AgriStability helps producers manage financial losses, including those caused by tariffs. It factors in any impact to margins, whether from reduced income and inventory value or increased input costs.

Fiction: The application process is too complicated and time-consuming.

Fact: It’s easy to apply to be part of AgriStability. All you need to do to enrol in AgriStability is complete an Application for Fee Notice form. Once enrolled, you will receive an enrolment/fee notice. Simply pay the fee and you are in the program.

Fiction: AgriStability is complex and requires a lot of paperwork.

Fact: AgriStability is a nuanced program that requires participants to submit certain details about their operation. However, these details are what gives AgriStability its strength, allowing it to respond to individual situations.

Fiction: AgriStability only uses an accrual adjusted reference margin and that means I need to submit a lot of information.

Fact: While the accrual adjusted reference margin was the only option for a number of years, recent changes now give producers the option to select their reference margin calculation method.

A new optional reference margin reduces complexity for some participants, especially those who file their taxes on a cash basis, as the reference margin is calculated using the same method used for tax reporting.

Fiction: The reference margin limit prevents payout except in really dire situations.

Fact: The reference margin limit was removed in 2021(retroactive to the 2020 program year). The change increased program transparency while making AgriStability less complicated and more responsive to all types of farming operations. Before this change, triggering a payout often required a significant drop in a producer’s margin; however, with the removal of the reference margin limit, a 30 per cent drop in your margin in the current year may trigger a payout.

Fiction: You have to lose most of your income before AgriStability does anything.

Fact: AgriStability offers assistance for events that significantly impact the financial health of a farming operation. It triggers when a farm’s margin for the program year is less than 70 per cent of its historical average. Losses experienced beyond the 70 per cent threshold are covered at $0.80 for every dollar of decline, up to a maximum of $3 million or 70 per cent of the overall margin decline, whichever is less.

Fiction: AgriRecovery initiatives cover disasters, like drought or disease, so there’s no need for AgriStability.

Fact: AgriRecovery is a disaster relief framework supported by federal, provincial, and territorial governments. It helps producers with the extraordinary costs of recovering from disasters. However, it does not cover income or production losses, recurring disasters, or replace long-term strategies to mitigate risk.

AgriStability, on the other hand, covers income and production losses and helps with recurring disaster events.

Fiction: AgriStability doesn’t respond to trade-related challenges.

Fact: AgriStability supports producers facing trade-related challenges by stabilizing farm incomes during market disruptions, addressing price volatility and trade uncertainty, and supporting farmers facing higher input costs.

Fiction: Enrolment in AgriStability is declining because it’s not effective.

Fact: Enrolment trends can vary, but many producers continue to find value in the program. In Alberta, more than 50 per cent of farm cash receipts are represented in the program.

The effectiveness of AgriStability is demonstrated by the support it provides during challenging times, helping farmers maintain financial stability and continue their operations.

AgriStability is a key risk management tool for many Alberta producers. If it’s time to make it part of your risk protection, please contact AFSC using Live Chat on our website or AFSC Connect, call the Client Care Centre at 1.877.899.2372 or contact your preferred branch office.

The deadline to enrol for 2025 is July 31.